Rental Rental Evaluation land plot It follows the principles of assessing the total value of the Earth and shows the amount that the potential buyer of this right is willing to pay for the benefit from it. But this process It has some specifics.

To provide full-fledged information on this issue in the legislation of the Russian Federation, the Ministry of Property Relations In 2003, Methodical recommendations were published, prescribing the procedure and methods for assessing the rental right. This document provides a summary of the methods used in the practice of estimating the transfer of land for rent, and also lists the information that should be specified in the evaluation report.

As a rule, the cost of renting land C / x appointment is calculated from cadastral value. You can learn about other methods of calculation from.

Features of the compilation of the report

The document compiled according to the results of the assessment contains the following details:

- FIO of the author of the document (appraiser), type of document, evaluation date and date of compilation (do not always coincide);

- Appointment of evaluation (for the bank, for the trial, etc.);

- The value to be evaluated (market value of the rental right);

- The appearance and subspecies of the estimated property, its name, location, detailed description;

- Methods used and methods.

On the first pages of the document, brief information about the property and the result of its assessment, expressed in the value of his rental right in rubles. The cost is written by numbers and in words.

- Lease terms;

- The right of the tenant;

- Rent size;

- Data on the state of the real estate market in the region;

- Reasons for receiving the rental right.

The document on average takes 40-50 pages.

average cost Earth estimates is 5-7 thousand rubles. If there is a need for an assessment of buildings, then a separate fee is made for it, component of 1000-2000 rubles.

Rental assessment Today is an important component of the economic activity of the entire Russian business. In accordance with Article 607 of the Civil Code of the Russian Federation, the owner or any copyright holder has the right to pass its property for rent to other individuals or legal entities. A leased object can be any things and items related to the category of "infused", namely real estate, land, apartments, enterprises and other property complexes, transport sphere facilities that do not lose their natural properties in the process of using them.

During the conclusion of a lease agreement, the tenant, together with the right to use the facility at its discretion, can also get full use and disposal of property - it depends on the terms of the contract. Thus, the right of lease, as well as other rights received under the contract, can be transferred to third parties in any legitimate form of civil turnover, for example, sold. But in order to profitably sell it, it is necessary to know the market price of the right, but such an opportunity, just gives evaluation of rental rights.

What are the features of the rental rights and rental rights? They consist of a comprehensive analysis of benefits and benefits that give a contract to the tenant. After all, in fact, the purchase of rights itself, the estimate of the rental cost is not small money, and if the set of beneficiaries in this document does not give any benefits, in comparison with the contract, which can be concluded directly with the landlord, the legal issue arises - Why do you need additional costs?

During the assessment of lease rights, the following factors are taken into account:

- rental Conditions (Terms, Amounts and Payment Procedure)

- characteristics of the lease itself (area, floors, construction Materials and elements of finishing, location, convenience of the entrance, the availability of communications)

- the infrastructure of the location in which the leased object is located;

- term of the lease agreement and prolongation conditions;

- any additional rights, as the right of redemption, the right to sell, etc.

Advantages increasing the cost of rental rights, which are accounted for when evaluating

- Advantage in the amount of rental rates

- The right to buy a leased object

- Rentation of the cost of tenant

Thus, the rental assessment in the estimated company gives you the opportunity to get real savings of your funds if you are in the role of the acquirer of the right to rent a land plot, apartments, other real estate, or, on the contrary, increase your profits from the realization of the rental rights if you are a landlord.

Rental rental of land

The cost of renting a land plot takes into account many factors and is directly dependent on: the content of the lease agreement and its term, the rights of the leaseholders granted to him by this Treaty, permits for the use of land for specific purposes expected by income for the period of time associated with the most theoretically profitable Its use. Also, the value of the rental right can be influenced by the place where the site is located, the availability of communications, the permitted and real use of the Earth, the convenience of the entrance.

Usually, the lease estimate of the land plot is carried out on the basis of the analysis of prices of prisoners of transactions or suggestions of proposals (offer) for the sale of the rights of use by land plots, which are identical to him in its characteristics (comparative assessment method).

Estimation of land rental rights can be carried out at:

- purchase and sale of rental rights;

- making the right as a contribution to the authorized capital of the enterprise;

- lending on bail;

- buying, selling, merger, absorption of an enterprise that owns rental rights land plots;

- development and adoption of management and investment solutions related to long-term planning;

- investing funds;

- other situations that are somehow intersect with the realization of the rights management of land owned.

Additional information about the assessment of land rental costs you can get on the pages.

