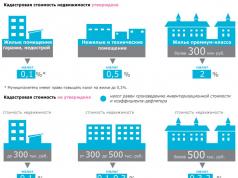

In 2019, the real estate tax for individuals is calculated based on the cadastral value of the property, with a fixed rate of 0.1%. Earlier in 2018, the inventory value of real estate was taken as the basis for calculating the mandatory fee.

How to calculate personal property tax

Since 2017, the property tax calculation has been based on the cadastral value, which is often significantly higher than the previously used inventory value.

Note that the cadastral value may differ from the market value upwards, since it is not an absolutely accurate indicator. Since it consists of an average assessment of the object for the cadastral area, taking into account the date of commissioning and some features of the structure. The legislation establishes that once every five years the cadastral value must be subject to clarification, recalculation based on the data of independent appraisers.

To calculate tax for 2018, you need to know:

1. Cadastral and inventory value.

2. Deflator coefficient:

- in 2017 - 1.425;

- in 2018 - 1,481.

3. Reducing factor.

Those regions that have switched to the cadastral value now have a transitional period for them, during which there will be a gradual increase in tax within the allotted time. The reduction factor will increase by 0.2 every year (not exceeding 0.6), while the maximum increase in the value of the tax should not exceed 20%.

A reduction factor that applies only when the cadastral value is higher than the inventory value.

For example: If in the Saratov region the cadastral value was approved as a tax calculation in 2018, then the coefficient will be equal to 0.2. Whereas in the Orenburg region they approved it a year earlier, respectively, the coefficient is 0.4.

Another 5 regions consider the tax in the old way:

- Volgograd region;

- Irkutsk region;

- Kurgan region;

- Republic of Crimea;

- Sevastopol.

From January 1, 2020, only the cadastral value is taken into account when calculating the tax.

4. Tax rate.

The tax rate on the property of individuals in 2019 will be 0.1%, calculated from the cost according to the cadastre. All residential premises, as well as household buildings of more than 50 square meters, will be subject to taxation. meters, in case of location on a plot of land for the purpose of construction, subsidiary farming, etc.

In some cities, the tax rate may vary depending on the structure, whether there is a garage apartment or a residential building, we recommend that you check the exact information in the “Reference Information on Property Tax Rates and Benefits” service.

Follow instructions:

- select the required "Type of tax";

- you must select a tax period;

- select "Subject of the Russian Federation";

- specify "Municipal entity";

- click the Find button;

- then a table will be generated, in it click on the link “More” and all information on tax rates in this region will open.

5. For payers of property tax, a tax deduction is provided, in accordance with paragraphs. 3 - 6 tbsp. 403 of the Tax Code of the Russian Federation. An area standard is established, which reduces the real estate tax base for:

- rooms (part of the apartment) per 10 sq. meters;

- apartments (part of the house) for 20 sq. meters;

- residential building of 50 sq. meters.

- a large family with 3 minor children, 5 sq.m. for apartments and rooms, 7 sq.m. for houses.

- a single real estate complex (includes one residential building) - 1 million rubles from the cadastral value (the definition of the UTC is given in Article 133.1 of the Civil Code).

The deduction is applied automatically when calculating the tax and does not require a declarative nature. On the difference, which will be in the end, and the tax on the property of individuals will be calculated. Thus, if by calculation it turns out to be zero, then there will be nothing to pay and there is no need to pay tax.

6. To somehow reduce the burden for those in need are provided.

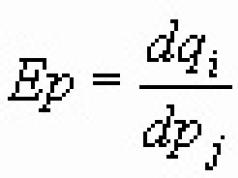

The formula for calculating property tax in 2019

H = (H1 – H2) × K + H2, where

- H1 is the amount of tax calculated on the basis of the cadastral value;

- H2 is the tax amount calculated based on the inventory value;

- K is a reduction factor.

H1 = (KC - B) × D × C

H2 = (IC × D) × CD × C, where

- KC - the price of the object according to the cadastre;

- IC - the price of the object determined according to the old one, based on the inventory price (set by the BTI);

- B - property deduction;

- D - share (provided that the property is divided into shares and it is necessary to find out the calculation of its part);

- KD - coefficient. deflator;

- C - rate.

Calculation example

Consider an ordinary two-room apartment in Tyumen with an area of 62 square meters, with a cadastral value of 2.26 million rubles. and inventory - 250,000 rubles. no divided shares.

Let's find H1 first:

By calculation, we derive the cost of one square meter, dividing by the area.

1,984,000 / 62 = 32,000 rubles for 1 sq. meter

Then we calculate the area of the apartment that is subject to taxation, taking into account the tax deduction:

62 - 20 \u003d 42 square meters. m.

