In the 19th century, a small funeral home operated and flourished in Kansas City. But on one not too happy day, its owner Almon Strowger calculated his income for the last months and found that the turnover was falling, but his main competitor, on the contrary, increased sales.

A small investigation showed that the fact is that the most prosperous clients have already begun to use telephones, and in the event of the death of a relative, they called the telephone exchange, where the wife of Strowger's main competitor worked. When she was asked to be connected to a ritual agency, of course, she redirected everyone to her own spouse.

This is a story about unfair competition. And it could have ended differently. Having calculated the losses, the entrepreneur could well close his own agency or kill the telephone operator in a fit of rage. But Almon Strowger acted differently: when complaints to the station's authorities failed, he focused on creating a mechanism that would replace manual labor. So in 1892 the first automatic telephone exchange was invented and patented, which the creator himself called "a telephone without young ladies and curses."

Such is it, many-sided competition! It can serve as an engine of progress, or, on the contrary, it can become the cause of cruel crimes. And in order to form your own opinion, whether competition is useful to society or dangerous to it, you will have to understand in detail the nature of this phenomenon. Shall we start?

Competition -what is it in simple words

For the first time the word "competition", borrowed from the German "konkurrieren", was recorded in the Russian dictionary in 1878. The term originates from two Latin words:

- con - together;

- currere - to run.

Thus, competition is the rivalry of several subjects in order to achieve one goal. Moreover, the successes of one always mean losses for the other. Biologists consider competition to be the driving force of evolution: it is thanks to it that the most adapted representatives of flora and fauna are preserved on the planet, and the weakest gradually die out.

Economists characterize competition as a struggle between companies. Each of them defends its own interests: it tries by any means to attract the attention of buyers, sell as many goods and services as possible and, as a result, get the maximum profit.

Interestingly, the word "competition" has the same roots as "competition". But in this case, we are not talking about a constant struggle for the buyer, but about the desire to achieve victory in the competition.

Competition as an economic law

For the first time, mankind encountered the phenomenon of economic competition in ancient times, in conditions of simple commodity production. Already in primitive society, each artisan sought to extract the maximum benefit for himself to the detriment of other participants in the market exchange.

With the emergence of the slave system, competition only intensified. The farms became larger, the labor of forced and hired workers made it possible to produce more and more, strengthening their position in society.

But only in the 18th century did Adam Smith, a Scottish economist and philosopher, become interested in competition as a phenomenon. He drew attention to the fact that there is a stable connection between rival companies. And he suggested that competition is not an accident, but an objectively acting force that actively influences not only sellers and buyers, but also the development of the industry as a whole.

At the same time, 3 conditions necessary for the emergence of competition were formulated:

- Complete economic independence of each manufacturer, in which each company acts solely to achieve its goals.

- The dependence of each seller on the current situation in the market: the volume of supply and demand, the amount of wages, the exchange rate. So, if the average salary of a sales assistant in Moscow is 40,000 rubles, the company can hardly count on finding, and most importantly, retaining an experienced, conscientious employee by offering him 25,000 rubles a month.

- Lack of agreements with other manufacturers, that is, the struggle of all against all.

In such a situation, the only way for the manufacturer to win is to fight to improve the quality of the goods, reduce their own costs, and, following them, prices. This is how the law of competition works - an objective process of removing expensive low-quality products from the market. The essence of the law is revealed more fully through the functions that competition performs in the economy.

Functions of competition in the economy

In a market economy, competition has 6 main functions:

1 Regulatory. In conditions of free competition, firms produce exactly as much product as the consumer needs. Equilibrium is not established immediately, the company comes to it after several months of work, analyzing the volume of demand and sales.

For example: the manufacturer of school desks made of natural wood "KIND" during the summer season sells 1500 - 1700 budget models "Novichok". If by June the company does not fulfill the production plan to meet demand, it will have to introduce additional shifts, urgently expand the staff, but still not every buyer agrees to wait for his purchase instead of the standard 3 days 2-3 weeks. Part of the profit will be lost. The reverse situation is also losing: excess production entails the need to expand storage facilities, and with them the overall costs of the enterprise.

Thus, competition in the market determines the amount of demand for the products of each firm, and establishes the optimal volume of production.

2 Allocation. Its name comes from the English "allocation" - "accommodation". And it means that in a competitive environment, it is easier to achieve success for enterprises that are located closest to production resources.

It is not for nothing that all hydroelectric power stations are located near large water sources, and the energy they produce supplies the nearby regions. It also makes no sense to install wind farms in the Moscow region, which belongs to the areas of the 1st, most windless, category. But the Krasnodar Territory, according to the wind map of Russia, has been assigned a coefficient of 6. And here the installation of wind power plants will be fully justified.

3 Innovative. The rapid development of technology in the modern world is the result of competition. The easiest way to trace this process is through the evolution of mobile phones. Only 36 years have passed since the release of the first model intended for free sale - Dyna TAC 8000X. On the scale of science, this is quite a bit. But today a smartphone is already a full-fledged replacement for a camera and a game console, a player and a computer. And engineers are not going to stop: leading manufacturers present new products every six months.

4 Adaptive. This function lies in the ability of enterprises to adapt to the external environment, offering customers exactly what they expect. So, most grocery stores have either switched to a 24-hour work schedule, or close closer to midnight. This allows customers to buy products after work in a calm mode, and entrepreneurs to increase profits.

5 Distribution. The market is a living organism that is constantly changing. Every day, entrepreneurs assess the situation and decide for themselves whether it makes sense to further invest their own resources in existing projects or whether it is time to explore new horizons. So from low-income industries, where there are already a sufficient number of manufacturers or the demand for products is steadily falling, there is a constant outflow to more promising areas.

6 Controlling. In conditions of fair competition, no manufacturer or seller can take a dominant position in the market and become a monopolist.

Working together, all the functions of competition turn the industry into an efficient, self-regulating system. And the combination of competitive industries creates a more or less successful market economy. That is why competition is often called the engine of the market economy.

Advantages and disadvantages of competition in the market

For society as a whole, competition is a positive phenomenon. She:

- stimulates the development of scientific and technological progress, thereby improving the quality of life of the population;

- makes manufacturers respond quickly to consumer requests: expand the range, improve the quality of goods, look for ways to reduce costs;

- forms fair market prices as opposed to the predatory pricing policy of monopolists;

- prevents the development of shortages of goods and services.

And the main sign of the presence of free competition in most sectors of the state and an effective market economy as a whole is the increase in the middle class among the population.

There are also negative points in the competitive environment:

- a huge temptation for many manufacturers to use "dirty" methods of dealing with competitors;

- instability of the situation in the market of goods and services: out of 100 entrepreneurs, 95 burn out in the first couple of years of their activity;

- a large number of ruined commodity producers provokes an increase in unemployment;

- incomes are distributed unevenly among different social groups of the population.

Conditions for maintaining competition

Free competition is a very unstable market model. Entrepreneurs left to their own devices first take weak players out of the game. They leave due to lack of resources:

And then viable companies begin to negotiate among themselves: about holding prices and even merging. It is more profitable for firms economically than constantly developing technologies and looking for ways to reduce costs. But the buyer ends up with inflated prices and an artificially created shortage.

