Any legal entity, its branches and separate structures, and persons engaged in private practice permitted by law are required to have a bank account. It is necessary for carrying out business activities, paying taxes and fees to various funds, paying wages, and making payments to suppliers and contractors. To open it, you need to provide a package of documents, which includes a card with sample signatures and a seal impression. Document number 0401026 according to the all-Russian classifier and is mandatory for all banking institutions and its clients. Making changes or additions to the established form is prohibited. It is only possible to increase the number of lines in some paragraphs of the document (number of checks issued, in the name of the owner, etc.). The procedure for submitting and rules for filling out the form are set out in the instructions of the Bank of Russia. The same document is drawn up when opening by legal entities.

Established internal regulations of commercial financial institutions and rules for working with clients may require notarization, but in many banks a card with sample signatures and a seal can be certified in the presence of a bank employee and employees of the enterprise authorized to work with the organization's financial assets and their distribution. Its actual registration is mandatory in any case. If you use Internet banking or client-bank systems, it will confirm your electronic signatures.

If the enterprise is a structural unit, then in the column where the name of the account holder is indicated, the name of the main legal entity is first written, and through the separating mark of the branch, in accordance with the statutory documents on formation. In such cases, with sample signatures, it is certified by a higher organization.

A prerequisite when filling out the form is to use black printing, writing, machine printing or writing by hand. not allowed. If you already have a bank account and there have been no changes in the list of authorized persons - fund distributors, you may not need an additional card with sample signatures and a seal imprint, this depends on the rules of the financial institution.

The card is considered valid until the end of the banking service agreement. In case of a change in the legal form of the enterprise, a change in the names of authorized persons, their composition, or at least one signature recorded in the document, another bank card with samples of signatures and seals, with the changes made, is required, and additional documents must be submitted that prove the fact of the changes made . Otherwise, the funds will be blocked until the bank receives properly executed papers.

If an employee of an enterprise authorized to work with a financial institution is temporarily absent, then an additional card is produced with sample signatures and a seal imprint, where the bank employee is marked “Temporary”.

When opening an account, you should not think that bank employees are making unreasonably high demands on you. They do their job, and you get the opportunity to get advice from a competent person in terms of the correct legal execution of all statutory documents.

All operations with a current account from the moment of its opening, maintenance and closure are carried out by the responsible person, as a rule, he is the director. In this case, all signatures of authorized representatives are checked against a card with sample signatures and seal imprints. The form of the card is the same for all credit institutions and approved by Bank of Russia Instruction No. 28-I dated September 14, 2006, in Appendix No. 1, its OKUD number is 0401026.

Sample of filling out a card with sample signatures

The card form can be printed (made) either by the client himself or by the bank. In this case, it is imperative to take into account that the form strictly corresponds to that approved by the Bank of Russia. It is only allowed to change the number of lines in such fields as “Signature sample”, “Last name, first name, patronymic”, “Account owner”, depending on how many people will have the right of first and second signature on bank documents.In addition, provided that persons authorized to sign documents at the bank and one operator maintains several accounts with the client at the same time, then in the sample signature card column “Bank account number” can also have the required number of lines.

The card with sample signatures can be filled out either by hand (with a ballpoint pen) or using computer technology, and you must use only a purple, black or blue pen. Sample signatures can only be affixed by the person responsible; the use of facsimiles in this case is not allowed.

The bank may request a sample signature card either in one copy or in several, depending on their internal requirements. Some banks require all cards in the form of originals, while others themselves can make the number of copies they need from the original.

The right of first signature of documents, as a rule, belongs to the director of the organization or a third party who is authorized to maintain accounting records on the basis of administrative documents. Most often, signatures are placed on when making various payments.

It is possible that the right of first and second signature is granted simultaneously to several employees of the organization. So the founders can reserve such rights for themselves and it is not necessary that such rights will be transferred to the chief accountant or director.

In addition, only the first signature can be indicated on the signature card - if the director independently maintains (is responsible for) accounting and manages the enterprise at the same time. In this case, in the “Second signature” field, you should make an entry that the right to put a second signature on documents does not belong to anyone.