It remains to multiply them by the cadastral value of a square meter:

42 × 32,000 = 1,344,000 rubles.

Applying the rate of 0.1%, we find the amount of property tax.

1,344,000 × 0.1% = 1,344 rubles.

Let's calculate an example for a large family with 3 children. Taking into account the benefits, an additional 15 square meters will be added to the standard area. meters.

62 - (20 + 15) = 27 sq. m.

(27 × 32,000) × 0.1% = 864 rubles.

The savings will be 480 rubles per year.

250,000 × 1.481 × 0.1% = 370 rubles.

Since the amount is 1344 or 864 > 370, we will adjust the tax amount taking into account the reduction factor. Otherwise, if H1< H2, уплачивается налог H1.

The transition to KC in the Tyumen region was established in 2018 (law of the Tyumen region dated October 24, 2017 No. 76), respectively, K = 0.2 (according to Article 408 of the Tax Code of the Russian Federation).

H \u003d (1344 - 370) × 0.2 + 370 \u003d 565 rubles.

H \u003d (864 - 370) × 0.2 + 370 \u003d 469 rubles. (the large family)

Add to this other objects that the family can own (land under the cottage, garage, car), and as a result, the amount will come up tangible in order to pay all taxes at once.

At the same time, the Moscow and Leningrad regions were left to independently determine the rates of tax on the property of individuals.

Among the problems of the new reform, analysts cite the insufficient number of accredited appraisers and their competence, which is increasingly being paid attention to in training and issuing a certificate. Already now you can see that an apartment in a new building at the cadastral value may be cheaper than in the "Khrushchev".

Real estate tax calculator in 2019 for individuals

To do this, select → type of tax → year → region → cadastral number ...

Tax on the garage for individuals in 2019

Any immovable property of citizens, including non-residential property, which includes a garage, is subject to taxation. This provision is enshrined in the Tax Code.

The tax itself is local and its rates are determined by the Tax Code of the Russian Federation and the regulations of the authorities of the territories. The base rate for a garage is 0.1% of its cadastral value. Local authorities can set their own value, but the Tax Code limits the upper limit of the tax. To calculate it, the total value of the entire property is used:

- 300 - 500 thousand rubles, the limit values \u200b\u200bwill be limited - 0.3%,

- over 500 thousand rubles - up to 2%.

Note that garages are included in the calculation along with other real estate.

The tax is calculated once a year for the period from the moment the right arises. For example, citizen I. bought a garage on March 5, 2019. The tax on this property for 2019 will be calculated for 10 months of ownership.

The owner of the garage can also be the owner of the land under it. Then you have to pay for it.

Garage tax due date, which the citizen owned during the year - December 2 of the year following him. Today, the personal property tax for 2018 must be paid before 12/02/2019.

For reference: Retirees are exempt from property tax on all residential and non-residential properties. But, if a pensioner owns several garages, then only one of them is exempt from paying tax at his discretion. In any case, you will have to pay for the land under the garage.

Who can not pay property tax

Below we will analyze examples of when you can not pay property tax.

Property tax benefits for individuals

The Tax Code in Articles 399 and 407 defines property tax beneficiaries: federal by category and type of property, as well as regional.

- disabled people of groups 1 and 2, as well as disabled people from childhood and children;

- recipients of old-age pensions;

- WWII veterans;

- persons with the title of Hero of the Soviet Union and the Russian Federation;

- holders of the Order of Glory of three degrees;

- liquidators of emergencies that occurred at radioactive facilities: the Chernobyl nuclear power plant, Mayak Production Association, tests at the test site in the city of Semipalatinsk;

- other categories of military personnel, as well as their families.

Article 407 of the Tax Code of the Russian Federation determines that individuals do not pay tax for buildings less than 50 square meters on land for individual housing construction, gardening, gardening and summer cottages.

Regional authorities may determine local benefits by their legislative acts. For example, in Moscow, under certain conditions, you can get exemption from tax on a garage or parking space (this concept has been introduced since 2017).

There are also conditions for receiving benefits:

- the object must be owned and not used for business activities;

- if the cadastral value of the immovable object over 300 million rubles The owner is not entitled to a benefit.

Benefits for pensioners

Real estate tax for pensioners from 2019, who are assigned a pension under the legislation of the Russian Federation, are exempted from paying tax only on one unit of each type of property. The pensioner can choose a preferential object himself. The rest are taxed at the established rate. In other words, only one apartment and car owned by a pensioner is exempt from property tax.

If a pensioner, for example, has several apartments, and he did not submit an application to the Federal Tax Service about choosing an object for which he wants to receive tax exemption, then the one where the tax amount is maximum is accepted for the benefit.