2 economy class hairdressing salons have opened in the residential area. But the first was opened by a student without initial capital, and the second by an experienced businessman with sufficient capital, who knows well that a new business in the first months requires constant injections. At the same prices, the chances of surviving at a hairdressing salon owned by a student are minimal.

But a businessman can attract visitors with a bright opening, great comfort, for example, by immediately installing a TV. Later, he will send craftsmen to advanced training courses and offer new services, and maybe even poach the best workers from his competitor. In an effort to become a monopolist, for a limited period of time he can work even at a loss, which a student cannot afford. But after the competing barbershop goes bankrupt, you can already dictate your prices.

Thus, competition naturally always, sooner or later, leads to the emergence of a monopoly enterprise. And the only way to keep the rivalry between entrepreneurs is government intervention.

Only external deterrents can protect firms from each other and prevent manifestations of unfair competition. Therefore, all the developed powers of the world have adopted antitrust laws. And they actively use 2 main methods of protecting competition:

- a ban on the creation of monopolies;

- strict regulation of prices for products of natural monopolies, for example, fixed fares for public transport tickets.

State regulation of competition

For Russia, the issue of supporting competition is of particular importance. For many decades, our country has been actively using the advantages of large-scale production, its specialization and concentration. In fact, the entire industry was in the hands of monopoly enterprises.

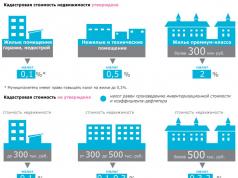

And with the transition to a market economy, it was necessary to create a new legal framework that could support the emerging small and medium-sized businesses. The first such document was the Law of the RSFSR "On Competition and Restriction of Monopolistic Activities in Commodity Markets", adopted on March 22, 1991. In connection with the active development of the banking services market, on June 4, 1999, another legal act was approved - the Federal Law “On Protection of Competition in the Financial Services Market”.

In 2006, both regulations were replaced by the Federal Law “On Protection of Competition”. Moreover, the conduct of antimonopoly policy is also spelled out in the Constitution of the Russian Federation. Article 34 unequivocally states: "Economic activities aimed at monopolization and unfair competition are not allowed."

Control over the implementation of the provisions of the Law is carried out:

- Ministry of the Russian Federation for Antimonopoly Policy and Entrepreneurship Support;

- its territorial divisions.

In order for the activity of an enterprise to be recognized as threatening free competition, the share of its products on the market for goods and services must be 65%. But there are exceptions: the antimonopoly committee can impose sanctions already with a share of 35%, if the company prevents new firms from entering the industry and dictates its conditions to competitors.

Participants of competitive relations

Participants of legal relations are called subjects by the legislation. In competition law, the main ones are:

- sellers or business entities, that is, individual entrepreneurs and enterprises of all forms of ownership that carry out income-generating activities;

- buyers of goods or services. For them, the Law does not prescribe duties, but acts precisely in their interests. In case of suspicion of violations of the antimonopoly law, buyers have the right to file a complaint with the territorial division of the antimonopoly committee.

The joint actions of buyers and sellers form supply and demand in the markets for goods and services. Under conditions of free competition, they balance naturally and set economically fair prices.

Other subjects can also influence competitive relations:

These entities do not participate in competition, but are in the field of antimonopoly legislation, as they are able to provide individual companies with significant advantages: issue a license, finance, establish tax incentives. All this negatively affects other participants in the competitive struggle.

Interestingly, the circle of subjects of competition law includes not only already operating enterprises and real buyers, but also potential sellers and potential consumers:

- a potential seller is one who is ready to start producing and/or selling a product within 1 year that is already on the market at a price not exceeding the average market price by more than 10%. At the same time, production costs will pay off within 12 months;

- a potential buyer is one who is ready to purchase a product, but for some reason has not yet done so.

Since, in an effort to oust competitors, firms often combine their efforts, the Law defines another subject of competition law - a group of persons. They can be united by relations of any kind: labor or contractual, property or family.

Despite the fact that their actions are coordinated and aimed at achieving the same goal, in the framework of legal proceedings, the degree of participation of each person in a crime is considered individually.

Forms of competition

To stay within the bounds of the law, today it is not enough not to cross the 65% barrier of control over the industry. On October 5, 2015, Chapter 2.1 was introduced into the Federal Law “On Protection of Competition”. Unfair competition. And now the Antimonopoly Committee has the right to consider not only the degree of influence of the company, but also the methods of its struggle. Therefore, it is very important to understand the line where conscientious, socially approved, competition ceases to be such.

Fair competition - fair and legal methods of competition that do not conflict with generally accepted business practices:

Unfair competition - any actions of economic entities that are contrary to the law and business ethics, and may harm the business reputation of competitors, cause financial damage to them.

Methods of unfair competition:

Types of competitive markets

Depending on the severity of competition between firms, there are 4 main types of the market for goods and services:

- Perfect Competition, in which a huge number of firms operate in the industry, and there are no barriers for newcomers. A product in a perfectly competitive market is standardized. For example, there are hundreds of farms in each region that provide stores with eggs, milk, vegetables and fruits. Farmers cannot influence the price of their products in any way, and any landowner is able to enter the market without much effort.

- Monopolistic competition- a market in which there are also a large number of sellers, and there are no barriers to entry into the industry. But the product in such a market has its own zest. For example, one publishing house publishes exclusively detective stories, another - women's novels, the third - non-fiction literature. The competition here is non-price, and advertising and brand awareness help to increase.

- Oligopoly- a market represented by a small number of sellers, largely due to the fact that entry into the industry is difficult. For example, to produce household appliances, one desire is not enough. Significant financial investments, engineering developments, highly qualified personnel, permits from regulatory authorities, and a well-thought-out marketing strategy will be required. Of course, few entrepreneurs are able to realize all this. Those who succeed become the few big players who can already influence pricing.

- Absolute monopoly. The market is represented by one single seller, and entry into the industry is blocked. The monopolist himself determines the volume of output and has unlimited power over prices. Example: OAO Gazprom, OAO Russian Railways.

Thus, the weaker the competition in the market for goods or services, the more power the producer has. And vice versa, when there are many sellers, the buyer has the opportunity to choose the product that suits him as much as possible in terms of price and quality.

Video: Competition and its types

Types of competition in the economy

Economists combine all 4 market models into 2 large groups, highlighting:

- perfect competition;

- imperfect competition.

Perfect or pure competition- an ideal model, an abstraction that is very rare in real life. It is characterized by:

- A very large number of vendors in the industry. They act independently of each other, each working in their own interests. So, there are a huge number of fishing enterprises in the world. And the largest of them account for approximately 0.0000107% of the world's catch. Even if one or several firms increase the catch several times, this will not affect the state of the industry in any way.

- Standardized or homogeneous product. The product is similar or so similar that, by and large, it makes no difference to the buyer from which of the sellers to make a purchase. A striking example: currency exchangers.

