Financial ratios are relative indicators of the financial condition of the enterprise. They are calculated as ratios of absolute indicators of financial condition or their linear combinations.

The system of relative financial ratios in economic terms can be divided into a number of characteristic groups:

- -indicators of assessing the profitability of the enterprise

- - business activity assessment indicators

- -indicators for assessing market stability

- -indicators for assessing the liquidity of the balance sheet assets as the basis of solvency.

Enterprise profitability assessment.

Indicators for evaluating the profitability of an enterprise - characterize the profitability of the enterprise and are calculated as the ratio of the profit received to the funds spent or the volume of sales.

Profitability indicators are the most generalized characteristic of the efficiency of economic activity. Depending on the base of comparison, the profitability of all capital, production assets is distinguished. equity, etc.

1) The profitability ratios of all capital show how much balance sheet or net profit is received per 1000 rubles of the value of the property:

balance sheet profit

Total return on equity = ______________________ x 100% (1)

Property value

Net profit

Net return on equity = ____________________ x 100% (2)

Property value

2) Efficiency ratios for the use of own funds reflect the share of balance sheet or net profit in the company's own funds:

Overall profitability Balance sheet profit

equity = _____________________ x 100% (3)

Own funds

Net margin Net profit

equity = ______________________ x 100% (4)

Own funds

Return on equity shows how much profit is received from each 1000 rubles invested by the owners of the enterprise. This indicator characterizes the effectiveness of the use of invested equity capital and serves as an important criterion for assessing the level of share quotation. The ratio allows you to evaluate the potential income from investing in securities of various enterprises.

The ratio of the overall profitability of the enterprise is compared with the ratio of the overall profitability of own funds. The difference between these indicators characterizes the attraction of external sources of financing.

3) The profitability of production assets is calculated by the ratio of the amount of profit to the cost of fixed assets and inventories:

Overall profitability book profit

production assets \u003d ___________________________ x100% (5)

working capital

Net profit net profit

production assets \u003d _________________________ x 100% (6)

Fixed assets + material

working capital

In Russian practice, it is these indicators that are of great importance, since they reflect the share of profit per thousand production assets.

4) Profitability of the main (fundamental profitability):

balance sheet profit

Total return on equity = ________________________ x 100% (7)

funds and other non-current assets

Net profit

Net return on equity = ________________________ x 100% (8)

The average value of the main

funds and other non-current assets

The profitability of fixed assets and other non-current assets reflects the efficiency of the use of fixed assets and other non-current assets, measured by the amount of profit per unit cost of funds. The growth of this indicator indicates an excessive increase in mobile funds, which may be the result of the formation of excessive stocks of inventory items, overstocking of finished products as a result of a decrease in demand, an excessive increase in receivables or cash

5) Return on sales (the difference between these indicators in the numerator of formulas, i.e. in financial results reflecting a certain aspect of economic activity):

Net profit per Net profit of the enterprise

1000 rubles of revenue \u003d _________________________________x100% (9)

Revenues from sales

Profit from sales Profit from product sales

Products per = __________________________________ x100% (10)

1000 rubles of proceeds Sales proceeds

Total profit on book profit

1000 rubles of revenue \u003d ________________________________x100% (11)

Revenues from sales

These ratios show how much profit falls on the unit of sales. The growth of this indicator is a consequence of rising prices at constant costs for the production and sale of goods and services or a decrease in costs at constant prices. A decrease in the profitability of sales indicates a decrease in prices at constant costs for production and sale of products or an increase in costs at constant prices, i.e. a decrease in demand for the company's products.

6) The profitability of financial investments is calculated as the ratio of income received from securities and from equity participation in the authorized capital of other enterprises to the cost of financial investments:

Income from + income from

Return on Equity Securities

financial investments =______________________________ х100% (12)

The cost of financial investments

7) The return on equity and long-term borrowed (permanent) capital serves to assess the efficiency of using the entire long-term capital of an enterprise:

Total profitability balance sheet profit permanent = x100% (13)

borrowed funds

Total profitability net profit permanent = ___________________________________________ x100% (14)

capital Equity + Long-term

borrowed funds

Estimated profitability indicators for 1996 - 1998 are shown in table 7.

Table 7

Profitability indicators.

|

Name of indicator |

The value of indicators, |

|||

|

Overall profitability capital |

||||

|

Net profit Capital |

||||

|

Overall profitability equity |

||||

|

Net profit equity |

||||

|

Overall profitability production assets |

||||

|

Net profit production assets |

||||

|

General fondorent- whiteness |

||||

|

Net fondorenta whiteness |

||||

|

Net profit per 1000 rubles of revenue |

||||

|

Profit from sales products for 1000 rubles |

||||

|

Total profit per 1000 rubles of revenue |

||||

|

Total return on permanent capital |

||||

|

Net return on permanent capital |

||||

Table 7 data allow us to draw the following conclusions. In general, for the analyzed enterprise, there is an improvement in the efficiency of the use of its property. From each ruble of the value of the property, the enterprise in 1996 had the following results: balance sheet profit of 12.3 and net profit of 10.0. This suggests that for 1 ruble of the value of the property, OAO kms received 12 kopecks of balance sheet profit and 10 kopecks of net profit. Accordingly, for 1997 these figures are 10.2 and 8.4 - this indicates a deterioration in the profitability of the enterprise. The best indicators were obtained in 1998 - 16 kopecks of balance and 11 kopecks of net profit per 1 ruble of property value. An analysis of the return on equity allows us to draw similar conclusions, the most profitable year was 1998 - 20.8 and 14.2, respectively, i.е. 20.8 kopecks of book profit and 14.2 kopecks of net profit were received from each ruble of equity capital. Less profitable 1996, whose figures are 15.0 and 12.5, respectively. And the worst figures were obtained in 1997 - 13 kopecks of book profit and 11 kopecks of net profit per 1 ruble of equity capital.