Practitioner appraiser, Cand. tehn science

moscow

In accordance with the legislation, the owner of the land plot has relative rights regarding him: possession, use, orders. When transferring a land plot for rent, the owner transmits the tenant for a period determined by the Rental Treaty, the right to use or possession and use, reserved the right to dispose of the land plot. The tenant, in turn, for the period of the lease agreement, the right to dispose of ownership and use rights transferred to him. In particular, he can render his rights, transfer them to a deposit, if it is not directly prohibited by the lease agreement.

The cost of the rights transferred to the tenant (hereinafter, we will consider only these rights and call them the right of lease) is usually determined on the basis of the possibility of extracting the income from the land transferred to the lease (memory). In the simplest version, the possibility of putting this section in the sublease and the extraction of income in the difference between the income from the sublease and rental boardprohibited by the owner. In a more complicated case, it is assumed that a business is created using a leased site, which is not possible in the absence of this site, and part of the tenant's income from the business is attributed to this memory. In both cases, the cost of lease rights is defined as the capitalized income of the tenant, assigned to the memory.

All of the above fully refers to the free (not built) land plot. In case the rented area built a building belonging to another owner, the situation changes somewhat. The owner of the land plot cannot at its discretion to stop renting a memory at the end of the lease agreement (the exception is the redemption of land for federal and municipal needs). He is forced to extend the ending lease agreement or sell the memory to the owner of the building. In turn, the tenant of the memory does not have the opportunity to pass it into a sublease or organize business on it, except by passing the building or its part for rent. Consequently, the wation of the period while the building is located, this site has a special status, that is, it is inseparable from this building and forms a uniform property.

Usually, to determine the cost of rental rights in this case, it is recommended to use the methods of the residue or selection. However, the accuracy of these methods is extremely low. First, due to the increase in relative error. When performing a mathematical operation of subtraction, the absolute errors of the components are folded, and the base relative to which the relative error is determined, decreases. Secondly, the company's price includes the profit of the entrepreneur, which in turn depends on the location of the memory and its value is determined with a high error. In addition, in this case, the cost approach to real estate assessment loses its independence on income or comparative approaches (depending on the method of calculating the cost of the land rental rights). It should also be noted that the obtained value is divorced from the land market, since it is used in its definition only data of the market for similar real estate objects and the construction industry market. Similar problems arise and when using the distribution method.

Observation shows that the dynamics of the land market and the dynamics of the above markets in certain periods of time can differ significantly. Therefore, when estimating the cost of the rental right, it acquires importance to changes in the land market. In order to tie the cost of rental rights with the land market, we use the correlation method. Consider two commercial real estate objects located next door to which everyone is equally, with the exception of rights to the memory. One building is built on its own land, and another on the leased. Since the buildings are the same, then the rental of their premises should give up at the same rate. Consequently, the potential and valid gross revenues from the owners of buildings are also the same. Operating expenses differ only on the difference in the board for the land. The owner of the building built on his own land pays land tax, and the owner of the building built on the leased land is paying a rent, which exceeds land tax. For both cases, you can write down the following ratios:

From the ZUS - the market value of ownership of the land plot;

With Zua - the market value of the right to rent a land plot;

With ZD - the market value of the building;

DVD - valid gross income from the property;

OR BZU - operating expenses excluding the cost of the content of the memory;

N z - land tax;

And the memory is rent;

R is a capitalization coefficient for real estate.

where

Y - rate of profitability for the object of real estate;

1, 2, ..., n, n + 1 are the numbers of the forecast and postprognos.

It should be noted that the conclusion of the addressed dependencies is based on the same use of the memory. Since the right to lease the built-up memory involves the determination of the value of this right in the current use, the cost of ownership of the land plot should be determined on the basis of similar use.

Another feature is that the cost of ownership of the memory is a market value of the memory (for current use), and the cost of lease rights depends on the value of the rent and generally does not correspond to a market value.

If we divide both parts of equations (3) and (4) to the area of \u200b\u200bthe memory, then we obtain addiction to calculate the specific value of the rental right from the specific value of the property right and the specific land tax rate (rubles / sq. M).

Since there is a handling practice for rent, the dependences obtained seems to be distributed to the objects of residential real estate.

The dependences (3) and (4) can be used when calculating the cost of rental rights (the rights of possession and use of the groan to the tenant) of the built-up land, taking into account the appointed rent. These same dependencies can be used to substantiate the compensation payment for the land during the compulsory redemption of the built-up leased land plot, since there are not market conditions of a transaction with a land plot with a certain value for a specific tenant.