- The inability of the seller to influence the price of the goods. For example, if at the vegetable market 3 sellers at once set a price of 300 rubles for 500-gram baskets of strawberries, it makes no sense for the fourth one to demand 400 rubles. He simply will not sell the berries, and they will go bad. But lowering prices is also unprofitable if there is an opportunity to earn more. Thus, in a perfectly competitive market, the seller always takes the role of a price follower.

- Free entry into and exit from the industry. New firms can enter a competitive market without serious financial opportunities or technological innovations. They are not hindered by legislative authorities, on the contrary, all information about doing business is freely available. Example: stall trade, the creation of construction and repair teams.

A situation in which one or more of the conditions for perfect competition is not met:

- Although the product from different sellers belongs to the same group, it has its own characteristics. For example, one sells Golden apples, and the other sells Semerenko;

- There are barriers to entry into the industry: for example, to open the most modest gym, you will need at least 1 million rubles. And this is not the amount that any potential entrepreneur can easily find;

- There are already leaders in the industry. In this case, we are talking more about oligopolistic competition;

- From the very beginning, the entrepreneur has the opportunity to influence the price of his products. For example, the same strawberry sellers in a small market may well agree on a single price. Or, using greenhouses, the farmer will achieve ripening of berries 2 weeks earlier, and will be able to sell his crop for much more.

Thus, imperfect competition is a market model that, to varying degrees, but allows sellers to influence the price of their products. And monopolistic competition, oligopoly, monopoly are just varieties of imperfect competition.

Types of competition by degree of freedom

The phrase "free competition" has long become stable. It implies that the activities of individual entrepreneurs are not influenced by either government agencies or larger and more influential market players.

In contrast to free competition, there is also regulated competition. It occurs when one or a few firms achieve a significant market share and are able to influence prices and prevent newcomers from entering the industry. The regulatory function in this case is performed by the state.

Types of competition by industry

Economics deals with market competition - the struggle of producers for each buyer. Demand in this market is limited by the solvency of consumers, and the struggle is carried out by all legal means: price and non-price.

Market competition is:

- intra-industry:

- intersectoral;

- international.

Intra-industry competition- this is the rivalry between manufacturers or sellers working in the same industry. They produce or sell similar products that differ in price, model range, quality. Moreover, intra-industry competition can be:

- subject;

- specific.

Subject competition- one in which rival firms produce an identical product. It can only vary slightly in quality. Example: Russian manufacturers of bed linen of the middle price category - "SailD", "MONA LIZA", "AMORE MIO".

Species competition- a type of rivalry in which companies produce goods of the same type: shoes, clothes, furniture, but at the same time it differs in some serious parameters. For example, the RIMAL shoe factory produces affordable children's shoes for absolutely healthy children, and the MEGA Orthopedic company specializes in tailoring orthopedic models.

Intersectoral or functional competition is the struggle of representatives of different industries. For example, residents of Moscow can get to Sochi both by rail and by plane. The first is cheaper, the second saves time. But in general, both that and that transport help the traveler to achieve the goal.

Interethnic competition is the competitive struggle of two countries. Its goal can be not only the conquest of the largest possible market, but also prestige on the world stage. Example: confrontation between the US and the USSR in the field of space exploration.

Competition Methods

There are two ways to try to beat competitors: by lowering the price or by offering more attractive conditions, but at the same prices.

The first strategy is price competition. For example, a newly opened dry cleaner offers a 20 percent discount on their services. The business owner is well aware that in the future he will not be able to keep such a low price, but in the short term the strategy will provide a large influx of customers, and if they like the service, they are likely to contact again and again.

Good service is non-price competition, which most buyers value more than a lower price and possible discounts. Our subconscious perceives price reduction more aggressively, forcing meticulously to look for a catch. Methods of non-price competition (catchy advertising, convenient delivery terms, beautiful packaging, other marketing tricks) seem to be more noble, although if you dig deeper, there is no difference.

For example, at the same prices for bottled water, the Aqua company will also offer free delivery. In terms of the price per liter of water for the buyer will be less. And non-price competition will be the most that neither is price.

Price competition is not always a short-term phenomenon. Thus, with the timely updating of equipment, improvement of the system and logistics, the manufacturer can really achieve a significant reduction in cost.

While maintaining the size of the trade margin and the achieved sales volume, the company's profit does not decrease, although for the end consumer the product will significantly fall in price. Competitors in such a situation have to either follow the more successful firm, or leave the market.

Competition outside economics

Competition as a competition for a good that is available in limited quantities is typical for politics and science, sports and military affairs, art and creativity. Perhaps there is not a single human activity in which it would be impossible for the emergence of a struggle for money, power, fame or respect.

Achieving the goal occurs with the help of competitive actions, a concept formulated by the American economist Michael Porter. It involves the commission of acts directly or indirectly addressed to competitors. Their goal is to strengthen their positions and at the same time weaken the opponent.

competition in biology

If in human society competition is rivalry, in the world of flora and fauna, the phenomenon is more likely to be synonymous with war. A war for a place to live, sources of food, a war for life itself.

There are two types of competition in biology:

- Intraspecific competition. The most desperate and cruel, the struggle flares up between representatives of the same species. Birds fight to the death for the best nesting sites, walruses and seals win back a female for mating, and out of hundreds of young Christmas trees in a clearing, only 2-3 trees grow to adulthood. The rest die from lack of sunlight.

- Interspecific competition flares up between individuals of different species. Moreover, the Russian biologist G.F. Gause proved that if 2 species with the same needs live in the same territory, the strongest will definitely crowd out the weakest. So, in Australia, the native bee, devoid of sting, has already been almost completely destroyed. And all because a few decades ago, a honey bee was introduced to the mainland.

Competition of norms in law

In legal practice, situations often occur when the same action is regulated by two different regulations. And the court will have to decide which of the two documents to apply. The competition of norms happens:

- temporary, when the norms were in force at different periods of time;

- spatial: for example, in different states of America, different punishments are provided for the same crime;

- hierarchical: all normative documents have different legal force. The main legal act in our country is the Constitution of the Russian Federation, then there are Federal constitutional laws, after them Federal laws and so on.

But the most common competition of norms in law is substantive. The easiest way to explain it is with an example. Suppose a crime is committed with two aggravating circumstances. They are described by different articles of the Criminal Code. When determining punishment, the judge, as a rule, qualifies the crime according to the norm that provides for a more severe punishment. And, conversely, under two mitigating circumstances, the rule prescribing a more lenient punishment is applied.

Answers on questions

Competitive as spelled

The correct spelling is “competitive” (without the “n”). This word consists of two roots: "competition" - there is no "n" and "capable".

What is a competitor

A competitor is a person or group of persons, and it can also be a company or even a state, that competes with another person(s) for the right to own something or for any interests.

Conclusion

Competition is the driving force of evolution. It condemns the weak to extinction and allows the strongest to survive. It is thanks to her that more and more resistant strains of bacteria and viruses appear on the planet, which are not amenable to known antibiotics and antiviral drugs. Hundreds of animal species and thousands of plant species have become extinct in competition. But those that survived have managed to adapt to droughts and frosts, polluted air and the ubiquitous humanity.