In Russian practice, indicators of profitability of production assets are of great importance, because reflect the share of profit for each ruble of production assets. For OAO ISS, these values are 39 and 27 for 1998, 25 and 28 for 1997, and 23 and 18.8 for 1996.

The profitability of non-current assets reflects the efficiency of the use of fixed assets and other non-current assets, shows the amount of profit per unit cost of funds. In our case, these figures are 23.4 gross profit and 16 net profit for 1998, 13.5 and 11, respectively, for 1997, and 16 13.3 for 1996.

The profitability of sales, showing how efficiently and profitably the company conducts its activities, in 1996, these values are equal to 10.4, 13.3 and 12.8, respectively, i.е. 10.4 kopecks of net profit per ruble of proceeds, 13.3 kopecks - profit from the sale of products for each ruble of proceeds and 12.8 kopecks of gross profit per 1 ruble of proceeds. For 1997, the net profit per ruble of proceeds is 7.1, the profit from the sale of products per 1 ruble of proceeds is 9.4, and the total profit per 1 ruble of proceeds is 8.7. From the analysis of 1996 and 1997. it can be seen that there was a decrease in the profitability of sales - this indicates a decrease in prices at constant production costs or an increase in production costs at constant prices, i.e. a decrease in demand for products. The indicators for 1998 have changed significantly - these figures are equal to 8.6 net profit, 13.7 profit from the sale of products and 12.6 total profit per 1 ruble of revenue. Such a change in indicators is a consequence of an increase in prices at constant costs for the production and sale of goods or a decrease in costs at constant prices. Given the economic situation in the country, as well as the prosperity of this enterprise, both of these reasons are justified. Because there are no short-term financial investments in the balance sheet of jsc mks, then the indicator of profitability of financial investments is not calculated.

Assessment of business activity.

Relative financial indicators can be expressed both in ratios and as percentages. Indicators of business activity are more clearly presented in coefficients.

Return on capital:

Revenues from sales

Return on capital =___________________________ (15)

Property value

2) Return on assets:

Return of the main sales proceeds

production means =__________________________________ (16)

and intangible assets Average cost of fixed assets

and intangible assets

Working capital turnover:

working capital =_____________________________________ (17)

Average value of current assets

Inventory turnover:

Cost of goods sold

Inventory Turnover =__________________________________ (18)

Average inventory value

Accounts receivable turnover:

accounts receivable = ______________________________ (19)

average value

accounts receivable

The accounts receivable turnover ratio shows the expansion or decrease in commercial credit provided by the enterprise. If the ratio is calculated based on sales revenue generated as invoices are paid, an increase in this indicator means a decrease in sales on credit. A decrease in this case indicates an increase in the amount of credit provided.

6) Average period of turnover of receivables:

Average turnaround time 365

accounts receivable = ____________________________________________ (20)

debts Accounts receivable turnover ratio

debt

The average period of turnover of accounts receivable characterizes the average period of repayment of accounts receivable.

7) Turnover of banking assets:

Turnover revenue from sales

bank assets=_______________________________________ (21)

Average free cash

8) Turnover of own capital:

Turnover revenue from sales

equity =__________________________ (22)

Own funds

The equity turnover ratio shows the rate of equity turnover, which for joint-stock companies means the activity of funds that shareholders risk. The sharp increase in this indicator reflects an increase in the level of sales, which should be largely secured by loans and, therefore, reduce the share of owners in the total capital of the enterprise. Significant decrease - reflects the tendency to inactivity of part of own funds.

9) Mobile assets turnover ratio:

turnover = _______________________________________ (23)

Mobile Funds Average for the period + Average for the period

stocks and costs the amount of cash

funds and other assets

The turnover ratio of mobile assets shows the turnover rate of all mobile (both tangible and intangible) assets of the enterprise. The growth of this indicator is characterized positively.

10) Accounts payable turnover ratio:

Product sales revenue ratio

turnover = ______________________________________________ (24)

creditor

indebtedness Average accounts payable for the period

The accounts payable turnover ratio shows the expansion or decline of a commercial loan provided to an enterprise. The growth of this indicator means an increase in the speed of payment of the company's debts, a decrease - an increase in purchases on credit.

11) Average term of accounts payable turnover:

Average turnaround time 365

accounts payable = _____________________________ (25)

Turnover ratio

accounts payable

The average turnover period of accounts payable reflects the average period of repayment of the company's debts (excluding liabilities to banks and other loans).

Estimated indicators of business activity are presented in table 8.