You can get acquainted with all benefits for pensioners on the website of the Federal Tax Service, detailed instructions.

For large families

At the federal level, since 2019, a benefit has been introduced that increases the amount of the property deduction for a family of 3 or more children. For each, 5 sq. m. for apartments and rooms, 7 sq. m. for private and horticultural houses.

Also, local authorities at their level can help reduce the amount of property taxes. Few of the territories decide to apply such measures, while only Nizhny Novgorod, Krasnodar and Novosibirsk, by decision of local Dumas, have exempted families with three or more children from property tax.

For invalids

The Tax Code determined that disabled people from childhood, the Second World War, as well as groups 1 and 2 are completely exempt from property tax. This is a federal regulation and local regulations do not play a role here.

The only exception will be property received by a disabled person by inheritance.

To find out the exact list of beneficiaries and objects for which you can get a benefit, you should contact the Federal Tax Service at the location of the property. Apply for a tax exemption, and at the same time indicate in the application information about the property for which you are claiming a benefit. The right to it can be confirmed by the relevant documents.

You can use the property tax exemption only from the month in which the right to it came. For the previous period, the tax will be calculated and it should be paid to the budget. If the application was received much later than the onset of the right, and the citizen continued to pay tax, then the overpayment will be returned to him, but only no more than three previous years.

Changes from January 1, 2019

In order to receive a property tax benefit, it is no longer necessary to submit documents confirming the right to a benefit to the tax service. You can simply fill out an application for benefits with the details of the right establishing the document.

Tax reform continues in Russia. Innovations relate to the procedure for calculating tax collections. By 2020, all regions of the Russian Federation will have to switch to the new system.

We will tell you what the rules of the new Reform in the field of taxation are, what tax will be calculated taking into account the cadastral value and according to what formulas, as well as give examples of calculation.

The general formula for calculating taxes on property of individuals in 2018

The general formula for calculating the tax collection in 2018 is as follows:

Important: if the region has not switched to the new taxation system, then the tax will be calculated based on the inventory value of the object.

The formula for calculating the tax on real estate of individuals in the transition period

In 2018, the 4th transitional period will continue. Therefore, the experts found more detailed formula, allowing for an imperceptible increase in tax collections - and a soft, smooth transition to a new taxation system for Russians.

In 2018-2020, the following scheme will operate:

|

H \u003d (N- H inv) x K + H inv \u003d (N- N inv x K def x C inv) x K + (N inv x K def x C inv) N \u003d (N cad - W) x C \u003d (N cad - Ux S w) x C = (N cad - N cad. / S x S w) x C

|

To make a calculation, you should:

- Calculate the unit cadastral value of the object - divide the cadastral value by the area taxed ( U = N cad /S).

- Calculate the deduction that is possible and legally required for a Russian ( W= X S w).

- Calculate the amount of tax on the cadastral value. To do this, it is necessary to deduct from the cadastral value the deduction calculated in paragraph 2 ( N = N cad. - W).

- Calculate the tax fee at the inventory price of the property ( N inv = (N inv x K def x C inv).

- And finally. calculate the final amount of tax to be paid to a citizen ( H \u003d (N- H inv) x K + H inv).

The fight against coronavirus: all arriving from abroad in Russia will have to undergo mandatory quarantine Fight against coronavirus: disinfection measures have been strengthened at the MCC and Lastochka electric trains Fight against coronavirus: Muscovites invited to virtual tours of museums and exhibitions of the city Fight against coronavirus: the construction of the building of the infectious center in New Moscow has begun The fight against coronavirus: information about the restriction of the work of supermarkets and markets is not true Fight against coronavirus: Moscow Government introduces online consultations for capital exporters Coronavirus fight: ambulance on high alert The fight against coronavirus: the Mayor of Moscow asked employers to transfer part of the employees to remote work Fight against coronavirus: students of four metropolitan universities are switching to distance learning The fight against coronavirus: the list of countries of the "quarantine zone" has been expanded, upon returning from which Muscovites must observe the regime of self-isolation The fight against coronavirus: until April 10, leisure activities with the participation of citizens in the open air are prohibited in Moscow

This is stated in the decision of the chief sanitary doctor of the Russian Federation Anna Popova. Isolation will be carried out at home, if this is not possible, citizens will be placed in an observatory.

Sanitization of the passenger infrastructure of stations and transport hubs of the Moscow Central Circle has been strengthened in order to prevent coronavirus, as well as seasonal influenza and SARS, the press service of the Moscow Railway reported.

Due to the spread of the coronavirus, many institutions in the capital were closed to visitors, but the cultural life of the city continues. Museums, libraries and cultural centers offer projects that can be found online. The full list of projects is available on the mos.ru website.