In the economy, competition acts for the benefit of the consumer, forcing sellers to reduce prices and expand the range, manufacturers to improve the quality of goods and design new, even more advanced models.

Entrepreneurs fear competition and dislike it. Still would! It is impossible to relax even for one day, otherwise a more efficient comrade will grab a share of the profit. And yet, fair competition is the fairest struggle, which unmistakably defines the losers and those who have chosen the right strategy.

Roman Kozhin

The author of the blog "My Ruble", in the past the head of the credit department in the bank. In the present Internet entrepreneur, investor. I talk about how to effectively manage your money, how to increase it profitably, and earn more. Thanks to the Internet, he moved to the sea. You can follow my life in social networks using the links below.

Today we will analyze one example of perfect competition and find out why there cannot be pure perfect competition?

In fact, it is difficult to give examples of perfect competition. Take the sale of agricultural products in the summer. The manufacturer cannot increase the price of the product, as this will greatly affect the sales of products. Therefore, they price closer to the market (the same as everyone else), and some even lower prices (probably due to cost reduction) to increase the number of sales. Still, such an example cannot lead to purely perfect competition. Although manufacturers sell the same product (carrots, cucumbers, tomatoes, etc.), they are not on equal terms. Some producers are huge agricultural complexes, others are ordinary private traders, grandparents, for example. Therefore, usually one or several large firms supply a lot of products to stores, thereby completely controlling it, and other small farms that do not compete with large firms.

Our experts can check your essay according to the USE criteria

Site experts Kritika24.ru

Teachers of leading schools and current experts of the Ministry of Education of the Russian Federation.

This already reminds me of an oligopoly. Therefore, it is impossible to give examples of pure perfect competition, since it simply does not exist. Other examples partly remind us of perfect competition, but are not completely so.

Updated: 2017-04-02

Attention!

Thanks for attention.

If you notice an error or typo, highlight the text and press Ctrl+Enter.

Thus, you will provide invaluable benefit to the project and other readers.

It is characterized by a balance of supply and demand. Thanks to this, the market is regulated independently and the seller or buyer cannot influence most of the processes, in particular pricing.

With this model, competition between sellers reaches its peak. Due to the fact that market participants practically do not influence the terms of sales, the economy is resistant to the occurrence of negative processes, such as unemployment, inflation.

Perfect competition has the following characteristics:

- a large number of buyers and sellers, including representatives of small and medium-sized businesses;

- sellers and manufacturers offer homogeneous goods;

- easy entry to the market even for small companies, the absence of barriers from the state;

- high awareness of all market participants about the state of affairs on it, processes, subjects, etc., information can be obtained by everyone without problems and restrictions;

- sellers and buyers cannot influence the terms of trade, they take them for granted;

- high mobility of resources.

If a model does not have at least one of these characteristics, it is not perfect competition. Any market strives for this structure. The main task of the state in this process is the creation of appropriate conditions through the formation of a regulatory framework.

Benefits of Perfect Competition

The desire for perfect competition makes it possible to achieve high efficiency of a market economy. Despite the fact that many people call such a model ideal, it has both undeniable advantages and some disadvantages.

Benefits of perfect competition:

- self-regulation of the market;

- no commodity shortage;

- efficient allocation of resources;

- high production efficiency;

- no overpricing;

- equality of opportunity for market participants;

- freedom to develop entrepreneurship;

- the state does not interfere in market processes;

- both buyers and sellers benefit here.

Disadvantages of perfect competition

Despite the large number of advantages, pure competition also has certain disadvantages:

- the market system is unstable;

- the risk of overproduction;

- market participants get different results;

- each market participant focuses on personal interests, ignoring the public.

Almost all the shortcomings of this market model boil down to the fact that with equal opportunities, equal results are not achieved. This is explained by the fact that each market participant organizes production, a marketing company in its own way, allocates resources, uses innovative technologies. Therefore, success is achieved by those who competently approach the organization of the production and sales process, and also use advanced technologies to outperform competitors.

To achieve economic efficiency, it is first necessary to achieve efficiency in the production and distribution of resources. This is easy to achieve in conditions of perfect competition. Therefore, it is considered an ideal market model. But in reality, its practical implementation does not exist. Minimal costs, efficient allocation of resources, lack of shortages, self-regulation of processes - all these conditions cannot be met in the long term. Although the desire to achieve a system that is as close as possible to pure competition allows the economy to develop.

Bookmarked: 0

What is pure competition? Description and definition of the concept.

Pure competition- these are prosperous conditions in the market, when there are many buyers and many sellers, and there is also a complete lack of monopoly.

When there is no barrier to entry or exit from the market, information about the quality and price of the product is available to all market participants.

A large number of consumers and an abundance of goods cannot affect the price and quantity of products. Both the seller and the consumer depend on the dynamics of the market.

In order to have a higher profit from the sale of products or goods, this is to use some advanced technologies, both in the manufacture of products and in their sale, which will cause a decrease in cost, and hence there will be an increase in profits.

Pure, perfect, free competition is an idealized state of the market, an economic model, when individual sellers and buyers cannot influence the price, but form it with their contribution of supply and demand. That is, it is a kind of market structure, where the market behavior of buyers and sellers lies in the adaptation to the equilibrium state of market conditions.

Let us consider, in more detail, what pure competition means.

Features of pure competition

Features of perfect competition:

- divisibility and homogeneity of products sold. It is understood that sellers or manufacturers produce such a product that can be completely replaced by products of other market participants;

- an infinite number of equal buyers and sellers. That is, all the demand that is on the market must be covered by more than one or several enterprises, as in the case of monopoly and oligopoly;

- high mobility of production factors. Neither the state, nor specific sellers or manufacturers should influence pricing. The price of goods should determine the cost of production, the level of demand, as well as supply;

- no barriers to exit or entry to the market. Examples can be a variety of small business areas where special requirements are not created and special licenses or other permits are not needed. These include: atelier, shoe repair shop and similar establishments;

- full and equal access of all participants to information (on the price of goods).

In a situation where at least one feature is missing, competition is imperfect. In a situation where these signs are removed artificially in order to occupy a monopoly position in the market, the situation is called unfair competition.

One of the widely used types of unfair competition in some countries is the giving of bribes, implicitly and explicitly, to various representatives of the state in exchange for various kinds of preferences.

David Ricardo revealed a tendency, natural in conditions of absolute competition, to reduce the economic profit of each seller.

The exchange market in a real economy is most like a market of perfect competition. The Keynesians, while observing the phenomena of economic crises, came to the conclusion that this form of competition usually fails, and the only way out of it is with the help of external intervention.

Improving production, reducing production costs, automating all processes, optimizing the structure of enterprises - all this is an important condition for the development of modern business.

What is the best incentive for businesses to do this? exclusively and only market. The market, in this sense, is a competition that arises between enterprises that manufacture or sell similar products.

In the case when there is a sufficiently high level of adequate competition, this seriously affects the quality of goods or services sold on the market.

Because every manufacturer wants to be the best, so he is interested in having the highest quality products and the lowest production costs. This is a condition for existence in a competitive market.