Table 8

Business Activity Indicators

|

Name of indicator |

Indicator value |

|||

|

return on capital |

||||

|

return on assets |

||||

|

Working capital turnover |

||||

|

inventory turnover |

||||

|

Accounts receivable turnover |

||||

|

Average turnover period of receivables |

||||

|

Turnover of banking assets |

||||

|

Equity turnover |

||||

|

Mobile asset turnover ratio |

||||

|

Accounts payable turnover ratio |

||||

|

Average turnover period of accounts payable |

As can be seen from table 8., the coefficients of return on capital for jsc ms are 0.965 for 1996, 1.173 for 1997. and 1.279 for 1998, i.e. 965 rubles per 1,000 rubles of property value in 1996; similarly, 1,173 rubles and 1,279 rubles per 1,000 rubles of property value in 1997 and 1998, respectively.

The return on assets ratio shows how many rubles of proceeds from sales fall on 1000 rubles of fixed assets of the enterprise. In this case, these values are 1.282 1.547 and 1.870 for 1996.1997 and 1998. accordingly, every year this figure increases, which indicates the effective use of available resources by the enterprise.

The turnover of working capital for this enterprise over the past 3 years amounted to 4.58 5.01 and 4.35 turnovers per year, thus the turnover period for 1996 was 79.7 days, for 1997 - 72.8 days and for 1998 - 83.9 days, at the same time, for most civilized countries, the standard for the turnover of working capital is 3 turnovers, i.e. approximately 122 days. Thus, when compared with developed countries, the turnover is very high. An increase in the inventory turnover ratio is also observed - it is equal to 5.1 7.3 and 9.1 turnovers, i.e. the turnover is 71.9 days 49.9 days and 40.1 days respectively. This positively characterizes the marketing activities of the enterprise, and also indicates an increase in demand for finished products.

The turnover of receivables for OAO kms for 1996 is 30.04 for 1997 -15.97 for 1998 -11.43. A decrease in this indicator may indicate an increase in the volume of credit provided. The average turnover period of receivables, in this case, is 12.2 22.9 31.9, respectively, for 1996, 1997, 1998. this trend of increasing the indicator can be given a negative assessment, because. the average period of turnover of receivables characterizes the average maturity of receivables.

The turnover of bank assets is equal to the following values

93.4 - for 1996, 88.9 - for 1997. and 56.3 for 1998. the increase in the company's cash has affected the decrease in turnover.

The turnover of equity capital is 1.25 1.49 and 1.75 turnovers, respectively, for each analyzed year. This indicator shows how many rubles of revenue fall on 1000 rubles of own funds. Therefore, for 1996 - 1246 rubles. revenue falls on 1000 rubles. own funds and the turnover lasts 304 days, for 1997 -1496 rubles. for 1000 rubles. own funds and turnover rate of 244 days and for 1998 the turnover of own funds lasts 208 days and 1748 rubles. sales revenue falls on 1000 rubles. own funds. The growth of this indicator, as in our case, reflects a trend towards greater employment in the production of the enterprise's own funds.

The turnover ratio of mobile means shows the turnover rate of all mobile, both tangible and intangible assets of the enterprise. For this enterprise, it is equal to the turnover ratio of working capital.

The accounts payable turnover ratio is 7.64 10.08 and 12.98, respectively, for the three analyzed periods. The growth of this indicator, as well as for Jsc ISS, means an increase in the speed of payment of the company's debts.

The average term of the accounts payable turnover reflects the average term of the company's debts. for this case, these indicators are equal to 47.77 36.21 and 28.12 or 7.6 10.1 and 12.9 days, respectively, for 1996, 1997, 1998.

assessment of market stability.

Financial stability ratios - characterize the degree of protection of the interests of investors and creditors.

1) One of the most important characteristics of the stability of the financial condition of the enterprise, its independence from borrowed sources of funds is the autonomy coefficient, equal to the share of sources of funds in the total balance sheet:

Own funds

Autonomy coefficient =__________________________________ (26)

Property value

A sufficiently high level of autonomy coefficient in the US and European countries is considered to be a value equal to 0.5 - 0.6. In this case, the risk of creditors is minimized: by selling half of the property formed at the expense of its own funds, the company can pay off its debt obligations, even if the second half, in which the borrowed funds are invested, is depreciated for some reason. In Japan, this indicator can be reduced to 0.2, since there is a very strict observance of the contractual obligation and attaches great importance to the reputation of the company.

The growth of the autonomy coefficient indicates an increase in the financial independence of the enterprise, reducing the risk of financial difficulties in future periods. From the point of view of creditors, this trend increases the security of the enterprise's obligations.

2) The indicator, the reciprocal of the autonomy coefficient, is the share of borrowed funds in the value of property:

Amount owed

Share of borrowed funds = ___________________________ (27)

Property value

Share of borrowed funds = 1- Coefficient of autonomy

3) The coefficient of autonomy complements the ratio of borrowed and own funds, equal to the ratio of the value of the enterprise's obligations to the value of its own funds, or it can be calculated using a different formula:

Ratio factor 1

borrowed and own funds = ______________________ - 1 (28)

Autonomy coefficient

The higher the value of the indicator, the higher the risk of shareholders, since in case of default on payments, the possibility of bankruptcy increases. 1 is taken as the critical value of the indicator. The excess of the amount of debt over the amount of own funds indicates that the financial stability of the enterprise is in doubt.

