Question: Request for the deduction calculation register

It is necessary to display employee accruals and deductions

I made a request only for accruals, everything turned out like this:

| 1C | ||

|

||

And if I add retention it turns out some kind of nonsense

Here:

| 1C | ||

|

||

Help me please...

Answer: I don't offend

I'm finally amazed at the level

I'm like that too. I think later

Question: ZUP 3.0 Refund of personal income tax to a dismissed employee

Answer:

Question: IL is temporarily not on hold

Answer:

Question: ZUP 3.1 Deductions from employees

There are a couple of deductions - compensation for damage and return of overpaid salary.

In ZUP it is implemented through “withholding against settlements for other transactions.”

But the calculation itself is either a fixed amount or according to a formula.

In practice, a calculation similar to writs of execution is used. Those. percentage of salary until the amount is reached.

Based on the standard mechanism, you will need to enter 3 identical deductions - in the amount, the total calculation base, the calculation base without sick leave.

Are there other solutions?

Answer: everything turns out to be even simpler))

create new deductions with the purpose of “Writ of Execution”.

In the IL document itself, you simply select the desired deduction.

Profit

Question: Retention is being tightened, but additional accrual is required upon dismissal

Answer:

Question: Calculation of personal income tax upon dismissal of an employee

Answer:

Question: Issuing goods to an employee with subsequent distribution according to orders (advice needed)

Greetings, Forum members!

UT 10.3, normal, 1s8.2

Please advise what you can come up with...

Answer:

| Ukraine |

|---|

| Greetings, Forum members! UT 10.3, normal, 1s8.2 The customer wanted to do the following: 1. To fulfill several orders, issue one employee with a certain number of goods (large list) I understand nonsense, but nevertheless, how can this be achieved. The difficulty is that, for example, Product 1 in the amount of 10 units can be distributed among different orders, for example 7+3. Please advise what you can come up with... |

make a register - delivery.. if you want, look at trade 11, something similar is done there.

They give the employee not a product but a set of orders - therefore there must be a measurement of the order and the product if necessary.

But this is how you are trying to do something through the OP...usually the documents are drawn up first and then delivered

Question: ZUP 3.1.5: One employee is not added to the salary payment sheet

The problem is this. When filling out the statement (both automatically and manually), it is impossible to include one employee. When the selection form opens from the list, this employee is not there (but all the others are). What could be the reason for this strange behavior? In the Employees directory, this employee is present as expected, everything is entered correctly. Maybe some registers are still used in the conditions for selection?

Answer:() Yeah, there’s a bug in standard 3.1.5

Below is a piece of my letter in 1C. While I'm waiting.

Problem: incorrect recording of changes in the Information Register of Main EmployeesIndividuals, as a result of which the list of employees for selection in documents and reports with selection for the Organization is incorrectly generated.

The error is reproduced in the demo configuration on version 3.1.5.129.

Procedure.

1. We create a new Organization Alpha, which is not a branch of another organization

2. We are introducing the hiring of a new employee to the new organization Alpha for the existing individual Anton Vladimirovich Bazin, who also works in the Kron-C organization

3. When Admission to the Alpha organization is carried out, the entry in the RS Main Employees of Individuals with the individual Anton Vladimirovich Bazin in the Kron-Ts organization is replaced by an entry with the Alpha organization. A new entry is not created. Fig 1.

4. When you try to select an employee, for example, in a pay slip for the Kron-Ts organization or in the document Statement to the Cashier, the employee Anton Vladimirovich Bazin is not in the employee selection list. Figure 2 and 3.

Please confirm the bug and plans to fix it.

Question: unloading of employees from ZiKSU ed. 3.1 in BSU ed.2

Good evening, dear specialists. It is necessary to download the directory of employees (and individuals) from Salaries and personnel of a state institution from 3.1.2.213 (current release) into the clean Accounting Department of a state institution 2.0.50.7 (current release). It seems that this can be done using standard means, i.e. configure data synchronization. I start the setup on the ZiKGU side, i.e. The BSU base is clean.