Perfect competition in the market

Perfect competition, as mentioned above, is the absolute opposite of monopoly.

In other words, this is a market in which an unlimited number of sellers operate who sell the same or similar goods and at the same time cannot influence its final cost in any way.

The state, in turn, should not influence the market or engage in its full regulation, since this can affect the number of sellers, as well as the volume of products on the market, which will instantly affect the cost per unit of production (goods or services).

However, unfortunately, such ideal conditions for doing business in real market conditions cannot exist for a long time. That is, perfect competition is a fickle and temporary phenomenon. Ultimately, the market becomes either an oligopoly or some other form of imperfect competition.

Perfect competition can lead to decline. This may be due to the fact that in the long run there is a constant decrease in prices. The human resource in the world is quite large, while the technological one is very limited.

Over time, all enterprises will gradually undergo a process of modernization of all fixed production assets and all production processes, and the price will still continue to fall due to the attempts of competitors to conquer a larger market.

And this will already lead to functioning on the verge of the break-even point or below it. It will be possible to save the market only by outside influence.

Perfect competition is extremely rare. In the real world, it is impossible to give examples of perfectly competitive firms, since there simply is no market that functions in this way. Although there are some segments that are as close as possible to its conditions.

To find such examples, it is necessary to find those markets in which small business mainly operates. As already mentioned, if any firm can enter the market where this segment operates, and also easily leave it, then this is a sign of perfect competition.

If we talk about imperfect competition, then monopoly markets are its brightest representative. Enterprises that operate in such conditions have no incentive to develop and improve. In addition, they produce such goods and provide such services that cannot be replaced by any other product.

An entire sector of the economy can be called an example of such a market - the oil and gas industry, and Gazprom is a monopoly company. An example of a perfectly competitive market is the automotive repair industry. There are a lot of all kinds of service stations and auto repair shops, both in the city and in other settlements.

Almost everywhere the same services are provided, and approximately the same amount of work is performed. If there is perfect competition in the market, then it becomes impossible to artificially increase the prices of goods in the legal field. We see examples of this in everyday life, in ordinary markets.

For example, one fruit seller raised the price of apples by 10 rubles, although their quality is the same as that of competitors, in this case, buyers will not buy goods from him at that price. If the monopolist has influence on the price by raising or lowering it, then in this case such methods are not suitable.

Under perfect competition, it is impossible to raise the price on its own, unlike a monopoly enterprise. Because of the competition in the market, you can't just raise the price, as all customers will be looking for a better deal. Thus, an enterprise can lose its market share, and this will entail disastrous consequences.

Some people reduce the cost of the goods offered. This is done in order to “win back” new market shares and increase revenue levels. To reduce prices, it is necessary to reduce the cost of raw materials.

And this, in turn, is possible due to the use of new technologies, production optimization and other processes, which allow saving costs on raw materials. In Russia, markets that are close to perfect competition are not developing fast enough.

Examples of a perfect economy can be found in almost all areas of small business. If we talk about the domestic market, we can see that a perfect economy in it is developing at an average pace, but it could be better.

Weak support from the state significantly hinders its development, since so far many laws are focused on supporting large producers, which in turn are monopolists.

Therefore, the small business sector remains without much attention and without proper funding.

Perfect competition, examples of which are listed above, is an ideal form of competition from the understanding of pricing, supply and demand criteria. Nowadays, not a single country, not a single economy in the world, can boast of such a market that would meet absolutely all the requirements that a market must meet with perfect competition.

We briefly reviewed what pure competition is, its distinctive features, as well as examples in the world market. Leave your comments or additions to the material.

Competition(lat. concurrentia, from lat. concurro - running away, colliding) - struggle, rivalry in any area. In economics, it is a struggle between economic entities for the most efficient use of factors of production.

Competitiveness- the ability of a certain object or subject to outperform competitors in given conditions.

The lower the firm's ability to influence the market, the more competitive the industry is considered to be. In the limiting case, when the degree of influence of one firm is equal to zero, one speaks of a perfectly competitive market.

In the scientific language, there are two different understandings of the term “competition”. Competition as a characteristic of the market structure (market competitiveness, perfect, monopolistic competition) and competition as a way of interaction between firms in the market (competition, price and non-price competition).

The terms used to refer to various types of market structures come from the Greek language and characterize, on the one hand, the belonging of economic entities to sellers or buyers (poleo - sell, psoneo - buy), and on the other hand, their number (mono - one, oligos - a few, poly - a lot).

Since the structure of a particular market is determined by many factors, the number of market structures is practically unlimited.

To simplify the analysis in economic theory, it is customary to distinguish four basic models:

- perfect competition;

- pure monopoly;

- monopolistic competition;

- homogeneous and heterogeneous oligopoly

Perfect Competition

Perfect competition is a state of the market in which there are a large number of buyers and sellers (manufacturers), each of which occupies a relatively small market share and cannot dictate the conditions for the sale and purchase of goods.

It is supposed to have the necessary and accessible information about prices, their dynamics, sellers and buyers not only in this place, but also in other regions and cities.

The market of perfect competition implies the absence of the power of the producer over the market and the setting of the price not by the producer, but through the function of supply and demand.

Features of perfect competition are not inherent in any of the industries in full. All of them can only approach the model.

The features of an ideal market (market of perfect competition) are:

- the absence of entry and exit barriers in a particular industry;

- no restrictions on the number of market participants;

- homogeneity of similar products presented on the market;

- free prices;

- lack of pressure, coercion from some participants in relation to others

Creating an ideal model of perfect competition is an extremely complex process. An example of an industry close to a perfectly competitive market is agriculture.

Imperfect Competition

Imperfect competition - competition in conditions where individual producers have the ability to control the prices of the products they produce. Perfect competition is not always possible in the market. Monopolistic competition, oligopoly and monopoly are forms of imperfect competition. With a monopoly, it is possible for the monopolist to crowd out other firms from the market.

Signs of imperfect competition are:

- dumping prices

- creation of entry barriers to the market of any goods

- price discrimination (selling the same product at different prices)

- use or disclosure of confidential scientific, technical, industrial and trade information

- dissemination of false information in advertising or other information regarding the method and place of manufacture or quantity of goods

- omission of important consumer information

Losses from imperfect competition:

- unjustified price increase

- increase in production and distribution costs

- slowdown in scientific and technological progress

- decrease in competitiveness in world markets

- decline in the efficiency of the economy.

Monopoly

A monopoly is an exclusive right to something. In relation to the economy - the exclusive right to manufacture, purchase, sell, owned by one person, a certain group of persons or the state.

Arises on the basis of high concentration and centralization of capital and production. The goal is to extract ultra-high profits. Provided by setting monopoly high or monopoly low prices.

Suppresses the competitive potential of the market economy, leads to higher prices and disproportions.

Monopoly Model:

- sole seller;

- lack of close substitute products;

- dictated price.

It is necessary to distinguish between natural monopoly, that is, structures whose demonopolization is either impractical or impossible: public utilities, the subway, energy, water supply, etc.

Monopolistic competition

Monopolistic competition occurs when many sellers compete to sell a differentiated product in a market where new sellers can enter.