- 4) While maintaining the minimum financial stability of the enterprise, the ratio of borrowed and own funds should be limited from above by the value of the ratio of the cost of the enterprise's mobile funds to the cost of its immobilized funds. This indicator is called the ratio of mobile and immobilized funds and is calculated by dividing current assets (section 2 assets) by immobilized assets (section 1 asset).

- 5) A very significant characteristic of the stability of the financial condition is the coefficient of maneuverability, equal to the ratio of the company's own working capital to the total value of sources of own funds:

Agility coefficient=_______________________________ (29)

Own funds

It shows what part of the enterprise's own funds is in a mobile form, allowing relatively free maneuvering of these funds. High values of the maneuverability coefficient positively characterize the financial condition, however, there are no normal values of the indicator that are well-established in practice. sometimes in the literature, 0.5 is recommended as the optimal value of the coefficient. The calculation of own working capital occurs by deducting the value of fixed assets from the company's own funds, the remaining value is the company's own working capital.

6) In accordance with the determining role played for the analysis of financial stability by the absolute indicators of the security of the enterprise with funds from the sources of formation of reserves and costs, one of the main relative indicators of the stability of the financial condition is the ratio of own working capital, equal to the ratio of the value of own working capital to the value of stocks and enterprise costs:

Own working capital

Security ratio=______________________________ (30)

own working capital Cost of inventories and costs

means

The normal limit of this indicator is:

The coefficient of provision with own working capital is 0.6 - 0.8.

7) An important characteristic of the structure of an enterprise's funds is given by the coefficient of production assets, equal to the ratio of the sum of the values (taken on the balance sheet) of fixed assets, capital investments, equipment, inventories and work in progress to the balance sheet total.

Based on the data of economic practice, the following limitation of the indicator is considered normal:

Industrial property ratio 0.5 or 50%

In the event of a decrease in the indicator below the critical limit, it is advisable to attract long-term borrowed funds to increase the production property, if the financial results in the reporting period do not significantly replenish the sources of own funds.

8) To characterize the structure of the sources of enterprise funds, along with the coefficients of autonomy, the ratio of borrowed and own funds, flexibility, one should also use private indicators that reflect various trends in the change in the structure of individual groups of sources.

The short-term debt ratio expresses the share

Ratio of short-term liabilities loans

short-term debt = _____________________ (31)

total debt

9) The ratio of accounts payable and other liabilities expresses the share of accounts payable and other liabilities in the total amount of the company's liabilities:

Accounts payable and other liabilities ratio = 1 - Short-term debt ratio

In our case, it is equal to: on 07/01/96 - 0.48 and at the beginning of the year - 0.423.

10) Data on the debt of the enterprise must be compared with the debts of debtors, the share of which in the value of property is calculated by the formula:

Receivables

Accounts receivable ratio=___________________ (32)

Property value

11) The financial stability of the enterprise also reflects the share of own and long-term borrowed funds (for a period of more than a year) in the value of property:

Share of own funds Long-term borrowed funds

Own =_________________________________________ (33)

and long-term

borrowed funds Property value

Estimated indicators for assessing market stability are shown in Table 9.

Table 9

Indicators for assessing market stability.

|

Name indicator |

Standard value of the indicator |

|||||

|

Coefficient autonomy |

not lower than 0.5 - 0.6 |

|||||

|

Specific gravity Borrowed money |

not higher than 0.5 |

|||||

|

Coefficient Debt to Equity Ratio |

||||||

|

Coefficient Ratios of mobile and immobilized means |

||||||

|

Coefficient maneuverability |

||||||

|

Coefficient security own funds |

||||||

|

Industrial property ratio |

More than 0.5 |

|||||

|

Share and long-term borrowings |

||||||

|

Short-term debt ratio |

||||||

|

Accounts payable ratio |

||||||

|

Accounts receivable ratio |

From the data in Table 9, the coefficient of autonomy for JSC ISS as of January 1, 1996 was 0.81, as of January 1, 1997 - 0.84, as of January 1, 1998 - 0.81, and at the end of the analyzed period - 0, 82, which indicates a fairly high independence of the firm from external financial sources.

The share of borrowed funds at the beginning of 1996 was 0.19, but by the end of the year it decreased by 0.03, but the next 1997 was less prosperous and this figure rose to the previous level - 0.19, but by the end of 1998 g. it amounted to 0.18, which indicates a positive trend in the structure of the balance sheet. The ratio of borrowed and own funds for this enterprise as of January 1, 1996 amounted to 0.23, as of January 1, 1997 this indicator decreased to 0.19, and as of January 1, 1998 and January 1, 1999 it is equal to 0.23, which, as already mentioned, indicates a fairly high independence from external sources of funding. In our case, the ratio of mobile and immobilized funds on January 1, 1999 was 0.45, and if we compare it with the previous indicators, we can see that the ratio of borrowed and own funds is in the range from 0 to 0.45, which says about a fairly stable independent state of the firm. On January 1, 1998, this coefficient was 0.33, on January 1, 1997 - 0.28, and on January 1, 1996 - 0.27.

The coefficient of maneuverability shows what part of the company's own funds is in a mobile form, which allows you to freely maneuver these funds. The optimal value of the coefficient is recommended 0.5. In our case, the indicators did not reach the optimal level and amounted to -0.03 on January 1, 1996; -0.09, however, the trend of increasing this coefficient can be assessed positively.