1. check the box for “data synchronization”

2. Click "data synchronization settings"

3. Click "set up data synchronization"

4. in the drop-down list, select the line “1C: Accounting of a government institution, edition 2.0”

5. "specify settings manually"

6. connection option = direct connection to the program, specify the directory of the infobase, enter authentication data (login, password)/, the connection check is successful.

7. rules for sending data to BSU ed.2

-Upload documents and background information starting January 1

2017

-Upload documents and reference information for all organizations

-Unload organizational units: no.

-Upload employee data: no.

8. Rules for sending data to ZiKSU:

-upload data: for all organizations

-Counterparty for salary accounting: not installed

-Type of primary document: not installed

9. "data synchronization setup completed successfully"

10. The “perform synchronization” checkbox is checked, I leave it. Click Next

11. The synchronization window (data comparison) appears. in the comparison table there was only one row with the directory "Items of Expenses", 37 elements were not compared (new ones will be created)

12. I agree, click Next. A window appears with settings for the data to be sent. (do not add; add documents; add data (with selection)). I leave the “do not add” option and click Next. Let me make a reservation right away that I tried to select the “add data” option, checked the box next to the “employees” directory, 651 items were selected for sending - but still the employees were not transferred to the BSU (the registration log indicates that only 291 objects were sent (other directories, without employees))

Question: what am I doing wrong? Why don’t employees go from ZiKSU rev. 3.1 to BSU rev. 2? It may be necessary to check the “upload PO for each employee” checkbox somewhere in the database settings, and not “summary”

Answer:+() Although the setting will not help, employees are uploaded using a link from the salary reflection document, just correct the rules.

Another interesting question from our subscribers:

“Every month, a group of employees (drivers) need to enter information to carry out deductions for the use of gasoline on company vehicles. I can’t find such an opportunity in 1C ZUP 3. Documents are entered only for one employee. How to assign a hold list in ZUP 3 for a group of employees?

✅ Seminar “Lifehacks for 1C ZUP 3.1”

Analysis of 15 life hacks for accounting in 1C ZUP 3.1:

✅ CHECKLIST for checking payroll calculations in 1C ZUP 3.1

VIDEO - monthly self-check of accounting:

✅ Payroll calculation in 1C ZUP 3.1

Step-by-step instructions for beginners:

Answer:

To do this, in ZUP 3 you need to enter an indicator for which, using the document "Data for salary calculation" Information about the required withholding amount will be entered.

Let's create an indicator (Settings - Payroll indicators). The indicator will be entered for a specific month for the employee.

Using the document “Templates for entering initial data” we will create a form for entering an indicator.

On the “Advanced” tab, we indicate that the input form can have several employees.

Now, using the “Payroll calculation data” document, we will enter information about the amount of deduction for a certain month.

You also need to configure the type of retention in which the indicator we created will be used. In addition, in the retention settings you must indicate that retention is calculated only if this indicator is entered.

After this, during the final calculation of employees in the document “Calculation of salaries and contributions”, the amounts entered in the document “Data for salary calculation” for the same month will be withheld.

To be the first to know about new publications, subscribe to my blog updates:

", December 2017

Setting up deductions in “1C: Salary and 8”, ed. 3.1, be it alimony, fines or loan payments.

How to keep child support

Deductions from wages are very diverse, but they can be divided into several types:

mandatory deductions, which include alimony, deductions based on writs of execution (fines), etc.;

at the initiative of the employer, fines for violation of traffic rules, etc.;

at the initiative of the employee, for example, deduction to pay off a loan.

First, let's look at how to withhold alimony in "1C: Salaries and Personnel Management 8", ed. 3.1.

If parents do not fulfill their obligations to support their children, then funds are recovered from the parents in court. In turn, the employer is obliged to withhold alimony from the employee’s salary every month and pay the person receiving alimony no later than three days from the date of payment of wages to the debtor.

The organization has received the executive documents, and we are forming the following actions in the system.

First, let's configure the system: go to the section “Settings” – “Payroll calculation” – “Setting up the composition of accruals and deductions” – “Deductions” – set the flag “Deductions under writs of execution.”

We register the terms of the writ of execution in the document “Writ of Execution”, which is located in the tab « Salary" – « Holds."

