Transfer of the leased object to the lessee There is no standard document for implementing this operation in 1C 8.3 Accounting. Therefore, the transfer of fixed assets for leasing is documented using the Operation document. You can create an Operation document from the Operations section, where we select Operations entered manually, then click Create and select Operation: Filling out the Operations document:

- Contents – the field describes the contents of the business transaction, so you can write “Transferred to the lessee”;

- Transaction amount – Initial (Residual) value of the transferred object.

The tabular part is filled in with the posting Dt 03.03 Ct 03.01; in the posting, do not forget to select our leasing object. The amounts for NU and BU do not differ, so no differences arise.

Accounting for leasing by the lessee

It is necessary to indicate the initial cost for tax accounting purposes, which is equal to the amount of expenses of the LESSON (namely the lessor, that is, the other party - not us!) for the acquisition of the leased asset. “Method of reflecting expenses on leasing payments.” As we remember, this is an account and analytics where expenses are written off.

In this case, for the purposes of NU. We called the “method of reflecting expenses on leasing payments” “Leasing payments”. From the inside it looks like this: Tab “Depreciation bonus”: We did not touch it in our example.

That's why we won't look at it. The postings of the document “Acceptance for accounting of fixed assets” will be as follows: Let’s comment on these postings.

Leasing in 1s:bukhgalteriya 8

Important! The ownership of the leased property does not pass to us. The lessor does not issue us an invoice! Invoice (received) – absent in this operation (not issued).

There is no button or fields “Register an invoice” on the document form. The VAT amount on account 76.07.9 is “deferred”. It will be written off gradually.

We will see this in an example. To summarize this operation in our example, we can say this: the document “Receipt for Leasing” accepts the Leasing Subject for accounting on account 08.04 and records the “deferred VAT” for the entire leasing agreement. 2. We transfer the Leasing Item into fixed assets.

MENU: Fixed assets and intangible assets \ Receipt of fixed assets \ Acceptance for accounting of fixed assets. Let's open the document Acceptance for accounting of fixed assets dated March 31, 2015. The header of the document is easy to fill out.

We will not comment on its completion. There are many bookmarks in the document. Let's go through each one.

Accounting for leasing on the lessee's balance sheet in 1s 8.3 step by step

Personal income tax on lottery winnings: who pays Who should transfer personal income tax from winnings to the budget (the lottery distributor or the winning citizen) depends on the amount of the prize won.< … Выдать увольняющемуся работнику копию СЗВ-М нельзя Согласно закону о персучете работодатель при увольнении сотрудника обязан выдать ему копии персонифицированных отчетов (в частности, СЗВ-М и СЗВ-СТАЖ).

Attention

However, these reporting forms are list-based, i.e. contain information about all employees. This means transferring a copy of such a report to one employee means disclosing the personal data of other employees.

< … Компенсация за неиспользованный отпуск: десять с половиной месяцев идут за год При увольнении сотрудника, проработавшего в организации 11 месяцев, компенсацию за неиспользованный отпуск ему нужно выплатить как за полный рабочий год (п.28 Правил, утв. НКТ СССР 30.04.1930 № 169).

Accounting for leasing on the lessee's balance sheet in 1s 8.3 and example of postings

In the “Calculations” detail the account for accounting for debt on lease payments is indicated - 76.07.2 (76.27.2, 76.37.2) · In the tabular part in the column “Accounting account” the account for accounting of lease obligations is indicated - 76.07.1 (76.27.1, 76.37.1) We remember that in account 76.07.1 we keep the amount of all our rental obligations - A LARGE AMOUNT! On account 76.07.2 - we take into account the debt on current leasing (usually monthly) payments. This is a small amount if we pay it strictly according to the lease payment schedule, without delays.

Info

Everything is filled in almost automatically. You just need to indicate the number and date of the Act on leasing payments. And don’t forget to register the invoice at the bottom of the Receipt of Goods and Services document.