A market with monopolistic competition is characterized by the following:

- the product of each firm trading in the market is an imperfect substitute for the product sold by other firms;

- there are a relatively large number of sellers in the market, each of which satisfies a small but not microscopic share of the market demand for a common type of product sold by the firm and its rivals;

- sellers in the market do not consider the reaction of their rivals when choosing what price to set their goods or when choosing annual sales targets;

- the market has conditions for entry and exit

Monopolistic competition is similar to a monopoly situation in that individual firms have the ability to control the price of their goods. It is also similar to perfect competition, since each product is sold by many firms, and there is free entry and exit in the market.

Oligopoly

Oligopoly is a type of market in which not one, but several firms dominate each sector of the economy. In other words, there are more producers in an oligopolistic industry than in a monopoly, but significantly fewer than in a perfect competition.

As a rule, there are 3 or more participants. A special case of an oligopoly is a duopoly. Price controls are very high, barriers to entry into the industry are high, and there is significant non-price competition. Examples include mobile operators and the housing market.

Antitrust policy

In all developed countries of the world there is antimonopoly legislation that restricts the activities of monopolies and their associations.

The antimonopoly policy in European countries is more aimed at regulating already established monopolies, regardless of how they achieved their monopoly position, and this regulation does not imply structural changes, that is, it does not contain requirements for deconcentration, splitting firms into independent enterprises.

First of all, and of course, the US state antimonopoly policy is characterized by such a position, according to which it is not at all necessary to deprive a company of monopoly high profits if it has achieved a monopoly position in the market "due to superior business qualities, ingenuity, or simply a lucky chance."

In addition to price regulation, reforming the structure of natural monopolies can also bring certain benefits - especially in Russia.

The fact is that in Russia, within the framework of a single corporation, both the production of natural monopoly goods and the production of goods that are more efficient to produce under competitive conditions are often combined.

This association is, as a rule, the nature of vertical integration. As a result, a giant monopoly is formed, representing a whole sphere of the national economy.

In general, the system of antimonopoly regulation in Russia is still in its infancy and requires radical improvement. In Russia, the body of antimonopoly regulation is the Federal Antimonopoly Service of Russia.

Objects with competitiveness can be divided into four groups:

- goods,

- enterprises (as producers of goods),

- industries (as a set of enterprises offering goods or services),

- regions (districts, regions, countries or their groups).

In this regard, it is customary to talk about its types such as:

- National Competitiveness

- Product competitiveness

- Enterprise competitiveness

In addition, it is fundamentally possible to distinguish four types of subjects that evaluate the competitiveness of certain objects:

- consumers,

- manufacturers,

- investors,

- state.

a source

source 2

source 3

Perfect and imperfect competition: essence and characteristics

Evgeny Malyar

# business vocabulary

In reality, competition is always imperfect, and is divided into types, depending on which condition corresponds to the market to a greater extent.

- Characteristics of perfect competition

- Signs of perfect competition

- Conditions close to perfect competition

- Advantages and disadvantages of perfect competition

- Advantages

- disadvantages

- perfect competition market

- Imperfect Competition

- Signs of imperfect competition

- Types of imperfect competition

Everyone is familiar with the concept of economic competition. This phenomenon is observed at the macroeconomic and even household level. Every day, choosing this or that product in the store, every citizen, willingly or not, participates in this process. And what is the competition, and, finally, what is it in general from a scientific point of view?

Characteristics of perfect competition

To begin with, a general definition of competition must be adopted. Regarding this objectively existing phenomenon, accompanying economic relations from the moment of their inception, various concepts have been put forward, from the most enthusiastic to completely pessimistic.

According to Adam Smith, expressed in his Inquiries into the Nature and Causes of the Wealth of Nations (1776), competition with its "invisible hand" transforms the selfish motives of the individual into socially useful energy. The theory of a self-regulating market assumes the denial of any state intervention in the natural course of economic processes.

John Stuart Mill, who was also a great liberal and a supporter of maximum individual economic freedom, was more cautious in his judgments, comparing competition with the sun. Probably, this eminent scientist also understood that on a too hot day a little shade is also a blessing.

Any scientific concept involves the use of idealized tools. Mathematicians refer to this as having no width "line" or dimensionless (infinitely small) "point". Economists have a concept of perfect competition.

Definition: Competition is the competitive interaction of market participants, each of which seeks to obtain the greatest profit.

As in any other science, in economic theory a certain ideal model of the market is adopted, which does not fully correspond to the realities, but allows one to study the ongoing processes.

Signs of perfect competition

The description of any hypothetical phenomenon requires criteria to which a real object should (or can) aspire. For example, doctors consider a healthy person with a body temperature of 36.6 ° and a pressure of 80 to 120. Economists, listing the features of perfect competition (also called pure competition), also rely on specific parameters.

The reasons why it is impossible to achieve the ideal are not important in this case - they are inherent in human nature itself. Each entrepreneur, receiving certain opportunities to assert their positions in the market, will definitely use them. However, hypothetical Perfect competition is characterized by the following features:

- An infinite number of equal participants, which are understood as sellers and buyers. The convention is obvious - nothing limitless exists within our planet.

- None of the sellers can influence the price of the product. In practice, there are always the most powerful participants capable of carrying out commodity interventions.

- The proposed commercial product has the properties of uniformity and divisibility. Also purely theoretical. An abstract commodity is something like grain, but even it can be of different quality.

- Complete freedom of participants to enter or leave the market. In practice, this is sometimes observed, but by no means always.

- Possibility of problem-free movement of production factors. Imagine, for example, a car factory that can be easily transferred to another continent, of course, you can, but this requires imagination.

- The price of a product is formed solely by the ratio of supply and demand, without the possibility of influence of other factors.

- And, finally, the complete public availability of information about prices, costs and other information, in real life, most often constituting a trade secret. There are no comments here at all.

After considering the above features, the conclusions are:

- Perfect competition in nature does not exist and cannot even exist.

- The ideal model is speculative and necessary for theoretical market research.

Conditions close to perfect competition

The practical utility of the concept of perfect competition lies in the ability to calculate the optimal equilibrium point of the firm, taking into account only three indicators: price, marginal cost and minimum total cost.

If these figures are equal to each other, the manager gets an idea of the dependence of the profitability of his enterprise on the volume of production.

This intersection point is visually illustrated by a graph on which all three lines converge:

Where: S is the amount of profit; ATC is the minimum gross cost; A is the equilibrium point; MC is the marginal cost; MR is the market price of the product;

Q is the volume of production.

Advantages and disadvantages of perfect competition

Since perfect competition as an ideal phenomenon in the economy does not exist, its properties can only be judged by individual features that manifest themselves in some cases from real life (at the maximum possible approximation). Speculative reasoning will also help to determine its hypothetical advantages and disadvantages.

Advantages

Ideally, such competitive relations could contribute to the rational distribution of resources and the achievement of the greatest efficiency in production and commercial activities.

The seller is forced to reduce costs, since the competitive environment does not allow him to raise the price.