The coefficient of provision with own working capital has limitations of 0.6 - 0.8. For JSC ISS these figures were 0.13 - as of 01.01.96, 0.13 as of 01.01.97. 0.23 as of 01.01.98 and 0.54 - as of 01.01.99. this is much less than the normative coefficients, which indicates the insufficient provision of the enterprise with the means of sources of formation of reserves and costs. However, there is a favorable trend towards its increase, especially in 1998 this indicator more than doubled.

An important characteristic of the structure of the company's funds gives the coefficient of industrial property. The normative value is 0.5 or 50. A high property coefficient was obtained for the analyzed period 0.95 - on 01/01/96 0.94 - on 01/01/97 0.87 - on 01/01/98 and 0.83 - as of 01.01.99, i.e. the value of this indicator is normal and since the beginning of the year there has been a downward trend.

The coefficient of short-term debt, in this case, these are bank loans, amounted to 0.32 on 01/01/96; up to 0.46. In 1998, a downward trend appeared, and as of January 1, 1999, it amounted to 0.42.

The accounts payable ratio for this enterprise was 0.68 at the beginning of 1996, and 0.78 at the end of the year. During 1997, this indicator decreased to 0.54, and by the end of 1998 it increased by 0.004 and amounted to 0 .58.

The accounts receivable ratio at the beginning of the analyzed period amounted to 0.025 and over 3 years it rapidly increased at the end of 1996 - 0.039, at the beginning of 1998 - 0.11 and at the end of 1998 - 0.13. Such an increase is negative, because funds are diverted from circulation, which threatens to reduce profits.

The share of own and long-term borrowed funds amounted to 0.81 as of 01.01.96; 0.88 as of 01.01.97; 0.85 as of 01.01.98; and 0.82 as of 01.01.99. Such high figures indicate that the financial stability of the enterprise is not in doubt.

Estimation of liquidity of the enterprise.

The general indicator of liquidity, discussed above, expresses the ability of the enterprise to carry out settlements for all types of obligations - both for the nearest and for distant ones. This indicator does not give an idea of the company's capabilities in terms of repayment of short-term liabilities. Therefore, to assess the solvency of the enterprise, three relative liquidity indicators are used, which differ in the set of liquid funds considered as covering short-term obligations. When calculating these indicators, short-term liabilities are taken as the calculation base.

1) Absolute liquidity ratio.

This ratio is equal to the ratio of the most liquid assets to the sum of the most urgent liabilities and short-term liabilities. The most liquid assets are cash and short-term securities. Short-term liabilities of the enterprise are represented by the sum of the most urgent liabilities and short-term liabilities:

short-term

ratio cash financial investment

absolute liquidity = ________________________________ (34)

short-term obligations

The limiting theoretical value of this indicator is 0.2 - 0.35.

Intermediate coverage ratio for short-term liabilities (critical liquidity ratio).

To calculate this ratio, accounts receivable and other assets are included in the composition of liquid funds in the numerators of the relative indicator:

Short term

intermediate cash financial receivables

ratio of investment funds debt

coatings =________________________________________________ (35)

short-term obligations

The liquidity ratio reflects the projected payment capabilities of the enterprise, subject to timely settlements with debtors. The theoretical value of the indicator is recognized as sufficient at the level of 0.7 - 0.8.

3) Current liquidity ratio or coverage ratio. It is equal to the ratio of the value of all current (mobile) assets of the enterprise to the value of short-term liabilities.

the value of the indicator should not fall below one. According to other data, a value greater than one is considered normal for it:

Short term

intermediate cash financial receivables and

ratio investment funds debt costs

coatings =_______________________________________________ (36)

short-term obligations

The coverage ratio characterizes the expected solvency of the enterprise for a period equal to the average duration of one turnover of all current assets.

4) Solvency indicators also include the share of reserves and costs in the amount of short-term liabilities:

Stocks and costs

Share of stocks and costs =_____________________________ (37)

in current liabilities Current liabilities

Calculated indicators for assessing the liquidity of the balance sheet are presented in table 10.

Table 10

Balance liquidity assessment indicators

The absolute liquidity ratio shows what part of the short-term debt the company can repay in the near future. The limiting theoretical value of this indicator is 0.2 - 0.35. This indicator is especially important for investors. The absolute liquidity ratio characterizes the solvency of the enterprise on the date of the balance sheet.

For jsc mks this indicator is equal to 0.04 - on 01/01/96, which indicates the low current liquidity of the enterprise, on 01/01/97 - 0.08 on 01/01/98 - 0.07, and at the end of the analyzed period this indicator amounted to a much larger amount - this means that in the near future it can repay 19% of its short-term obligations.

The intermediate coverage ratio of short-term obligations characterizes the expected solvency of the enterprise for a period equal to the average duration of one turnover of receivables. This indicator is of particular interest to shareholders. The standard value of the indicator is 0.6-0.8.

For this enterprise on 01/01/96 it is equal to 0.17 or 17%, on 01/01/97 - 0.35 or 35, which confirms the data of the previous indicator about the low current solvency of the enterprise. at the end of 1997 and the beginning of 1998 this indicator was equal to 0.64, which is within the normative value, which indicates the normal current solvency of the enterprise. On 01.01.99 the intermediate coverage ratio for short-term obligations is 0.89 - this exceeds the standard values and characterizes the high solvency of the enterprise.