In the writ of execution we indicate the employee from whom alimony is required to be withheld, the withholding period, the recipient and his address, and the method of calculation. Calculation methods can be as follows

Percentage, if the writ of execution specifies to withhold alimony as a percentage.

Fixed amount.

A share, if the calculation is similar to the calculation by percentage, however, allows you to avoid errors in the calculation due to rounding (for example, 1/3 instead of 33.33%).

A money transfer through a paying agent is completed if the amount withheld from the employee will be transferred to the recipient using a paying agent: bank or post office.

The deduction itself is made in the document “ » when calculating wages. Further, the payment of income occurs without taking into account the amounts under writs of execution.

Fines for traffic violations

An organization can pay a fine for violating traffic rules (traffic rules) and withhold the amount from the employee’s salary in accordance with Art. 138, 238, 248 Labor Code of the Russian Federation.

To do this, in “1C: Salaries and Personnel Management 8”, ed. 3.1, create a new hold. Let's go to “Settings” – “Holds”. We create a new element in the directory. In it we indicate: “Name” – “Traffic fines”. Select the retention purpose “Deduction for settlements on other transactions»; "Calculation and indicators» – the result is entered as a fixed amount; “Type of salary transaction” – “Compensation for damage”.

We enter the amount of the received fine using a special document “ Deduction for other transactions", which is located in “Salary” – “Deductions”. In the new document we indicate the organization, employee, retention period, and amount of retention.

At the end of the month we calculate the salary using the document “ Calculation of salaries and contributions", where on the tab " Holds» is automatically subject to deductions according to traffic regulations. To reflect transactions, we must register “ Reflection of salaries in accounting».

Note: transactions uploaded to the accounting program are generated automatically by debit and credit 73.02.

Deduction for loan repayment

At the request of an employee, an organization can reduce earnings by making transfers to other organizations, for example, paying off an employee’s loan.

First of all, we set up the system: create a new element in the directory " Holds" Fill in the new element: "Name" -“Deduction for loan repayment”; “Hold Assignment” –“Other retention in favor of third parties”, “Hold in progress” – “ Monthly ", "Calculation and indicators" –“The result is entered as a fixed amount.”

In this case, it is enough to create a retention once and then apply it to all employees.

Then we register the terms of retention in the document “ Permanent retention in favor of third parties» (“Salary” – “Deductions”). Select an employee in the line “ Hold» – previously created hold. Next, set the switch to "Start New Hold", we determine the period, in the line “Counterparty” we select the recipient - the bank. In the tabular part of the document, we select an employee and indicate the amount, since when creating the deduction, we indicated that the result is a fixed amount.

At the time of calculating the salary for the month, the system will withhold the specified amounts from the employee. When uploading to “1C:Accounting 8”, debit and credit entries 76.49 will be generated.

Checking the withheld amounts can be done through salary reports: payslip, salary analysis, and so on.

Sometimes situations arise in which it is necessary to withhold certain amounts from an employee’s salary. In one of the previous articles we already looked at Retention by writ of execution in 1C: Enterprise Accounting 8 edition 3.0. In this article we will look at how to work with other types of deductions: debt on accountable amounts, union membership dues and the cost of damaged material assets (defects in the manufacture of products).

How are these deductions fundamentally different from the deductions based on a writ of execution, discussed earlier? The fact is that accounting for such operations is not automated in the 1C: Enterprise Accounting 8 program and therefore raises quite a lot of questions from users.

But before we begin to deal with how these situations are reflected in the program, I would like to remind you that, according to Article 138 of the Labor Code of the Russian Federation, the amount of deductions at the initiative of the employer should not exceed 20% of the employee’s salary. Therefore, if the amount of deductions exceeds the maximum possible, then the balance is withheld in the next month.

So, let's look at how to reflect each of the three listed cases in the program.

1. Retention of debt on accountable amounts

Let’s say that an employee did not fully account for the amounts issued on account and did not return the balance of the debt. It was decided to withhold the specified amount from his salary.

First of all, we need to add a new Type of calculation. To do this, open the section “Salaries and Personnel”, “Directories and Settings”, “Deductions”

Click on the “Create” button and fill in:

- Name

- calculation type code, which must be unique, that is, it must not be repeated.