In this case, new economical technologies, high organization of labor processes and all-round thrift can serve as means of achieving advantages.

In part, all this is observed in real conditions of imperfect competition, but there are examples of a literally barbaric attitude towards resources on the part of monopolies, especially if state control is weak for some reason.

An illustration of the predatory attitude to resources can be the activities of the United Fruit company, which for a long time ruthlessly exploited the natural resources of the countries of South America.

disadvantages

It should be understood that even in its ideal form, perfect (aka pure) competition would have systemic flaws.

- First, its theoretical model does not provide for economically unjustified spending on achieving public goods and raising social standards (these costs do not fit into the scheme).

- Secondly, the consumer would be extremely limited in the choice of a generalized product: all sellers offer in fact the same thing and at about the same price.

- Third, an infinitely large number of producers leads to a low concentration of capital. This makes it impossible to invest in large-scale resource-intensive projects and long-term scientific programs, without which progress is problematic.

Thus, the position of the firm under conditions of pure competition, as well as the position of the consumer, would be very far from ideal.

perfect competition market

The closest to the idealized model at the present stage is the exchange type of the market. Its participants do not have bulky and inert assets, they easily enter and leave the business, their product is relatively homogeneous (estimated by quotations).

There are many brokers (although their number is not infinite) and they operate mainly with supply and demand values. However, the economy does not consist of exchanges alone.

In reality, competition is imperfect, and is divided into types, whichever condition suits the market best.

Profit maximization in conditions of perfect competition is achieved exclusively by price methods.

The characteristics and model of the market are important for determining the possibilities of functioning in conditions of imperfect competition. It is hard to imagine that a huge number of sellers offer absolutely the same type of product, which is in demand among an unlimited number of buyers. This is the ideal picture, suitable only for conceptual reasoning.

In the real world, competition is always imperfect. At the same time, there is only one common feature of the markets of perfect and monopolistic competition (the most common) and it consists in the competitive nature of the phenomenon.

There is no doubt that business entities seek to achieve advantages, take advantage of them and develop success up to full mastery of all possible sales volumes.

In all other respects, perfect competition and monopoly differ significantly.

Signs of imperfect competition

Since the ideal model of "capitalist competition" has been discussed above, it remains to analyze its differences with what happens in a functioning world market. The main signs of real competition include the following points:

- The number of producers is limited.

- Barriers, natural monopolies, fiscal and licensing restrictions objectively exist.

- Market entry can be difficult. Exit too.

- Products are produced in a variety of quality, price, consumer properties and other characteristics. However, they are not always separable. Is it possible to build and sell half of a nuclear reactor?

- Mobility of production takes place (in particular, towards cheap resources), but the processes of moving capacities themselves are very costly.

- Individual participants have the opportunity to influence the market price of the product, including non-economic methods.

- Technology and pricing information is not public.

From this list it is clear that the real conditions of the modern market are not only far from the ideal model, but most often contradict it.

Types of imperfect competition

Like any non-ideal phenomenon, imperfect competition is characterized by a variety of forms. Until recently, economists simplistically divided them according to the principle of functioning into three categories: monopoly, oligopolistic and monopolistic, but now two more concepts have been introduced - oligopsony and monopsony.

These models and types of imperfect competition deserve detailed consideration.

Monopsony

This type of imperfect competition occurs when only one consumer can purchase a manufactured product.

There are types of products intended, for example, exclusively for state structures (powerful weapons, special equipment). In economic terms, monopsony is the opposite of monopoly.

This is a kind of dictate of a single buyer (and not a manufacturer), and it is not common.

There is also a phenomenon in the labor market. When only one, for example, a factory operates in a city, then the average person has limited opportunities to sell his labor.

Oligopsony

It is very similar to monopsony, but there is a choice of buyers, albeit small. Most often, such imperfect competition occurs between manufacturers of components or ingredients intended for large consumers.

For example, some recipe component can only be sold to a large confectionery factory, and there are only a few of them in the country.

Another option - a tire manufacturer seeks to interest one of the car factories for the regular supply of its products.

As a result, we note: any competition that exists in real conditions is as imperfect as the market itself. From the point of view of economic theory, perfect competition is a simplified concept. It is far from ideal, but necessary. Doesn't it surprise anyone that physicists use different mathematical models and scientific assumptions?

Imperfect competition is diverse in forms, and it is possible that new ones will be added to its already existing types in the future.

Perfect Competition

Competition is the basic concept of economics. It refers to the rivalry of subjects (companies, organizations, firms or individuals) in any segment of the economy in order to capture the market and make a profit.

Economists distinguish two types of competition:

Perfect

Imperfect (monopolistic, oligopoly and absolute monopoly).

The article discusses perfect competition in detail.

Definition of perfect competition

Perfect (pure) competition is a market model in which many sellers and buyers interact. At the same time, all subjects of market relations have equal rights and opportunities.

Imagine that there is a market for rye flour. It interacts with sellers (5 firms) and buyers. The rye flour market is designed in such a way that a new participant offering his products can easily enter it. In this market model, there is perfect (pure) competition.

A distinctive feature of the market of pure competition is that the seller and the buyer cannot influence the price of the goods. The price of a product is determined by the market.

Necessary Conditions for Perfect Competition

In order for the same product to have the same price from different sellers in the same period of time, the following conditions must be met:

1. Homogeneity of the market; 2. Unlimited number of sellers and buyers of the product;3.

No monopoly (one influential manufacturer that captured the lion's share of the market) and monopsony (the only buyer of the product); 4.

Prices for goods are set by the market, and not by the state or interested persons; 5. Equal opportunities for conducting economic and economic activities for all members of the society;

6. Open information about the main economic indicators of all market players. It is about the demand, supply and prices of the product. In a market of pure competition, all indicators are considered fairly;

7. Mobile factors of production;

8. The impossibility of a situation where one market entity influences the rest by non-economic methods.

If these conditions are met, perfect competition is established in the market. Another thing is that in practice this does not happen. Let's look at why next.

Pure competition - abstraction or reality?

There is no perfect competition in real life. Any market consists of living people who pursue their own interests and have leverage over the process. There are three main barriers that prevent a new firm from simply entering the market:

Economic. Trademarks, brands, patents and licenses. Organizations that have been on the market for a long time are sure to patent their product.

This is done so that newcomers cannot simply copy the product and start a successful trade; Bureaucratic. With any number of approximately equal producers, a dominant firm always stands out.

It is she who has the power in the market and sets the price of the product;

Mergers and acquisitions. Large enterprises buy up new, developing firms. This is done to introduce new technologies and expand the range of the enterprise under one brand. An effective way to compete with successful newcomers.

Economic and bureaucratic obstacles greatly increase the costs for newcomers to enter the market. Business leaders ask themselves questions:

1. Will the income from the sale of products cover the costs of promotion and development?

2. Will my business be profitable?

The purpose of barriers to entry is to prevent new businesses from gaining a foothold in the market. Theoretically, any enterprise can become a new monopolist. There have been such cases in history. Another thing is that in percentage terms it will be 1-2% of 100% of new enterprises.