The coverage ratio shows the payment capabilities of the enterprise, assessed subject to not only timely settlements with debtors and favorable sales of finished products, but also the sale, in case of need, of other elements of tangible assets. Liquid funds should be sufficient to meet short-term obligations, i.e. the value of the indicator should not fall below one.

For OAO ms, this figure is 1.09 1.36 1.32, respectively, at the beginning of 1996, 1997, 1998, 1999. - all indicators are greater than one, and the growth of this coefficient characterizes a positive trend in increasing the short-term solvency of the enterprise.

The share of stocks and costs in short-term liabilities as of 01.01.96. equal to 0.91 as of 01.01.97. - 1.03 as of 01.01.98 - 0.67 and on 01.01.99. - 0.71, the values of the indicator indicate that the value of reserves and costs, with the exception of data as of 01.01.97. does not exceed the value of short-term liabilities, and the upward trend of this ratio is assessed positively.

Thus, for the analyzed period of 1996 - 1998, Stavropol Dairy Plant JSC has a dynamic development model.

The organizational structure of OJSC MKS ensures a fairly stable financial condition of the enterprise. This confirms the analysis of the financial results of the enterprise.

In the course of the analysis, an increase in profitability indicators is observed. The highest value of the company's profitability ratios was obtained in 1998 - the total return on capital is 16%, the net profitability is 11%, which indicates the effective use of the company's property.

The analysis of the coefficients of business activity also allows us to conclude that the company's activities are improving, since there is an increase in the coefficients of capital return, capital productivity, and a high turnover of working capital. The indicator of receivables turnover deserves a negative assessment, as the average repayment period of receivables has increased.

An analysis of market stability indicators indicates a fairly high independence of the company from external sources of the enterprise, and over the analyzed period, there is a significant improvement in all indicators of market stability, with the exception of the receivables ratio. The accounts receivable ratio has increased and this change is negative, as funds are diverted from turnover.

The indicators for assessing the liquidity of the balance sheet, if they do not correspond, then are extremely close to the normative values of the coefficients, which characterizes the normal solvency of the enterprise.

Financial analysis at the enterprise is needed for an objective assessment of the economic and financial condition in the periods of past, present and predicted future activities. To determine the weak areas of production, hotbeds of problems, to identify strong factors that management can rely on, the main financial indicators are calculated.

An objective assessment of the company's position in terms of economy and finances is based on financial ratios, which are a manifestation of the ratio of individual accounting data. The purpose of financial analysis is to solve a selected set of analytical tasks, that is, a specific analysis of all primary sources of accounting, management and economic reporting.

The main objectives of economic and financial analysis

If the analysis of the main financial indicators of the enterprise is considered as revealing the true state of affairs in the enterprise, then the results are answers to the following questions:

- the company's ability to invest in investing in new projects;

- the present course of affairs in relation to tangible and other assets and liabilities;

- the state of loans and the ability of the enterprise to repay them;

- the existence of reserves to prevent bankruptcy;

- identification of prospects for further financial activities;

- valuation of the enterprise in terms of cost for sale or conversion;

- tracking the dynamic growth or decline of economic or financial activities;

- identifying the causes that negatively affect the results of management and finding ways out of the situation;

- consideration and comparison of income and expenses, identification of net and total profit from sales;

- study of the dynamics of income for the main goods and in general from the entire sale;

- determination of the part of income used for reimbursement of costs, taxes and interest;

- study of the reason for the deviation of the amount of balance sheet profit from the amount of income from sales;

- study of profitability and reserves for its increase;

- determination of the degree of conformity of own funds, assets, liabilities of the enterprise and the amount of borrowed capital.

Stakeholders

The analysis of the main financial indicators of the company is carried out with the participation of various economic representatives of departments interested in obtaining the most reliable information about the affairs of the enterprise:

- internal entities include shareholders, managers, founders, audit or liquidation commissions;

- external are represented by creditors, audit offices, investors and employees of state bodies.

Financial Analysis Capabilities

The initiators of the analysis of the work of the enterprise are not only its representatives, but also employees of other organizations interested in determining the actual creditworthiness and the possibility of investment in the development of new projects. For example, bank auditors are interested in the liquidity of a firm's assets or its current ability to pay its bills. Legal entities and individuals who wish to invest in the development fund of this enterprise are trying to understand the degree of profitability and the risks of the contribution. Evaluation of the main financial indicators using a special methodology predicts the bankruptcy of an institution or speaks of its stable development.

Internal and external financial analysis

Financial analysis is part of the overall economic analysis of the enterprise and, accordingly, part of a complete economic audit. The full analysis is subdivided into on-farm managerial and external financial audit. This division is due to two practically established systems in accounting - managerial and financial accounting. The division is recognized as conditional, since in practice external and internal analysis complement each other with information and are logically interconnected. There are two main differences between them:

- by accessibility and breadth of the information field used;

- degree of application of analytical methods and procedures.

An internal analysis of the main financial indicators is carried out to obtain generalized information within the enterprise, determine the results of the last reporting period, identify free resources for reconstruction or re-equipment, etc. To obtain the results, all available indicators are used, which are also applicable in the study by external analysts.