Accounting for leasing in 1C 8.3 from the lessor (property on the lessor’s balance sheet)

Right in paragraph 1, paragraph 2, it is written: “The initial cost of a fixed asset is determined as the amount of expenses for its acquisition (and if the fixed asset was received by the taxpayer free of charge, or identified as a result of an inventory, as the amount at which such property is valued in accordance with with paragraphs 8 and 20 of Article 250 of this Code), construction, production, delivery and bringing it to a state in which it is suitable for use, with the exception of value added tax and excise taxes, except as provided for by this Code.” What are our acquisition costs? That's right - the redemption value of the Leased Item.

There is another kind Letter from the Ministry of Finance of the Russian Federation dated February 6, 2006 N 03-03-04/1/90.

Leasing: postings

Operation Account debit Account credit Amount, rub. The leasing object was accepted for accounting (3,540,000 * 100 / 118) 08 “Investments in non-current assets” 76, sub-account “Lease obligations” 3,029,000 Submitted VAT by the lessor 19 76, sub-account “Lease obligations” 545,220 The object was accepted for accounting as part of fixed assets 01 “Fixed assets”, sub-account “Property under leasing” 08 3,029,000 Lease payment transferred (3,540,000 / 60) 76, sub-account “Debt on leasing payments” 51 59,000 Monthly lease payment was taken into account 76, sub-account “Lease obligations” » 76, subaccount “Debt on leasing payments” 59,000 Accepted for deduction of VAT regarding the leasing payment 68 19 9,000 Monthly depreciation was accrued (3,029,000 / 60) 20, 26, 44, etc.

Reflection of transactions under leasing agreements in the enterprise accounting program 3.0

Closing the month: Depreciation and Recognition of Leasing Payments in Tax Accounting MENU: Operations \ Closing the period \ Closing the month. We are simply conducting the Closing of the month of MARCH 2015. There won't be anything special.

We will begin to accrue depreciation only from the next month after the fixed asset is put into operation. Leasing payments will also begin to accrue from next month.

Everything will happen only in APRIL 2015. Therefore, we are closing the Month of APRIL 2015. And now the first depreciation charge appears: The posting correspondence is clear.

Where did these numbers come from? According to accounting, our fixed asset “village” was credited to account 01 in the amount of 3,240,000 rubles (document Acceptance of fixed assets for accounting). The useful life in our accounting is 6 years = 72 months. This means depreciation in accounting for one month: 3,240,000 / 72 = 45,000 rubles.

Our depreciation in tax accounting is more than the monthly lease payment! And here the question arises: how do you want me to understand the Tax Code of the Russian Federation?! If depreciation were less than our monthly lease payment, then what would go into our expenses? First, depreciation. Secondly, the monthly lease payment minus depreciation. Let's add these two amounts: depreciation + monthly lease payment – depreciation = monthly lease payment. That is, the amount of the monthly lease payment would go into expenses! But our depreciation is more than the monthly lease payment.

Important

Why don’t we take into account the entire amount of depreciation in expenses - after all, it is more than the monthly lease payment. And by the way, in ConsultantPlus, in the situation we are considering, this is exactly what is done.

And this is not bad: more expenses – less profit – less taxes.

Leasing transactions in 1c 8 3 on the lessor’s balance sheet

Ninth Wiring: ATTENTION! Here you need to understand: what is the initial cost of a fixed asset! Before the buyout, we had a leased item. Now we have our OWN main tool. An old item, but in a new quality. All the costs and depreciation that we observed before the repurchase were all related to the Leasing Subject. Now we are dealing with OUR fixed asset and forming its initial cost. How the initial cost of a fixed asset is formed for tax accounting purposes is written in the Tax Code of the Russian Federation in Article 257 “The procedure for determining the value of depreciable property.”

On this tab we will make adjustments to our information register:

- List of parameters - click on the Create button, the table field will be automatically filled with the necessary parameters from the subconto:

Click Record and close, the standard operation in 1C 8.3 is ready. When choosing a standard operation, you only need to enter the parameter data and click on the Fill button: And all the necessary data in 1C 8.3 will be automatically generated. Leasing on the lessor's balance sheet posting in 1C 8.3: Step 3. Accounting for revenue from lease payments To enter lease payments in 1C 8.3, use the document Sales (acts, invoice).