Markets close to pure competition

If pure competition is an abstraction, why is it needed? An economic model is needed in order to study the laws of the market and more complex types of competition. Perfect competition plays a very important role in the economy:

1. Almost perfect competition emerges in some markets. This includes agriculture, securities and precious metals. Knowing the model of perfect competition, it is quite easy to predict the fate of a new firm.

2. Pure competition is a simple economic model. It allows comparison with other types of competition.

Perfect competition, like other types of rivalry between economic entities, is an integral part of market relations.

Perfect competition. Examples of perfect competition

Improving production, reducing production costs, automating all processes, optimizing the structure of enterprises - all this is an important condition for the development of modern business. What is the best way to get businesses to do all this? Market only.

The market is understood as the competition that occurs between enterprises that produce or sell similar products. If there is a high level of healthy competition, then in order to exist in such a market, it is necessary to constantly improve the quality of the product and reduce the level of total costs.

The concept of perfect competition

Perfect competition, examples of which are given in the article, is the complete opposite of monopoly. That is, it is a market in which an unlimited number of sellers operate who deal with the same or similar goods and at the same time cannot influence its price.

At the same time, the state should not influence the market or engage in its full regulation, since this can affect the number of sellers, as well as the volume of products on the market, which is immediately reflected in the price per unit of goods.

Despite the seemingly ideal conditions for doing business, many experts are inclined to believe that perfect competition will not be able to exist in the market for a long time in real conditions. Examples that confirm their words have happened more than once in history. The end result was that the market became either an oligopoly or some other form of imperfect competition.

Perfect competition can lead to decline

This is due to the fact that in the long run there is a constant decrease in prices. And if the human resource in the world is large, then the technological one is very limited. And sooner or later, enterprises will move to the fact that all fixed assets and all production processes will be modernized, and the price will still fall due to attempts by competitors to conquer a larger market.

And this will already lead to functioning on the verge of the break-even point or below it. It will be possible to save the situation only by influence from outside the market.

Key Features of Perfect Competition

We can distinguish the following features that a perfectly competitive market should have:

- a large number of sellers or manufacturers of products. That is, all the demand that is on the market must be covered by more than one or several enterprises, as in the case of monopoly and oligopoly;

- products in such a market must be either homogeneous or interchangeable. It is understood that sellers or manufacturers produce such a product that can be completely replaced by products of other market participants;

- prices are set only by the market and depend on supply and demand. Neither the state, nor specific sellers or manufacturers should influence pricing. The price of goods should determine the cost of production, the level of demand, as well as supply;

– there should be no barriers to entry or entry into the market of perfect competition. Examples can be very different from the small business sector, where special requirements are not created and special licenses are not needed: ateliers, shoe repair services, etc.;

– there should be no other influences on the market from the outside.

Perfect competition is extremely rare.

In the real world, it is impossible to give examples of perfectly competitive firms, since there is simply no market that operates according to such rules. There are segments that are as close as possible to its conditions.

To find such examples, it is necessary to find those markets in which small business mainly operates. If any firm can enter the market where it operates, and it is also easy to exit it, then this is a sign of such competition.

Examples of Perfect and Imperfect Competition

If we talk about imperfect competition, then monopoly markets are its brightest representative. Enterprises that operate in such conditions have no incentive to develop and improve.

In addition, they produce such goods and provide such services that cannot be replaced by any other product. This explains the poorly controlled price level, which is established by non-market means. An example of such a market is a whole sector of the economy - the oil and gas industry, and Gazprom is a monopoly company.

An example of a perfectly competitive market is the provision of automotive repair services. There are a lot of various service stations and car repair shops both in the city and in other settlements. The type and amount of work performed is almost the same everywhere.

It is impossible in the legal field to artificially increase the prices of goods if there is perfect competition in the market. Examples confirming this statement, everyone saw in his life repeatedly in the ordinary market. If one seller of vegetables raised the price of tomatoes by 10 rubles, despite the fact that their quality is the same as that of competitors, then buyers will stop buying from him.

If, under a monopoly, a monopolist can influence the price by increasing or decreasing supply, then in this case such methods are not suitable.

Under perfect competition, it is impossible to raise the price on its own, as a monopolist can do.

Due to the large number of competitors, it is simply impossible to raise the price, since all customers will simply switch to purchasing the relevant goods from other enterprises. Thus, an enterprise may lose its market share, which will entail irreversible consequences.

In addition, in such markets there is a decrease in the prices of goods by individual sellers. This happens in an attempt to "win" new market shares to increase revenue levels.

And in order to reduce prices, it is necessary to spend less raw materials and other resources on the production of one unit of output. Such changes are only possible through the introduction of new technologies, production optimization and other processes that can reduce the cost of doing business.

In Russia, markets that are close to perfect competition are not developing fast enough

If we talk about the domestic market, perfect competition in Russia, examples of which are found in almost all areas of small business, is developing at an average pace, but it could be better.

The main problem is the weak support of the state, since so far many laws are focused on supporting large manufacturers, which are often monopolists.

In the meantime, the small business sector remains without much attention and the necessary funding.

Perfect competition, examples of which are given above, is an ideal form of competition on the part of understanding the criteria for pricing, supply and demand. To date, no economy in the world can find such a market that would meet all the requirements that must be observed under perfect competition.

No related posts.

The perfect competition market model is based on four basic conditions (Fig. 1.1). Let's consider them sequentially.

Rice. 1.1. Conditions for perfect competition

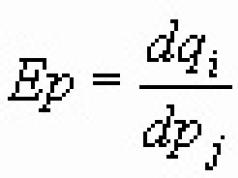

1.product homogeneity. This means that the products of firms in the view of buyers are homogeneous and indistinguishable, i.e. these products of different enterprises are completely interchangeable (they are complete substitute goods). More strictly, the concept of product homogeneity can be expressed in terms of the cross-price elasticity of demand for these goods. For any pair of manufacturing enterprises, it should be close to infinity. The economic meaning of this provision is as follows: goods are so similar to each other that even a small price increase by one manufacturer leads to a complete switch in demand for the products of other enterprises.

Under these conditions, no buyer will be willing to pay any particular firm a higher price than he would pay its competitive firm. After all, the goods are the same, customers do not care which company they buy from, and they, of course, opt for cheaper ones. The condition of product homogeneity actually means that the price difference is the only reason why a buyer can choose one seller over another.

2. Under perfect competition, neither sellers nor buyers affect the market situation due to the small size of the firm, the multiplicity of market participants. Sometimes both of these features of perfect competition are combined, speaking of the atomistic structure of the market. This means that there are a large number of small sellers and buyers operating in the market, just as any drop of water is made up of a gigantic number of tiny atoms.

At the same time, purchases made by the consumer (or sales by the seller) are so small compared to the total volume of the market, but the decision to lower or increase their volumes does not create either surpluses or shortages of goods. The aggregate size of supply and demand simply "does not notice" such small changes.

All these limitations (homogeneity of products, large number and small size of enterprises) actually predetermine that, under perfect competition, market entities are not able to influence prices. Therefore, it is often said that under perfect competition, each individual firm-seller "takes the price", or is a price-taker.