Since the land tax rate is usually proportional to the cadastral value of the Earth, then dividing both parts of equations (3) and (4), shown to the specific value to the specific value of ownership, you can obtain the dependencies of the relative value market value Rent rights from the relative magnitude of cadastral value. Dependence takes the form:

where

* - upper index denoting the specific value;

C * CAD - the cadastral value of the memory;

KN - Land tax rate (percentage of cadastral value).

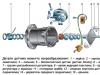

The results of the calculation of the dependence (5) with n \u003d 1.5% and R \u003d 15% are given on

Fig. one.

Fig. 1 Dependence of the relative value of the cost of renting the right from the relative size of cadastral value at a land tax rate of 1.5% and the capitalization ratio for a 15% real estate factor.

Analysis of the dependences of those shown in Fig. 1 allows you to draw the following conclusions. When renting a zoom at a rate of equal land tax rate, the cost of rental rights and property rights coincide.

It is a fundamentally a rental rate, in which the cost of its lease right is zero (with fixed relative cadastral value). This corresponds to the condition under which the owner of the Earth is withdrawn from the tenant all incomes that belong to the land plot. Apparently, this magnitude of the rental rate should be considered as the theoretical limit of the business activity of the developer. The excess of this limit leads to the fact that the cost of building construction exceeds the capitalized value of income related to the building.

Indeed, of the dependence (2), with zoys \u003d 0 it follows:

![]()

where

And the memory is the rental fee, corresponding to the zero cost of its right to lease.

Substituting this ratio into dependence (1), and turning to the specific values \u200b\u200bto be obtained:

However, in practice (in market conditions), the limit of business activity must occur slightly earlier (with a smaller rental value), since the cost of redemption is usually assigned to the right of rent to the right of ownership. Therefore, the practical ratio has the form:

![]()

The dependence (6) in essence reflects the market conditions under which the owner of the memory has the ability to assign the maximum cost of rent for land with which the tenant (developer) must agree. Thus, the market rate of rent for the built-up zone is defined as:

In turn, the owner, submitting the tenant the right of ownership and use, can sell the built-up memory (to realize the order left for him) at any time. However, the presence of a long-term tenant usually when making a purchase and sale transaction is considered as encumbrance, so at a market value, the owner of the memory can sell it only after the end of the life life of the building. Therefore, the market (reasonable) value of the redemption value can be determined how the cost of the reversion of the memory discounted on the date is based on the possible cost of land reclamation. The estimated dependence in specific units has the form:

where

C * wipe - the specific market value of the buyback by the lease;

C * roar - the specific value of the reversion of the memory;

C * RVC - the specific cost of reclamation of the memory;

Y Zu - rate of yield for memory.

The cost of reversion can be determined by capitalizing the rent at the last year of the building of the building, taking into account the addition of the annual growth rate of its growth, or by direct forecasting the current value of ownership of the memory, taking into account its growth rates.

Conclusion

Dependencies proposed on the basis of the data of the regional land market to determine the cost of renting (the rights of possession and use of the Rent of the Tenant) of the built-up land plot taking into account the designated rental fee. The substantiation of the method of calculating the market rate of the rent and the market redemption value of the built-up land plot for the tenant is given. The dependences obtained can be used in the practical assessment of real estate objects and to assign a substantiated rent for the land. The dependences were also used to substantiate the compensation payment for the land during the compulsory redemption of the built-up leased land plot.

Literature

1. Civil Code Russian Federation. GL 34. M.: Publisher Norma, 2000

2. The right to conclude a land lease agreement. Discussion materials on the site www.appraiser.ru

3. D. Friedman, N. Orday. Analysis and assessment of real estate income. M.: Case, 1995

4. Methodical recommendations for determining the market value of the right to lease of land. Approved by the order of the Ministry of Property of Russia dated 04.04.2003 No. 11102-p

5. Tax Code of the Russian Federation. Art. 390, 394. M.: Elite Publisher, 2007

Ministry of Property Relations

RUSSIAN FEDERATION

Order

On approval of guidelines for the definition of the market value of the right to rent land

The document is returned without the State Registration

Ministry of Justice of the Russian Federation

Letter of the Ministry of Justice of Russia of 06.05.2003 No. 07/4533-SMD.

______________________________________________________________

In accordance with (meeting of the legislation of the Russian Federation, 2001, N 29, Article.3026):

Approve the accompanying guidelines for the definition of the market value of the right to lease of land.