Filling out the document is as follows:

- Signatures on the card are placed only in the presence of the person certifying this document. They can be approached by a bank representative or a notary (in this case, he is provided with the same package of documents as for a bank to open a current account).

- The card indicates the position, surname and initials of the employee who certifies the signatures on the document.

- The date is indicated in numbers.

- Next, the bank employee puts his signature and puts the seal (stamp) of the bank, which is reserved for these purposes by the credit institution.

If you are opening a current account for your individual entrepreneur or enterprise, then most likely a card with sample signatures and seals will become an integral attribute of this procedure. Organizations of any form of ownership and legal status are faced with this document. Let's look at what you need to know about this form and give a sample of filling out the card.

Why is a card needed?

The purpose of the card with sample signatures and seal imprint is quite simple and clear: it serves to ensure that employees of a banking institution clearly know what it should look like:

1. Original handwritten signature of the current account owner or his representative.

2. Company seal stamp.

After all, banks are special organizations that work with the financial resources of their clients. It is extremely important for them to take all possible precautions when accepting, issuing and/or transferring them in order to prevent various abuses and fraudulent schemes.

In this regard, increased demands are placed on signatures and seals: the main thing is that they must coincide one-to-one with those given on the bank card with samples of signatures and seal impressions, and be clear and legible. Otherwise, the transaction on the account will be denied.

The bank employee may ask the client to sign or re-stamp the form. And if the signature does not 100% match the one indicated on the signature card, the credit institution has the right to refuse to provide the requested banking service.

Mandatory stamp on the card

By the way, the form of the card with sample signatures does not necessarily contain a sample of the company seal. The fact is that from April 7, 2015, organizations can refuse to use round seals. They acquired this right after the Law of April 6, 2015 No. 82-FZ came into force. From this date, LLCs and JSCs (with some exceptions) have the right to independently decide whether to have a seal or not (prescribed in the internal regulatory documents of the enterprise).

Previously, all domestic legal entities were required to have their own corporate seal (stamp). And businessmen, as now, can choose whether to conduct business with a seal or not.

One account - one card?

You can limit yourself to filling out one card with samples of signature and seal if the company opens more than one current account within the same credit institution. A prerequisite in this case: access to the accounts is registered to the same persons.

And vice versa: you will need to issue several cards with signatures and a seal when the company opens current accounts in different banks. For example, due to more favorable rates (conditions) in another credit institution.

Who fills out the card

The document in question consists of 3 parts:

- the first is filled out by the general director of the enterprise or his representative, specifically authorized to do so by a power of attorney;

- the second (certifying signature certification) - a notary or bank employee;

- the third is a bank employee.

Card form

Let us say right away that there is no generally required sample signature card for a bank. At the same time, Instruction of the Central Bank of the Russian Federation dated May 30, 2014 No. 153-I “On opening and closing bank accounts, deposit accounts, deposit accounts” (hereinafter referred to as Central Bank Instruction No. 153-I) suggests using one of two options:

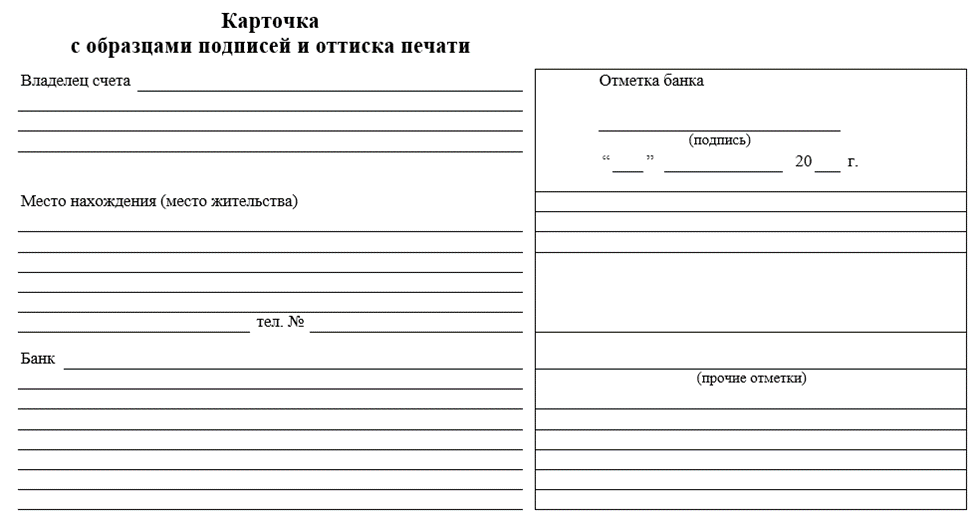

1. Form No. 0401026 according to OKUD (OK 011-93) from Appendix 1 to the specified Instructions:

2. Or a form for a card of sample signatures and a seal imprint according to the internal form of a bank or other organization (it necessarily includes all the details of form No. 0401026 according to OKUD (see above)).

As you can see, the card in form No. 0401026 includes only 2 signature samples and does not include such details as TIN, KPP, OKPO, OKVED codes, etc. That is, it contains a narrowly limited amount of information.

Filling out the card

For 2018, a sample of filling out a card with sample signatures looks something like this:

The rules for its design are as follows:

- can be filled out on a PC (if the bank is ready to issue it in electronic format) or with a ballpoint pen in blue, purple or black ink (not in pencil!);

- facsimile signature is not acceptable;

- There should be no blots, inaccuracies, or corrections (the damaged form must be destroyed).

Each bank determines how many completed copies of the card are needed at its own discretion.

The most important thing: either a notary or a bank employee must be present when signing.

Temporary card

There is also a temporary signature sample card, which is attached to the permanent card. Externally, its only difference is that in the upper right corner on the front side there is a “Temporary” mark.

According to clause 7.13 of Central Bank Instruction No. 153-I, such a card is issued:

1. If the right to sign is temporarily transferred to persons not indicated on the original card.

2. In case of temporary use of an additional seal impression.

A bank card with sample signatures is one of the mandatory documents required by the bank when opening a bank account or deposit account. The procedure and conditions for registration and use by clients of a bank signature card are prescribed in the Instruction of the Central Bank of Russia “On opening and closing bank accounts, deposit accounts.”

A bank card with sample signatures is issued for transactions with funds placed in the accounts of legal entities and individual entrepreneurs. A bank card is filled out according to the model provided by the Instructions of the Central Bank of Russia. When issuing a bank signature card, you must strictly adhere to the rules established by the Central Bank for filling out the fields of the bank card. A sample form of the approved form of a bank card with sample signatures is presented on our website in the “Sample Documents” section. Also on our website you can download a bank card for filling out yourself.

A bank signature card can be produced by both the bank and clients. An indispensable condition is strict compliance of the bank card with the sample OKUD form established by the appendix to the Central Bank Instructions.

A bank card with sample signatures can be filled out by hand (in blue, black or purple ink) or using a computer. Facsimile signatures are not allowed when filling out a bank card. The bank does not accept bank signature cards with a different location or number of fields than indicated in the sample. An arbitrary number of lines is allowed on a bank card only in cases provided for by the Central Bank Instructions. A bank card with sample signatures may contain interlinear translation of the fields into other languages.

To carry out banking operations, the required number of copies of the bank signature card is made. All copies of a bank card are certified by the signature of the bank’s chief accountant, or the signature of another bank employee authorized to issue a bank card. In cases provided for by the bank's rules, it is allowed to use copies of a bank card with samples of signatures in electronic form, obtained by scanning. If necessary, such a copy must be reproduced on paper in accordance with the form established by the Central Bank Instructions. Instead of copies, the client can download a bank card and issue a sufficient number of additional copies of the card. The authenticity of signatures on each bank card must be certified in the manner established by the Central Bank Instructions.

If all the client’s bank accounts are serviced by one bank employee, and the list of officials whose authentic signatures are certified on the bank card is the same, the bank does not have the right to require the client to issue a separate bank signature card for each account.

The right of first signature on a bank card of an individual entrepreneur belongs to an individual entrepreneur or an individual acting on the basis of a power of attorney from an individual entrepreneur. When certifying the authenticity of a signature on a bank card, the personal presence of an individual entrepreneur or his representative with a valid power of attorney certified by a notary is required.