External financial analysis is performed by independent auditors, outside analysts who do not have access to the firm's internal results and performance. Methods of external audit suggest some limitation of the information field. Regardless of the type of audit, its methods and methods are always the same. Common in external and internal analysis is the derivation, generalization and detailed study of financial ratios. These basic financial indicators of the company's activities provide answers to all questions regarding the work and prosperity of the institution.

Four main indicators of financial condition

The main requirement for the break-even functioning of an enterprise in the conditions of market relations is economic and other activities that ensure profitability and profitability. Economic activities are aimed at reimbursement of expenses by the income received, making a profit to meet the economic and social needs of the members of the team and the material interests of the owner. There are many indicators to characterize activities, in particular, they include gross income, turnover, profitability, profit, costs, taxes and other characteristics. For all types of enterprises, the main financial indicators of the organization's activities are identified:

- financial stability;

- liquidity;

- profitability;

- business activity.

Indicator of financial stability

This indicator characterizes the ratio of the organization's own funds and borrowed capital, in particular, how much borrowed funds per 1 ruble of money invested in tangible assets. If such an indicator in the calculation turns out to be more than 0.7, then the financial position of the company is unstable, the activity of the enterprise to some extent depends on the attraction of external borrowed funds.

Liquidity characteristic

This parameter indicates the main financial indicators of the company and characterizes the sufficiency of the organization's current assets to pay off its own short-term debts. It is calculated as the ratio of the value of current current assets to the value of current passive liabilities. The liquidity indicator indicates the possibility of converting the assets and values of the company into cash capital and shows the degree of mobility of such a transformation. The liquidity of the enterprise is determined by two angles:

- the period of time required to turn current assets into money;

- the ability to sell assets at a specified price.

To identify the true indicator of liquidity, the enterprise takes into account the dynamics of the indicator, which allows not only to determine the financial strength of the company or its insolvency, but also to identify the critical state of the organization's finances. Sometimes the liquidity ratio is low due to the increased demand for the industry's products. Such an organization is quite liquid and has a high degree of solvency, since its capital consists of cash and short-term loans. The dynamics of the main financial indicators shows that the situation looks worse if the organization has working capital only in the form of a large amount of stored products in the form of current assets. For their transformation into capital, a certain time for implementation and the presence of a buyer base are required.

The main financial indicators of the enterprise, which include liquidity, show the state of solvency. The firm's current assets should be sufficient to repay current short-term loans. In the best position, these values are approximately at the same level. If the enterprise has working capital much more in value than short-term loans, then this indicates an inefficient investment of money by the enterprise in current assets. If the amount of working capital is lower than the cost of short-term loans, this indicates the imminent bankruptcy of the company.

As a special case, there is an indicator of fast current liquidity. It is expressed in the ability to repay short-term liabilities at the expense of the liquid part of the assets, which is calculated as the difference between the entire current part and short-term liabilities. International standards define the optimal level of the coefficient in the range of 0.7-0.8. The presence of a sufficient number of liquid assets or net working capital in the enterprise attracts creditors and investors to invest in the development of the enterprise.

Profitability indicator

The main financial performance indicators of the organization include the value of profitability, which determines the effectiveness of the use of the funds of the company's owners and, in general, shows how profitable the work of the enterprise is. The value of profitability is the main criterion for determining the level of the exchange quotation. To calculate the indicator, the amount of net profit is divided by the amount of the average profit from the sale of the company's net assets for the selected period. The indicator reveals how much net profit each unit of the sold product brought.

The generated income ratio is used to compare the income of the company in question, compared with the same indicator of another company operating under a different taxation system. The calculation of the main financial indicators of this group provides for the ratio of the profit received before taxes and due interest to the assets of the enterprise. As a result, information appears about how much profit was brought by each monetary unit invested for work in the company's assets.

Business activity indicator

It characterizes how much finance is obtained from the sale of each monetary unit of a certain type of asset and shows the turnover rate of the financial and material resources of the organization. For the calculation, the ratio of net profit for the selected period to the average cost of costs in material terms, money and short-term securities is taken.

There is no normative limit for this indicator, but the company's management forces strive to accelerate turnover. The constant use of outside loans in economic activity indicates an insufficient flow of finance as a result of sales, which do not cover production costs. If the amount of turnover assets on the organization's balance sheet is overstated, this results in the payment of additional taxes and interest on bank loans, which leads to a loss of profit. A low number of active funds leads to delays in the implementation of the production plan and the loss of profitable commercial projects.

For an objective visual examination of economic activity indicators, special tables are compiled that show the main financial indicators. The table contains the main characteristics of work for all parameters of financial analysis:

- inventory turnover ratio;

- the indicator of the turnover of accounts receivable of the company in the time period;

- value of return on assets;

- resource return indicator.

Inventory turnover ratio

Shows the ratio of revenue from the sale of goods to the amount in monetary terms of stocks at the enterprise. The value characterizes the rate of sale of material and commodity resources classified as a warehouse. An increase in the coefficient indicates the strengthening of the financial position of the organization. The positive dynamics of the indicator is especially important in the context of large accounts payable.

Accounts receivable turnover ratio

This ratio is not considered as the main financial indicators, but is an important characteristic. It shows the average time period in which the company expects payment after the sale of goods. The ratio of receivables to the average daily sales proceeds is taken for calculation. The average is obtained by dividing the total revenue for the year by 360 days.