Minister

F.R. Gazizullin

Methodical recommendations for determining the market value of the right to rent land

I. General provisions

This methodological guidelines for the definition of the market value of the Rental Rent of land developed by the Ministry of Property of Russia in accordance with the Decree of the Government of the Russian Federation of 06.07.2001 N 519 "On Approval of Evaluation Standards".

II. Methodical Fundamentals Evaluation of the Market Cost Rent Law of Land

The market value of the rental right of the land plot is determined on the basis of the principles of utility, supply and demand, replacement, changes, the external influence set out in section II of methodical recommendations for determining the market value of land plots approved *.

________________

* Letter of the Ministry of Justice of Russia of April 15, 2002 N 07/3593-SMD recognized not in need of state registration.

The market value of the rental right of the land plot depends on the right-wing tenant, the term of the right, the burden of rental rights, the rights of other persons to the land plot, purpose and the permitted use of the land plot.

The market value of the rental right of the land plot depends on the expected value, duration and probability of obtaining income from the right of lease for a certain period of time with the most efficient use of the land tenant (the principle of expectation).

The market value of the rental right of the land plot is determined on the basis of the most efficient use by the tenant of the land plot, that is, the most likely use of the land plot, which is practically and financially implemented, economically justified, the relevant requirements of the legislation and as a result of which the estimated value of the value of the land lease rate will be maximum ( The principle of the most efficient use).

The estimated value of the value of the rental right of the land plot can be expressed by a negative value (for example, if the size of the rent set by the lease agreement of the land plot is higher than the market size of the rent for this site). In such cases, as a rule, it is not possible to alienate the object of assessment in the open market in the context of competition when the parties of the transaction act intelligently, having all the necessary information, and there are no extraordinary circumstances on the transaction.

When assessing the market value of the Rental Rent of the Land Registration, it is recommended to use the provisions of section III methodological recommendations for determining the market value of land plots approved by the order of the Ministry of Property of Russia from 06.03.2002 N 568-P

The report on the assessment of the market value of the land rental right is recommended including:

information on state registration of the rental rights (lease agreement) in cases where the specified registration is mandatory;

information about the burden of rental rights of the land plot and the most land;

the basis of the occurrence of rental rights at the tenant;

determination of the Poverver Tenant:

the deadline for which the land lease agreement is concluded;

characteristics of the land market, other real estate, land lease rights, including the market for renting land and other real estate.

IV. Methods Evaluation

An appraiser during the assessment is obliged to use (or justify the refusal of use) costly, comparative and profitable approaches to the assessment. The appraiser has the right to independently determine the specific methods of evaluation within each of the approaches to the assessment. When choosing methods, adequacy and accuracy are taken into account to use this or that method of information.

As a rule, when evaluating the market value of land lease rights, sales comparison method, the allocation method, the distribution method, the capitalization method of income, the balance method, the method of intended use are used.

The comparative approach is based: the sales comparison method, the allocation method, the distribution method. The income approach is based: the capitalization method of income, the balance method, the method of intended use. Elements cost approach In terms of calculating the cost of reproduction or replacement of improvements of the land plot is used in the method of the residue, the method of isolation.

The content of the listed methods is given in relation to the estimate of the market value of the right to lease of land plots, both engaged in buildings, buildings and (or) structures (hereinafter - built-up land plots) and the right to lease of land not occupied by buildings, buildings and (or) structures (hereinafter - undressed land).

In the case of using other methods in the evaluation report, it is advisable to disclose their content and justify the use.

1. Sales comparison method

1. Sales comparison method

The method is used to assess the right to lease of built-up and unaked land. When assessing the market value of the rental right to the method of comparing sales, it is recommended to use the provisions of clause 1 of the IV methodological guidelines to determine the market value of land plots approved by the order of the Ministry of Property of Russia from 06.03.2002 N 568-P, taking into account the following features.

When evaluating the market value of the right to lease of the land plot with a sales comparison method as part of value factors, including the following factors are taken into account:

time period remaining until the end of the lease agreement;

the value of the rent provided by the lease agreement;

the procedure and conditions of application (including frequency) and changes in the rent provided for by the lease agreement;

the need to obtain the consent of the owner to make a transaction with the right lease;

the tenant has the right to redeem the rented land plot;

the presence of a tenant preferential right to conclude a new lease agreement for the land plot after the lease agreement expires.

2. Isolation method

2. Isolation method

The method is used to assess the right to lease of built-up land plots. When assessing the market value of the right of lease by the method of selection, it is recommended to use the provisions of clause 2 of the IV methodological guidelines for determining the market value of land plots approved by the order of the Ministry of Property of Russia from 06.03.2002 N 568-p.