You can create a document from the Sales section - then Sales (acts, invoices) - Sales command - selecting Services (act). In the header of the document, you can set up accounting accounts with the lessee, as well as the procedure for crediting the advance.

Faces different challenges at work. And for many, the emergence of leasing causes difficulties, since the accountant will need to do a lot of work in order to correctly take into account and submit reports. In order to make your task easier, we have identified and examined three common positions when accounting for leasing in 1C: Accounting 8, ed. 3.

Accounting with the lessor. Object on the lessor's balance sheet

First, we make a document “ Receipt (act, invoice)" through the section " Purchases" with the type of operation " Equipment" We put down the contract in the document, select the nomenclature, enter its quantity, price and VAT (18%). We process the document and create an invoice based on it. Postings:

The next document is " Acceptance of fixed assets for accounting" On the " Non-current asset» specify the type of operation « Equipment", method of acquisition - " For a fee." On the " The main thing» we create an operating system with a unique personnel number for each individual fixed asset. In it we indicate the name, accounting group of fixed assets, OKOF and its depreciation group. We fill out the accounting and tax accounting tab, depreciation calculation, and the method of reflecting depreciation. We get the postings:

When paying to the supplier, we create a payment order and, based on it, a debit document from the current account with the transaction type “ Payment to the supplier", and be sure to indicate the contract.

To transfer the operating system to the lessee, we create the document “ Operations entered manually" and pull it through " More» register selection – information register « OS accounting accounts", there we indicate the fixed assets accounting account and the depreciation account. Postings:

To calculate lease payments, we use the document “ Sales (act, invoice)":

To receive payment, create a document "Admission to" with the type of operation " Receipt from the buyer."

The OS can be sold through " Disposal of fixed assets", document " OS transfer", preparation document " Preparing for OS transfer».

Accounting with the lessee. Object on the lessor's balance sheet

The first operation is the arrival of this OS. We accept it to an off-balance sheet account using the document “ Manual entries"and do the wiring:

When paying, we create a document “ Payment order" and based on - " Debiting from current account". When paying, we pay the leasing payment and part of the purchase price. The resulting wiring is:

At the end of the contract, we transfer the leased asset, for this we create a document “ Manual entries"and write the wiring there:

To reflect the redemption value, you will need to accept this OS on your balance sheet through “ Receipt acts, invoices", then do " Acceptance for registration" Postings:

Accounting with the lessee. Object on the balance sheet of the lessee

In this case, we first go to the “ OS and intangible assets"create a document" Entry into leasing" The resulting wires are:

Next we reflect the business transaction “ Acceptance of fixed assets for accounting" Select the method of receipt " According to the leasing agreement", then the field " Initial cost» and the method of reflecting expenses on leasing payments. Postings:

If this operation is reflected according to the algorithm described above, then temporary and permanent ones will be reflected in accordance with PBU 18, that is, the difference between the amount upon receipt and the initial cost will be different in tax accounting.

Reflection of transactions under leasing agreements in the program

"1C:Accounting 8" (edition 3.0)

The word "leasing" is borrowed from the English language. It comes from the verb “to lease”, which means “to rent, to rent”. Indeed, there are many similarities between leasing and renting. However, these concepts should not be identified.

Rent consists of the lessor transferring his property for use and temporary possession to the lessee for a fee. The object of lease can be both movable and immovable property, including land plots.

Leasing(the so-called financial lease) consists in the fact that the lessor undertakes to acquire ownership of new property specified by the lessee from a specific supplier and provide this property to the lessee for a fee for temporary possession and use (clause 4 art. 15 Federal Law dated October 29, 1998 No. 164-FZ). The subject of a leasing agreement can be any non-consumable items. As a rule, these are fixed assets, with the exception of land plots and environmental management facilities. Moreover, depending on the terms of the agreement, the lessee has the right to buy this property at the end of the leasing agreement by paying the redemption price, or return it to the lessor.