The “Deduction Category” field is not filled in in our case, since there is no suitable category in the list for the “Retention of Accountable Amounts” calculation type.

Write it down and close it.

Next, create a “Payroll” document. Open the section “Salaries and Personnel”, “Salaries”, “All Accruals”. After automatically filling out this document, go to the “Retentions” tab, click the “Add” button and fill out:

- Full name of the employee

- type of calculation

- amount of withholding

- recipient of deductions

But if we post the document, we will notice the following peculiarity: the document did not automatically generate postings for this deduction. To register this fact in accounting, you must additionally use the “Operation” document (section “Operations”, “Accounting”, “Operations entered manually”).

We add the posting Dt account 70 Kt account 71.01 “Settlements with accountable persons”

Why then was it necessary to add this deduction to the payroll document if the postings still have to be generated manually? And this must be done so that this amount is reflected in the payroll and payslip, and is also taken into account when determining the amount to be paid. We will generate a pay slip (section “Salaries and Personnel”, “Salary”, “Salary Reports”, “Pay Slip”) and check the amount withheld.

2. Withholding of trade union dues

We start again by setting up the calculation type. As in the first case, fill in the name and code of the calculation type. Only now we select the deduction category “Trade Union Dues”, because she is on the list.

Write it down and close it.

We create the “Payroll” document, fill it out and use the “Add” button on the “Deductions” tab to enter the necessary information, selecting the created type of calculation.

Next, we register the amount of deduction in accounting using the document “Operations entered manually.” We create a posting for Dt account 70 Kt account 76.49 “Calculations for other deductions from employees’ salaries”

To check, we will generate a payslip; the amount of deduction should be reflected in the section Held.

3. Retention for marriage.

Let's consider an example when an employee of the organization Maxima LLC manufactured a part with a defect that cannot be corrected, and we must deduct the cost of damaged material assets from his salary.

Just as in previous cases, we start by setting up the calculation type. We do not fill out the retention category.

Now we fill out the “Payroll” document and add information about our deduction to the appropriate tab.

Click on the link in the lower left corner to view and print the Payslip

We register the amount of deduction in accounting by filling out the document “Operations entered manually.” We create the posting Dt 70 Kt 73.02 “Calculations for compensation for material damage.”

As you may have noticed, the reflection of all three situations in the program is approximately the same, only the postings that need to be generated manually are different. You can use the same algorithm of actions when creating any other deductions that are needed in your organization.

At the very beginning of working with the 1C ZUP 8 program in its initial setup, you can contact the “Initial program setup” assistant.

Fig 1. Processing “Initial program settings”

Processing allows you to enter initial information about the organization, fill out the accounting policy, as well as settings for personnel records and payroll. Based on the entered data, accruals and deductions are created in the assistant.