The right of first signature on a bank card with sample signatures of a legal entity belongs to the sole executive body (manager), as well as other authorized persons vested with the right of first signature on the basis of an order or power of attorney issued by a legal entity in the manner prescribed by law. In cases provided for by the Central Bank Instructions, the right of first signature on a bank signature card may also belong to employees of a separate division of a legal entity.

The right of first signature cannot be granted to officials who have the right of second signature on a bank card with sample signatures.

The right of first signature on a bank card can be transferred to the manager - an individual entrepreneur or a management company.

The right of the second signature on a bank card with sample signatures belongs to the chief accountant of a legal entity or other persons carrying out accounting, based on the order of the manager. In case of accounting by third parties, the right of the second signature on the bank signature card is granted to these persons.

The sole executive body, the chief accountant of a legal entity and an individual entrepreneur may not be indicated on the bank signature card, subject to certification of the authenticity of the signatures on the bank card of other persons entitled to the first and second signature.

One individual cannot simultaneously have the right of first and second signature on a bank card. Granting the right of first or second signature to several officials of a legal entity at the same time is permitted by the Central Bank Instruction.

If the sole executive body (head) of a legal entity performs the functions of the chief accountant, the bank card with sample signatures indicates persons who have only the right of first signature.

The seal of a legal entity on a bank signature card must strictly correspond to the seal owned by the legal entity.

The authenticity of signatures on a bank card is certified by a notary. Certification of the authenticity of all signatures on a bank card must be performed by one notary. Otherwise, the bank will not accept the card.

A bank employee authorized to perform these actions can also certify the authenticity of the signature on a bank card.

A bank card with sample signatures is valid:

- until the agreement with the bank is terminated;

- before closing the bank account;

- before replacing the previous bank signature card with a new card.

A new bank card with sample signatures is issued in the following cases:

- change of surname, name and/or patronymic of the person entitled to the first or second signature;

- change of name or change in the organizational and legal form of a legal entity;

- early termination or suspension of the powers of the management bodies of a legal entity;

- loss or replacement of a seal;

- replacement of at least one signature on a bank card;

- adding a new signature to the bank card.

One of the main documents required by organizations to open and further maintain a bank account is a card with sample signatures and seal impressions. The form of the card was approved by Bank of Russia Instruction No. 28-I dated September 14, 2006 and was assigned OKUD code 0401026.

The card form can be produced (drawn up and printed) independently by both the bank and the client. But it must strictly comply with the approved form. It is only allowed to change the number of lines in the fields “Account owner”, “Last name, first name, patronymic” and “Signature sample” depending on the number of persons who have the right of first and second signature.

There can also be any number of lines in the “Bank account number” field. But this is permitted if only one bank operational employee services several client accounts, and provided that the list of persons authorized to sign coincides.

A bank card is filled out, usually using computer technology in black font, or by hand using a ballpoint pen with black, blue or purple ink.

Sample signatures on the card must be made by the responsible persons themselves. The use of a facsimile signature is not permitted.

The number of cards submitted to the bank varies. Some banks ask for one copy and then make the required number of copies themselves. Others require the client to provide the required number of original cards.

The right of first signature may belong to the head of the organization or another authorized person, in accordance with the administrative act (power of attorney) of the head.

The right of the second signature may be granted to the chief accountant or another (third) person authorized to maintain accounting records in the organization, on the basis of an administrative act of the head of the legal entity.

Situations are also possible when several employees of an organization can be granted the right of first and second signature at the same time. The head and chief accountant of the organization are not necessarily included in the list of these persons; for example, the founders of the organization may reserve this right for themselves.

The card can only indicate persons who have the right of first signature (for example, if the head of the organization keeps accounting records himself). In this case, in the “Second signature” field, you must indicate that the right of the second signature does not belong to anyone.

Signatures are placed in the presence of a person who will certify their authenticity. This may be a notary (he will need to submit the same set of documents as for) or an authorized person of the bank. The bank employee certifying the client’s signatures fully indicates his position, surname and initials, surname and initials of the person (persons) whose signatures are made in his presence, indicates the date (in numbers) and affixes a handwritten signature with the seal (stamp) of the bank attached, specified for these purposes by an administrative act of the bank.