Thus, unlike a lease agreement, a leasing agreement implies the emergence of legal relations between three parties: the seller of the property, the lessor and the lessee, and also gives the lessee the right to acquire ownership of the leased asset at the end of the agreement.

The redemption price is paid either in a lump sum at the end of the leasing agreement, or in equal shares as part of the leasing payments. According to Art. 28 Federal Law “On financial lease (leasing)” “Leasing payments mean the total amount of payments under the leasing agreement for the entire term of the leasing agreement, which includes reimbursement of the lessor’s costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with the provision of other provided service leasing agreement, as well as the lessor’s income. The total amount of the leasing agreement may include the redemption price of the leased asset if the leasing agreement provides for the transfer of ownership of the leased asset to the lessee."

In the event that, at the end of the contract, the property becomes the property of the lessee, the purchase price of the property must be indicated in the contract (or an addition/appendix to it) (letters from the Ministry of Finance of the Russian Federationdated 09.11.2005 No. 03-03-04/1/348 And dated 09/05/2006 No. 03-03-04/1/648 ) and the procedure for its payment. At the same time, the presence or absence of a redemption price in the contract affects only the tax accounting of leasing transactions.

The redemption price is taken into account for tax purposes separately from the other amount of lease payments in any order of its payment (letter from the Ministry of Finance of the Russian Federationdated 02.06.2010 No. 03-03-06/1/368 ). No matter how the redemption price is paid: in parts during the term of the contract as part of leasing payments, or at some point in full, or in several separate payments, the lessee is an advance paid. Like any other advance paid, until the transfer of ownership, the redemption price is not an expense taken into account when calculating income tax. Thus, the lessee's expense taken into account when calculating income tax is only reimbursement of the lessor's costs associated with the acquisition and transfer of the leased asset to the lessee, reimbursement of costs associated with the provision of other services provided for in the leasing agreement, as well as the lessor's income.

At the time of transfer of ownership, the redemption price paid to the lessor forms the initial tax value of the depreciated property. Depreciation is charged by the lessee in the usual manner, as when purchasing used property.

Accounting for transactions related to a leasing agreement is regulated Instructions on the reflection in accounting of operations under a leasing agreement, approved. by order of the Ministry of Finance of Russia dated February 17, 1997 No. 15.

During the period of validity of the leasing agreement, depending on its terms, the property may be on the balance sheet of the lessor or on the balance sheet of the lessee. The most difficult case from the point of view of accounting and tax accounting of leasing operations is the case when the property is on the balance sheet of the lessee (accounting from the position of the lessee). Let us consider, using a specific example, the sequence of accounting operations in the program “1C: Accounting 8”, edition 3.0 (hereinafter referred to as the “program”) for the lessee in the specified case, taking into account the options when the property is purchased at the end of the leasing agreement or returned to the lessor.

Example

Yantar LLC (lessee) entered into leasing agreement No. 001 dated January 1, 2013 with Euroleasing LLC (lessor) for a period of 6 months. The subject of leasing is a FIAT car, which was accepted on the balance sheet of Yantar LLC on January 1, 2013. The costs of its acquisition by the lessor amount to 497,016 rubles. (including VAT 18% - RUB 75,816). Under the terms of the leasing agreement, the cost of a FIAT car, taking into account the redemption price, is 1,416,000 rubles. (including VAT 18% - RUB 216,000). In this case, the redemption price of the vehicle is paid in equal monthly installments along with leasing payments. The monthly amount of leasing payments is 106,200 rubles. (including VAT 18% - 16,200 rubles). The redemption price is 778,800 rubles. (including VAT 18% - 118,800 rubles) and its monthly amount is 129,800 rubles. (including VAT 18% - RUB 19,800). The useful life of the vehicle is 84 months. Depreciation is calculated using the straight-line method. At the end of the contract, the FIAT car becomes the property of Yantar LLC.

The following transactions must be generated in the program (Table 1).