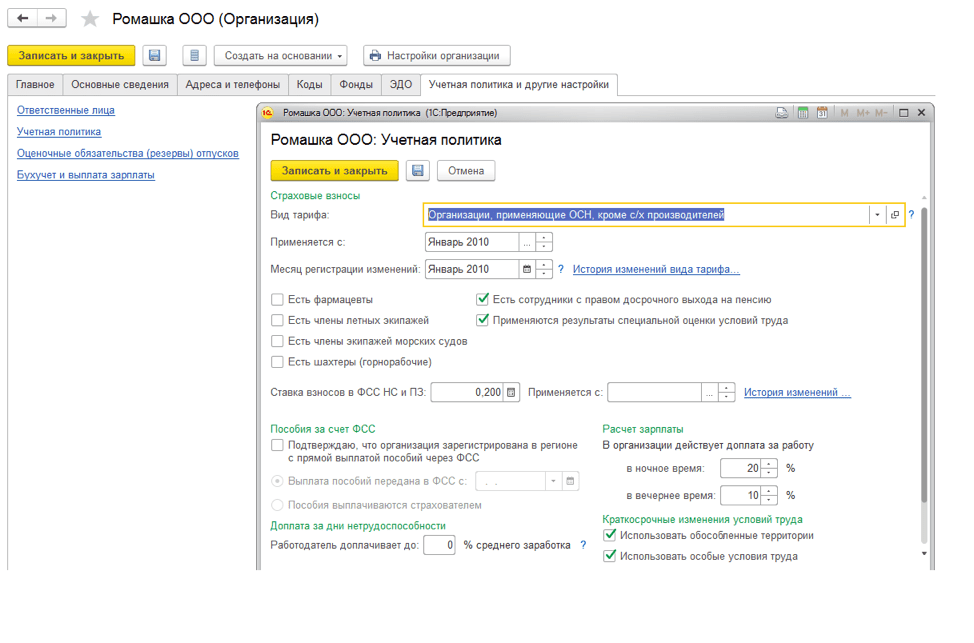

Fig 2. Accounting policy of the organization

Fig 2. Accounting policy of the organization

All entered settings for the personnel and calculation contour can be viewed or corrected in the “Settings” subsystem.

Fig 3. Setting up by personnel and calculation contour

Basic settings affecting payroll calculation:

- Income is paid to former employees of the enterprise. When you set this setting, the program will have access to the “Payment to Former Employees” document, which allows you to register financial assistance to former employees, retained earnings during employment, etc. Registered payments are reflected in the “Non-salary income” report;

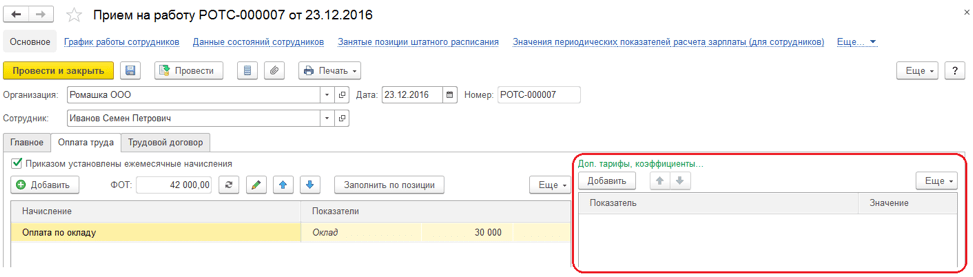

- Several tariff rates are used for one employee. When this setting is set, the block* “Additional” will be available. tariffs, coefficients."

Rice. 4. Add. tariffs, odds

Rice. 4. Add. tariffs, odds

*In the block you can select salary calculation indicators with the method of applying the value - in all months after entering the value (constant use) and the purpose of the indicator - for the employee. The selected indicators will be used in all employee accruals if they are specified in the calculation formula.

- Several types of time are used in the work schedule. When you set this setting in the program, custom time types will be available in work schedules, for which in the “Main Time” attribute the predefined values of the time types “Attendance”, “Shift”, “Night hours”, “Evening hours”, “Work in part-time mode”, “Reduced time for on-the-job training”, “Reduced working hours in accordance with the law”.

- Check compliance of actual time with planned time. This setting will not allow you to post the Timesheet document if the actual time on the timesheet does not coincide with the work schedule or individual schedule.

- Limit the amount of deductions to a percentage of wages. The setting will allow you to limit the total amount of deductions to a percentage of wages in accordance with Art. 138 Labor Code of the Russian Federation. When this attribute is specified in deductions, the attribute “Is a collection”* becomes available.

Rice. 5. Setup hold

Rice. 5. Setup hold

*When you set this feature, you can select the order of collection in the writ of execution, and control of the amounts of deductions in accordance with the law is carried out in the document “Limitation of Collections.”

- The procedure for converting an employee’s tariff rate into the cost of an hour. The setting allows you to define the algorithm for calculating the indicators “Cost of a Day, Hour,” “Cost of a Day,” and “Cost of an Hour.”

- Indicators that determine the composition of the aggregate tariff rate. Here is a list of indicators included in the employee’s total tariff rate. When calculating the indicators “Cost of a Day/Hour”, “Cost of a Day”, “Cost of an Hour”, the selected indicators will be used in the employee’s tariff rate.

- Check compliance of charges and payments When the setting is enabled, if you try to pay more than accrued, the program will issue a warning and the salary slip will not be processed.

- Perform additional accrual and recalculation of salaries in a separate document. When this setting is set, all recalculations will be recorded in the document “Additional accrual, recalculations”.