3. Distribution method

3. Distribution method

The method is used to assess the right to lease of built-up land plots. When assessing the market value of the Rent Rent by the distribution method, it is recommended to use the provisions of paragraph 3 of the IV section of the methodological recommendations for determining the market value of land plots approved by the order of the Ministry of Property of Russia from 06.03.2002 N 568-p.

4. Method of capitalization of income

4. Method of capitalization of income

The method is used to assess the right to lease of built-up and unaked land. The condition for applying the method is the possibility of obtaining for the same intervals of the time equal to each other or varying with the same rate of income from the estimated land rental right.

The method assumes the following sequence of actions:

calculation of the income for a certain period of time generated by the right to lease of the land plot with the most efficient use of a land tenant;

determination of the value of the corresponding coefficient of capitalization of income;

calculation of the market value of the land lease right by capitalizing the income generated by this right.

Under the capitalization of income is a definition at the date of evaluation of the value of all future equal shares or varying with the same rate of income per equal periods of time. The calculation is made by dividing the amount of income for the first after the date of the evaluation of the period by the appropriate capitalization ratio of a certain appraiser.

When evaluating the market value of the land rental right income from of this right It is calculated as the difference between land rental and rental fees provided for by the lease agreement for the corresponding period. At the same time, the magnitude of the land rent can be calculated as the income from the delivery of the land plot for rent at the market rates of the rent (the most likely rental rates on which the land plot can be leased on the open market in competition, when the parties of the transaction are reasonable, having With all the necessary information, and at the size of the rental rates, any emergency circumstances are not reflected).

The definition of market rates of rent within this method involves the following sequence of actions:

the selection for the land plot, the right of lease of which is estimated, similar objects, the rental rates for which are known from rental transactions and (and / and) public offer;

the definition of the elements on which the land plot is compared, the right to lease of which is estimated, with analogues (hereinafter - comparison elements);

determination for each element of comparing the character and the extent of the differences of each analogue from the land plot, the right to lease of which is estimated;

determination for each element of comparing the adjustments of rental rates of analogs corresponding to the nature and degree of differences between each analogue from the land plot, the right to lease of which is estimated;

adjustment for each element of comparison of the rental rate of each analog, smoothing their differences from the land plot, the right to lease of which is estimated;

calculation of the market rate of the rent for the land plot, the right to lease of which is estimated, through the reasonable generalization of the adjusted rates of the rental counterparts.

When calculating the capitalization coefficient for income generated by the right to lease of the land plot, it should be considered: a risk-free rate of return on capital; the magnitude of the award for the risk associated with the investment of capital in the acquisition of the estimated rental rights; The most likely pace of changes in income from the right to rent a land plot and the most likely change in its cost (for example, with a decrease in the cost of rental rights - take into account the return of capital invested in the acquisition of rental rights).

In case of reliable information on the magnitude of the income generated by an analogue of the assessment object for a certain period of time, and its price, the capitalization coefficient for income generated by the right lease of the land plot can be determined by dividing the income value created by the analogue for a certain period of time, the price of this analog .

5. Residue method

5. Residue method

The method is used to assess the right to lease of built-up and unaked land. When assessing the market value of the rental right to the residue method, it is recommended to use the provisions of clause 5 of the IV methodological guidelines for the determination of the market value of land plots approved by the order of the Ministry of Property of Russia from 06.03.2002 N 568-P

the difference between clean operating income from a single real estate object and a clean operating income relating to the improvements of the land plot is part of land rent not carried by the owner of the land plot in the form of rent, but by the lease by the tenant;

when calculating the capitalization coefficient for income from the rental right, the likelihood of maintaining the difference between the size of the rent and the amount of rent, provided for by the lease agreement, the period remaining until the end of the lease agreement, as well as the possibility of concluding a tenant a new lease agreement for a certain period of lease.

6. Method of intended use

6. Method of intended use

The method is used to assess the right to lease of built-up and unaked land. When assessing the market value of the rental right to the method of intended use, it is recommended to use the provisions of paragraph 6 of the IV methodological guidelines for determining the market value of land plots approved by the order of the Ministry of Property of Russia from 06.03.2002 N 568-P, taking into account the following features:

as part of operating expenses, including the amount of rent provided for by the existing land lease agreement;

when calculating the discount rate for income from the rental right, the likelihood of maintaining income from this right should be taken into account;

when determining the forecast period, the period of time remaining until the end of the lease agreement is also considered, as well as the possibility of concluding a tenant of a new contract for a certain period.