Table 1 - Accounting entries under the leasing agreement

|

Debit |

Credit |

||||||||

|

For accounting and tax accounting, appropriate entries are made in analytical registers |

|||||||||

As a result of posting the “Receipt of goods and services” document, the following transactions will be generated (Fig. 2).

Rice. 2 - Postings of the document “Receipt of goods and services”

As mentioned above, until the transfer of ownership of the property to the lessee, the redemption price is not taken into account when calculating income tax. Therefore, we will resort to manual adjustment of document movements and in the columns “Amount NU Dt”, “Amount NU Kt” we will enter the amount of the lessor’s expenses for the acquisition of property (excluding VAT) - 421,200 rubles. Redemption price 778,800 rubles. We will reflect the difference as a constant, putting it in the appropriate columns (Fig. 3).

Rice. 3 - Manual adjustment of entries in the “Receipt of goods and services” document

3. To perform the operation of accepting a fixed asset for accounting, you must create a document “Acceptance for accounting of fixed assets” (Fig. 4). This document registers the fact of completion of the formation of the initial cost of a fixed asset item and (or) its commissioning. When creating a fixed asset, it is advisable to create a special folder in the “Fixed Assets” directory for fixed assets received on lease.

The initial cost of the object, which is planned to be taken into account as fixed assets, is formed on account 08 “Investments in non-current assets”.

Rice. 4 - Acceptance of fixed assets for accounting

We will also fill in the “Accounting” and “Tax Accounting” tabs of the document “Acceptance of fixed assets for accounting”, as shown in Fig. 5 and 6.

Rice. 5 - Filling out the “Accounting” tab

Rice. 6 - Filling out the “Tax Accounting” tab

As a result of the document “Acceptance for accounting of fixed assets”, the following transactions will be generated (Fig. 7).

Rice. 7 - Postings of the document “Acceptance for accounting of fixed assets”

4. At the end of the first month of the leasing agreement, the next leasing payment is accrued. To reflect this operation, you can enter the operation manually or use the “Debt Adjustment” document (the “Purchases and Sales” tab, the “Settlements with Counterparties” section) with the “Debt Transfer” operation type (Fig. 8).

Rice. 8 - Filling out the “Debt Adjustment” document

In the “Amount” field, we will manually enter the amount of the next lease payment of 236,000 rubles. = 1,416,000 rub. / 6 months (contract time).

In the “New accounting account” field, indicate account 76.09 “Other settlements with various debtors and creditors.” It is he who will appear as a loan account as a result of posting the document (Fig. 9).

Rice. 9 - Posting the accrual of the lease payment

All other monthly lease payments can be calculated in the same way.

5. We will transfer the next lease payment to the lessor. To do this, we will first create the document “Payment order” (Fig. 10), and then, based on this document, we will enter the document “Write-off from the current account” (Fig. 11).

Rice. 10 - Payment order for transfer of lease payment

Rice. 11 - Debiting the lease payment from the current account

After receiving a bank statement, which records the debiting of funds from the current account, it is necessary to confirm the previously created document “Writing off from the current account” to generate transactions” (checkbox “Confirmed by bank statement” in the lower left corner of the form in Fig. 11).

When posting the document, posting Dt 76.09 - Kt 51 is generated (Fig. 12), because according to the conditions of our example, the fact of receiving material assets (fixed assets) is first recorded, then the fact of payment, i.e. at the time of payment there was an account payable to the supplier. As a result of business transactions, accounts payable were repaid.

Rice. 12 - Result of posting the document “Write-off from the current account”

6. The initial cost of the leased object is included in expenses through depreciation charges. Since the leased asset is on the balance sheet of the lessee, he charges monthly depreciation charges on the leased asset in the amount of the depreciation rate calculated based on the useful life of this object.

To calculate the amount of depreciation charges, we will perform the “Month Closing” procedure in the “Accounting, Taxes, Reporting” section (this can also be done using the routine operation “Depreciation and depreciation of fixed assets” on the “Fixed Assets and Intangible Assets” tab). First, we will close January (depreciation will not be accrued in January, since fixed assets were taken into account in this month), and then February (Fig. 13). Before calculating depreciation and carrying out any other routine operations to close the month, it is necessary to monitor the sequence of documents.