Setting up charges and deductions. Payroll indicators

Figure 6. Setting up charges and deductions

Figure 6. Setting up charges and deductions

According to the selected settings, the program creates calculation types, as well as salary calculation indicators used in the formulas for newly created accruals and deductions.

You can set up a new accrual or deduction in the menu “Settings/Accruals/Deductions”.

Let's look at an example of creating a new accrual.

Rice. 7. Setting up accrual

Rice. 7. Setting up accrual

On the “Basic” tab fill in:

- Accrual assignment allows you to automatically fill in some accrual details. For example, when choosing a destination - vacation pay, the accrual will be carried out by the “Vacation” document, the personal income tax code is 2012, the “Average Earnings” tab will be blocked.

- Execution method. Filling is available for certain accrual purposes, for example, when choosing the purpose - time-based wages and allowances. The following values are available:

- Monthly;

- According to a separate document. A choice of documents is available - one-time accrual or bonus;

- In the months listed;

- Only if an indicator value is entered;

- Only if the time tracking type is entered;

- Only if the time falls on holidays.

- Supports multiple simultaneous accruals. When you set this feature, the system will allow you to enter several types of accruals in one month in the context of basis documents.

- Include in payroll. During installation, this accrual will be included in the wage fund.

- Accrued when calculating the first half of the month. When this flag is set, the type of calculation will be accrued when calculating the advance payment using the document “Accrual for the first half of the month”.

- In the “Constant indicators” block, you must indicate for which constant indicators you need to request input of the indicator value, and for which you need to clear the value when canceling the accrual.

In the accrual formula we write: Tariff RateHourly*Percentage of Supplement for the Nature of Work*TimeInHours.

On the Time Accounting tab, the type of accrual is indicated:

- For working a full shift within normal time limits. The type of calculation will record the time worked. Set for the employee’s main all-day planned accrual.

- For working a part-time shift within normal time limits. The type of calculation will record the time worked. Installed for intra-shift accrual.

- For working overtime. For example, it is established for an accrual that pays for work on a holiday.

- Additional payment for already paid time. Set for bonuses, allowances, surcharges, etc.

- Full shifts\Partial shifts. Set for accruals that are deviations from the employee’s work schedule. For example, vacations, business trips, etc.

We indicate the type of time that is taken into account in the indicators “TimeInDaysHours”, “TimeInDays”, “TimeInHours”.

In the example, we indicate “Working time” - a predefined type of time, which includes all types of time with the “Working time” attribute set.

Rice. 8. “Time tracking” tab for accruals

Rice. 8. “Time tracking” tab for accruals

On the “Dependencies” tab, accruals and deductions are indicated, the calculation base of which includes this accrual. On the “Priority” tab, crowding out accruals are indicated. On the “Average earnings” and “Taxes, contributions, accounting” tabs, the accounting and taxation procedure is configured.