“Concrete foundations have already been prepared. The block consists of 12 buildings, including laboratory, utility and sanitation buildings. In the near future, we will start building an intensive care unit - 16 more buildings, including a single complex of 10 intensive care buildings for 250 beds," said Deputy Moscow Mayor for Urban Planning Policy and Construction Andrey Bochkarev.

“Large markets, grocery stores and supermarkets continue to operate. Information about their closure is not true," said Alexei Nemeryuk, head of the Department of Trade and Services of the City of Moscow.

The Moscow government is launching pilot projects to support metropolitan exporters in the current epidemiological situation in the world. Thus, meetings of Moscow companies with foreign partners are being transferred online. This was reported in the Department of investment and industrial policy of the city of Moscow.

The Moscow ambulance has been on high alert since the first day of the threat of the spread of coronavirus infection. A specialized call center has been created on the basis of the ambulance service. Its main goal is, according to the lists formed by Rospotrebnadzor, to clarify the location of persons who are likely to be infected with coronavirus, for example, after returning from countries with a high increase in the incidence. And, if necessary, organize the sampling of biomaterial for analysis for COVID-19.

“Dozens of enterprises and organizations have voluntarily transferred their employees to work remotely. Under the circumstances, I am asking all employers in the city of Moscow to follow their example and, if possible, transfer some of your employees to work from home. This is especially true for women, whose children will not go to school in the coming weeks. By doing so, you will make a huge contribution to the fight against coronavirus infection,” said Moscow Mayor Sergei Sobyanin in his blog.

Latest news in taxation in the Russian Federation

Changes in the taxation procedure in Russia for individuals were introduced in 2015. But for adaptation, a transitional period was introduced - until 2020. From January 1, 2017, citizens will have to switch to a new algorithm for determining the tax base. The difference from the previous tax calculation system is that previously the base was equal to the inventory value of the property, and since 2017 it has been equal to the cadastral value. Given that the cadastral value is higher than the inventory value, it can be indicated that the amount of tax due to be paid by citizens will increase.

Regions can set individual regional rates within the limits specified in the Tax Code of the Russian Federation. Minimum - 0%, maximum - x3 of the legally established indicator. Benefits may also change up to a complete exemption from the obligation to pay a rate on property. The following rates apply in Moscow:

Benefits in determining property tax in Russia

For the adaptation period, reduction coefficients are set to identify the amount of real estate tax. The legislator has established that citizens will pay the full amount starting from 2020. And from 2016 to 2020, special coefficients will be applied - 0.2 for each year.

Additional benefits provided:

- for the main housing base is reduced by 20 square meters. m;

- for unfinished buildings, outbuildings up to 50 sq. m., garages on the territory of summer cottages, the rate is determined not higher than 0.1%;

- for residential buildings on the territory of gardening and country associations, if their area does not exceed 50 sq. m. the rate is 0.1%;

- base reduction by 10 sq. m. for rooms, 50 km. m. for home;

- the cadastral value of the complex is subject to reduction by 1 million rubles.

In 2017, they retain benefits for full exemption from paying the property tax rate for pensioners, veterans, participants in the Second World War, war veterans and other categories of citizens (Article 407 of the Tax Code of the Russian Federation). The benefit for pensioners and other persons applies to only one object. If there are several objects in possession, then the property tax on them is paid in full.

Tax calculator for individuals

- Determine the status of housing: basic or additional.

- If the apartment (house) is the main place to live, then 20 square meters must be subtracted from the total area. m. (50 sq. m. for the house).

- Having determined the cadastral value for 1 sq. m. of housing, it is necessary to multiply the price by the taxable area.

- The resulting derivative must be multiplied with the rate indicator in the region. The result is the amount due from 2020.

- We apply the reduced coefficient of 2017 to the base tax amount - 0.4.

The amount of property tax for 2017 will increase due to two factors: the growth of the coefficient and the use in the calculation of the cadastral value, which is equal to, and sometimes exceeds the market price of the object in comparison with the inventory price.

If the calculation did not come

Russians are required to pay property tax after they receive the appropriate receipts from the tax authorities. Directly the calculation of the amount of tax is determined by the tax authorities. But what if the receipt has not been received? This happens when the property is not entered in the register and, therefore, is not taxed. Citizens in Russia are charged with the obligation to register their real estate.

For violation of this, the tax authorities may apply sanctions if they reveal unrecorded property. The penalty is 20% of the total amount of unpaid tax, which will be calculated for the last 3 years. Now the tax authorities cannot fine citizens. The norm is introduced exclusively from January 1, 2017. However, if by the end of the current 2016 the Russians register their property, they will not be able to collect a fine and a three-year payment.