Rice. 13 - Calculation of depreciation using the “Closing of the month” operation

As a result, the following wiring will be generated (Fig. 14)

As you can see, the posting reflects a constant difference of 9271.43 rubles, which arose due to the difference in the cost of fixed assets in accounting and tax accounting. This difference will be formed throughout the entire period of depreciation in tax accounting.

In addition to depreciation deductions, expenses in the form of leasing payments minus the amount of depreciation on the leased property are recognized monthly in the tax accounting of the lessee. In this regard, taxable temporary differences arise, which lead to the formation of deferred tax liabilities, reflected in the debit of account 68 “Calculations for taxes and fees” and the credit of account 77 “Deferred tax liabilities”. The adjustment amount is determined as the difference between the monthly lease payment excluding VAT and the amount of depreciation, multiplied by the income tax rate.

If the monthly depreciation amount exceeds the lease payment amount, only depreciation on the leased object will be taken into account in tax accounting expenses.

Obviously, in our example, the amount of monthly depreciation deductions is less than the amount of leasing payments. The difference is

200,000 - 14,285.71 = 185,714.29 rubles.

Therefore, it is necessary to reflect this difference as temporary for tax accounting purposes.

To pay off monthly deferred tax liabilities in accounting, you can use the operationentered manually (tab “Accounting, taxes, reporting”, section “Accounting”, item “Operations (accounting and accounting)”). The generated wiring is shown in Fig. 15. The amount of the entered transaction is equal to the above temporary difference multiplied by the income tax rate:

185,714.29 * 0.2 = 37,142.86 rubles.

Rice. 15 - Entering a manual transaction to settle a deferred tax liability

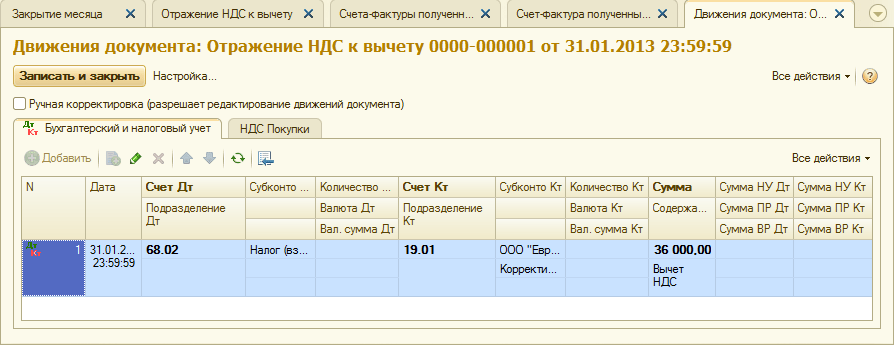

7. To reflect VAT on the lease payment accepted for deduction, we will create a document “Reflection of VAT for deduction” (tab “Accounting, taxes, reporting”, section “VAT”). Let's fill it in as shown in Fig. 16. As a payment document, we will indicate the “Debt Adjustment” document corresponding to this lease payment.

Rice. 16 - Reflection of VAT on lease payment for deduction

It is also necessary to create an invoice received based on the created document (Fig. 17).

Rice. 17 - Form “invoice received” for lease payment

The posting generated by the document “Reflection of VAT for deduction” is shown in Fig. 18

Rice. 18 - Result of conducting the document “Reflection of VAT for deduction”

8 . Upon expiration of the lease agreement and payment of the entire amount of lease payments, including the redemption price, the object is transferred to its own fixed assets.

To reflect changes in the state of the OS, the document “Changes in the state of OS” can be used (tab “Fixed assets and intangible assets”). Let's fill out its form, as shown in Fig. 19. If the “Transition of ownership of the OS upon completion of leasing” event is not in the “Asset Event” list, it must be created. When creating, specify the OS event type as “Internal movement”.

Rice. 19 - Changing the OS state

After the transfer of ownership, depreciation parameters may change due to a change in the value of the fixed assets in tax accounting or a change in the acceleration coefficient (Fig. 20).