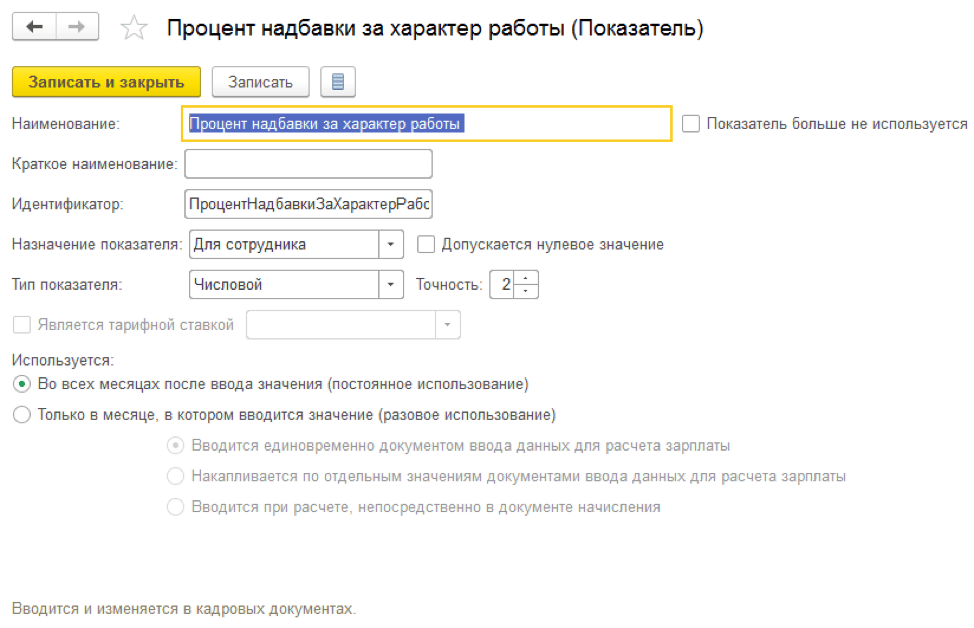

Let’s create the indicator “Percentage of Allowance for Character of Work”.

Rice. 9. Setting up the indicator “Percentage of Allowance for the Character of Work”

Rice. 9. Setting up the indicator “Percentage of Allowance for the Character of Work”

The purpose of the indicator can be for an employee, department, or organization. Can be periodic, one-time or operational.

Periodic indicators are entered in personnel documents, one-time indicators are entered in “Data for salary calculation” for the month. The operational indicator can be entered in the documents “Data for salary calculation” during the month, the total value is accumulated.

Registration of employment

To formalize the hiring of an employee, you need to create an employee card, enter the document “Hiring” or “Hiring by list”.

Rice. 10. Document “Hiring”

Rice. 10. Document “Hiring”

On the “Main” tab, we indicate the date of reception, number of bids, schedule, position, division and territory, if the accounting policy is set up to keep records by territory.

Rice. 11. Setting up the organization’s “Accounting Policy”

Rice. 11. Setting up the organization’s “Accounting Policy”

On the “Payment” tab, select planned accruals for the employee, set the procedure for calculating the advance payment and the procedure for recalculating the employee’s tariff rate into the indicators “Cost of the Day, Hour,” “Cost of the Day,” “Cost of the Hour” when calculating overtime, holidays, etc.

If the program transferred data from previous versions of the programs, then the above information is filled in automatically during the transfer in the “Initial staffing” document.

Accrual for the first half of the month

The program provides the following options for calculating the advance:

- Fixed amount;

- Percentage of the tariff;

- Calculated for the first half of the month.

The procedure for calculating and paying the advance is indicated in the personnel documents “Hiring”, “Personnel transfer”, “Change in wages”. To set the method for calculating the advance payment for a list of employees, you must use the “Change Advance Payment” document.

Rice. 12. Selecting the option for calculating the advance in the personnel document, the “Payment” tab

Rice. 12. Selecting the option for calculating the advance in the personnel document, the “Payment” tab

Methods of paying an advance in a “fixed amount” and “percentage of the tariff” do not require additional calculations and entry of documents. The payment occurs directly in the salary payment document with the nature of the payment “Advance”. The “percentage of tariff” calculation method is calculated as a percentage of the payroll, i.e. All planned employee accruals included in the payroll are taken into account.

The advance payment method “by calculation for the first half of the month” implies entering the document “Accrual for the first half of the month”. The document includes employee accruals, in the settings of which the attribute “Accrued when calculating the first half of the month” is set.

Rice. 13. Sign “Accrued when calculating the first half of the month”

Rice. 13. Sign “Accrued when calculating the first half of the month”

Salaries for the first half of the month must be paid in a statement with the nature of the payment “Advance”.

Rice. 14. Statement for advance payment

Rice. 14. Statement for advance payment

To view the results of accrual and payment of advance payments, you must use the reports “Payslip T-51 (for the first half of the month), “Payslip for the first half of the month” of the “Salary/Salary Reports” menu.

Payments during the inter-settlement period

Interpayments include the calculation of vacation pay, sick leave and other deviations from the employee’s work schedule.

Let's look at the example of calculating temporary disability benefits.