Rice. 20 - Changing depreciation parameters

The remaining useful life of the asset in months is indicated here (84 - 6 = 78), and the redemption price is entered in the “Depreciation (PR)” column (the difference in the initial estimate of the cost of the asset in the accounting book and NU). In the future, depreciation in NU will be calculated based on the redemption price.

In conclusion, let us consider the case when the property is returned to the lessor upon completion of the leasing agreement.

To register this fact in the program, you must use a manual operation (Fig. 21).

Rice. 21 - Reflection of the return of property to the lessor

We generate transactions Dt 01.09 (“Disposal of fixed assets”) - Kt 01.01, as well as Dt 02.01 - Kt 01.09. Thus, the property was returned to the lessor with full depreciation value.

Step 1. Receiving the leased item

Step 2. Accounting for leasing payments

An advance leasing payment, like a regular service in 1C 8.3, is taken into account by the Receipt document (act, invoice). This document is created from the Purchases tab – then Receipts (acts, invoices) – click Receipts:

The object is identified on the lessor's balance sheet

From the list elements, select Services (act). In field Calculations if leasing is not the main activity, then you need to select accounting account 76.05:

For each individual service, you can adjust cost accounting accounts, as well as enter cost analytics:

Select Leasing Services in the operation selection list. Filling out these documents is not much different:

- The main thing that is necessary is to fill out the accounting accounts;

- Advance rules - do not count if the contract also includes monthly purchase price along with leasing payments;

- When receiving the original, you must set the Original received flag;

- Don’t forget to enter the details of the incoming invoice and register it using the Register button.

Step 3. Payment of advance payments

Client-bank is not used

In 1C 8.3, it is created in the Bank and cash desk tabs - then Payment orders and based on it we register. In the payment order:

- The type of transaction must be specified as Payment to supplier;

- The amount is indicated in full with the redemption price. The distribution of this amount will be in 1C postings;

- Check the Paid box;

- A debit from a current account is registered via Enter document debit from a current account:

We establish accounting accounts in the document if:

- The object is identified on the lessor’s balance sheet – 05;

- The object is identified on the balance sheet of the lessee - 07.2.

Set the Debt repayment value to By document. When selecting a document, do not forget to set the required accounting account:

The Confirmed by bank statement flag must be cleared and set when the payment goes through. Movements in 1C 8.3 are formed only after checking this box.

Client bank used

If you use , then you do not need to create a Payment Order document. The debit from the current account is filled out based on the uploaded payment order or manually:

- For the first option, you need to sort the documents in the payment order journal using the selection fields and find the required payment order.

- For the second option, use the command Write-off from the document register. When creating manually, do not forget to set the transaction type to Payment to supplier.

From the document Debiting from a current account, do not forget to register an advance invoice.

Step 4. Calculate depreciation

For a leasing object, it is necessary to register only if the object is identified on the balance sheet of the lessee.

Depreciation, as well as the recognition of leasing payments in the accounting system in 1C 8.3, are formed by the regulatory operation Depreciation and depreciation of fixed assets, as well as the operation Recognition of leasing payments in the accounting system when closing the month, respectively (Operations - Closing the month):

Important! Depreciation is accrued in the next month after acceptance for accounting.

Movements of the operation Depreciation and wear of the OS:

Recognition of leasing payments in tax accounting:

The depreciation sheet can be generated in the fixed assets and intangible assets tabs - then the fixed asset depreciation sheet:

Step 5. Status of settlements with the lessor

The status of settlements with the lessor in 1C 8.3 can be viewed using the Account Analysis report. Is the entire redemption price transferred to the lessor:

- Analysis of account 60.02 - shows how much leasing payments have been accrued and paid;

- The object is identified on the lessor’s balance sheet - analysis of account 05;

- The object is identified on the lessee’s balance sheet - account analysis 07.2.

Step 6. Transfer of ownership to the lessee

The object is identified on the lessor's balance sheet

There is no standard document in 1C 8.3 Accounting, so we will use the Operation document.