Rice. 15. Calculation of temporary disability benefits

Rice. 15. Calculation of temporary disability benefits

The system allows you to pay benefits together:

- With advance payment. When choosing this method, the benefit will be paid in a statement with the nature of the payment “Advance”;

- During the inter-settlement period. When choosing this payment method, the system will allow you to create a document for payment based on the entered “Sick Leave” document;

- With a salary. When choosing this method, the benefit will be paid in a statement with the nature of the payment “Monthly salary”.

In the “Payment” field, indicate – during the inter-settlement period. When you click on the “Pay” button, a statement document is created with the nature of the payment “Sick Leave”.

Rice. 16. Creation of a document for payment during the interpayment period

Rice. 16. Creation of a document for payment during the interpayment period

Payroll accrual and calculation. Payroll in 1C 8.3 ZUP

Salary in 1C ZUP 8.3 is calculated in the document “Calculation of salaries and contributions”. By clicking the “Details” button in the tabular part of the document, you can view the indicators on the basis of which this or that accrual was calculated.

Rice. 17. Document “Calculation of salaries and contributions”

Rice. 17. Document “Calculation of salaries and contributions”

On the “Agreements” tab, employees are calculated under civil contracts. On the “Benefits” tab, employees receiving benefits for up to 1.5 and up to 3 years are calculated. Deductions, personal income tax and insurance premiums are calculated on the document tabs of the same name. The “Additional accruals, recalculations” tab records the employee’s recalculations for previous periods, recorded by the “Recalculations” mechanism.

Rice. 18. “Recalculations” mechanism of the “Salary” menu

Rice. 18. “Recalculations” mechanism of the “Salary” menu

If the “Perform additional accrual and recalculation of salary in a separate document” checkbox is set in the settings, then the employee’s recalculations are recorded in the “Additional accrual, recalculation” document.

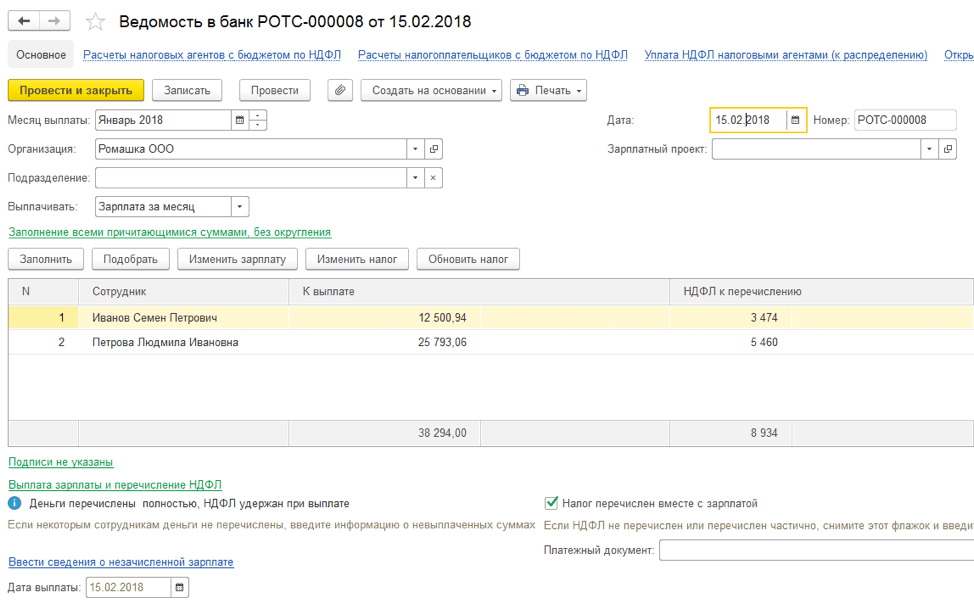

To pay wages, you must enter a document statement with the nature of the payment “Salary for the month.”

Rice. 19. Statement for salary payment

Rice. 19. Statement for salary payment

Reflection of salaries in 1C accounting

To reflect the accrual results in accounting and generate transactions in the system, you must enter the document “Reflection of wages in accounting.”

Rice. 20. Document “Reflection of salaries in accounting.” Payroll accounting in 1C

Rice. 20. Document “Reflection of salaries in accounting.” Payroll accounting in 1C

Based on it, transactions are generated in 1C according to the type of operation and the method of reflection specified in the document.