You can create an Operation document from the Operations section, where we select Operations entered manually, then click Create and select Operation:

The document must reflect the write-off from the off-balance sheet account, as well as reflect the depreciation of the fixed asset. The document Receipt (act, invoice) in 1C 8.3 registers the redemption value of the OS.

The acquisition of an OS in 1C 8.3 is documented in the document Receipt. It can be found in the Purchases or OS and Intangible Assets tab, in the latter the document is called Equipment Receipt.

Key points when preparing the Admission document (it doesn’t matter which link you use to create it!):

- The fixed asset is entered in the Equipment table;

- Payment accounts can be left as default;

- Don't forget to register your invoice:

The Receipt document records all advances at the purchase price, and also records the receipt on the lessee's balance sheet.

In the document Acceptance for accounting of fixed assets:

- OS event – indicate acceptance for accounting with commissioning;

- Identify the financially responsible person and indicate the location of the OS.

In the Non-current asset section:

- Type of operation – install Equipment;

- Receipt method – set the value to Purchase for a fee.

The bookmarks OS, BU, NU, Depreciation bonus are filled in according to the accounting data of the accepted fixed asset:

The object is identified on the balance sheet of the lessee

The transfer of ownership of the leased object in 1C 8.3 is formalized by the document Redemption of the leased object in the OS and Intangible assets tabs - further Redemption of the leased object. This document in 1C 8.3 is automatically filled in when selecting a counterparty agreement, if the document Acceptance of leasing has already been drawn up under the selected agreement. The table part can be filled out using the Fill button:

How to carry out leasing operations in the 1C 8.3 Accounting program?

Let's consider an example of accounting for leasing in 1C Accounting 8.3, when fixed assets are listed on the balance sheet of the lessee.

Access to equipment leasing

First, we will receive the property. Let’s go to the “Fixed assets and intangible assets” menu, then in the “Receipt of fixed assets” section, select “Receipt of leasing”. To create a new document, click the “Create” button in the window that opens. A new document window will open.

First, fill out the header of the document. Let's indicate there:

- organization

- counterparty

- agreement with the counterparty

- Settlement account is indicated as 76.07.1

When entering a lease, 1C 8.3 makes the following entries:

Registration of equipment and other property

After you have created a receipt of fixed assets, you need to take them into account. To do this, in the same section, select “Acceptance for accounting of fixed assets“.

Click the “Create” button and fill out the document:

- We indicate that we accept equipment for registration upon commissioning

- indicate the financially responsible person (MRP)

- indicate the location of the fixed asset

- type of operation – equipment

- method of receipt - under a leasing agreement

- Next, select the counterparty, contract and equipment from the “Nomenclature” directory

On the “Fixed Assets” tab, we indicate the property already from the “Fixed Assets” directory. Essentially, this is a fixed asset card.

Information for calculating depreciation is located on the “Accounting” tab. Here we fill in the following fields:

- accounting account: 01.03

- accounting procedure: depreciation

- Next, we indicate in what order depreciation will be calculated

This example is filled out like this:

On the “Tax Accounting” tab, as a rule, the same parameters are indicated.

Now the document can be posted. Please note that the data entered when accepting a fixed asset for accounting is reflected automatically in its card:

How to reflect the monthly lease payment

The leasing payment in the program is reflected as a receipt document in the “Purchases” menu. In the latest releases of 1C 8.3, the “Leasing Service” operation was added to it:

An example of postings for leasing services in 1C Accounting looks like this:

Also in the 1C 8.3 program, in the “OS and intangible assets” section, a document has appeared that allows you to change the reflection of expenses on leasing payments:

Calculation of equipment depreciation

In this case, the equipment is on the balance sheet of our enterprise, so its initial cost is reduced due to depreciation.

Depreciation in 1C is calculated at the end of the month using the “Closing the Month” regulatory procedure.

Before performing the operation, do not forget to restore the sequence of documents (repost them from the moment of the last corrected document). The link to this operation is in the processing of the routine operation.

Based on materials from: programmist1s.ru