The resulting value characterizes the contractual terms of work with buyers. If the indicator is high, it means that the partner provides preferential working conditions, but this causes caution among subsequent investors and creditors. A small value of the indicator leads in market conditions to a revision of the contract with this partner. An option for obtaining the indicator is a relative calculation, which is taken as the ratio of sales proceeds to the company's receivables. An increase in the coefficient indicates an insignificant debt of debtors and a high demand for products.

The value of return on assets

The main financial indicators of the enterprise are most fully complemented by the return on assets indicator, which characterizes the turnover rate of finances spent on the acquisition of fixed assets. The calculation takes into account the ratio of revenue from goods sold to the annual average cost of fixed assets. An increase in the indicator indicates a low cost of expenses in terms of fixed assets (machines, equipment, buildings) and a high volume of goods sold. A high return on assets indicates low production costs, and a low return on assets indicates an inefficient use of assets.

Resource return rate

For the most complete understanding of how the main financial indicators of the organization's activities are formed, there is an equally important coefficient of return on resources. It shows the degree of efficiency of the company's use of all assets on the balance sheet, regardless of the method of acquisition and receipt, namely, how much revenue is received for each monetary unit of fixed and current assets. The indicator depends on the depreciation calculation procedure adopted at the enterprise and reveals the degree of illiquid assets, which are disposed of in order to increase the coefficient.

Key financial indicators of LLC

The coefficients for managing sources of income show the structure of finance, characterize the protection of the interests of investors who have made long-term injections of assets into the development of the organization. They reflect the firm's ability to repay long-term loans and credits:

- the share of loans in the total amount of financial sources;

- ownership ratio;

- capitalization ratio;

- coverage ratio.

The main financial indicators are characterized by the amount of borrowed capital in the total mass of financial sources. The leverage ratio determines the specific amounts of asset acquisitions with borrowed money, which include long-term and short-term financial obligations of the firm.

The ownership ratio complements the main financial indicators of the enterprise with a characteristic of the share of equity spent on the acquisition of assets and fixed assets. The guarantee of obtaining loans and investing investor money in the project of development and re-equipment of the enterprise is the indicator of the share of own funds spent on assets in the amount of 60%. This level is an indicator of the stability of the organization and protects it from losses during a downturn in business activity.

The capitalization ratio determines the proportional relationship between borrowings from various sources. To determine the proportion between own funds and borrowed finance, the inverse leverage ratio is used.

The indicator of security of interest payable or the coverage indicator characterizes the protection of all types of creditors from non-payment of the interest rate. This ratio is calculated as the ratio of the amount of profit before paying interest to the amount of money intended for paying interest. The indicator shows how much during the selected period the company gained money to pay borrowed interest.

Market activity indicator

The main financial indicators of the organization in terms of market activity indicate the position of the enterprise in the securities market and allow managers to judge the attitude of creditors to the overall activities of the company over the past period and in the future. The indicator is considered as the ratio of the initial accounting value of the share, the income received on it and the prevailing market price at the given time. If all other financial indicators are in the acceptable range, then the indicator of market activity will also be normal with a high market value of the share.

In conclusion, it should be noted that the financial analysis of the economic structure of the organization is important for all business entities, shareholders, short-term and long-term creditors, founders and management.

There are many links between different elements of financial statements, as well as between the same elements but at different points in time. Ratios (indicators) are a useful way of expressing these relationships. They express one quantity in relation to another (usually as a fraction of one element in another).

In simple words: Coefficient is a number(s) divided by another number(s).

Notable academic studies have focused on the importance of indicators in predicting stock returns (Oy and Penman, 1989b; Abarbel and Bushche, 1998) or assessing creditworthiness (Altman, 1968; Olson, 1980; Hopwood et al., 1994). These studies have shown that financial reporting ratios are effective in choosing where to invest and in predicting financial hardship. Practitioners constantly use metrics to display the value of a company and its securities.

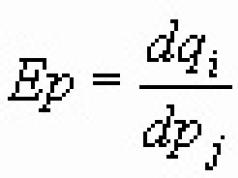

Some aspects of the analysis of indicators are important for their understanding. First, the calculated coefficient is not an "answer". A metric is an indicator of some aspect of a company's performance, saying what happened, not why it happened. For example, an analyst might want to answer the question: Which of the two companies was more profitable? Return on sales based on net income, which expresses profit in relation to revenue, can provide insight into this issue. Return on sales by net profit (net profit margin) is calculated by dividing net profit by revenue:

Net profit / Revenue

Suppose company A has 100,000 thousand rubles. net profit and 2 billion rubles. revenue, and thus the profitability is 100/2000 * 100% = 5 percent. Company B has 200,000 thousand rubles. net profit and 6 billion in revenue, and thus the return on sales of 3.33 percent. By expressing net income as a percentage of revenue, the relationship can be accurately determined: for every $100 of revenue, Company A earns $5 of net income, while Company B earns only $3.33 for every $100 of revenue. So now we can answer the question of which company was more profitable in percentage terms: Company A was more profitable because it has a higher net income of 5 percent. We also note that company A was more profitable despite the fact that company B reported a higher profit margin (200,000 thousand rubles versus 100,000 thousand rubles). However, this figure alone does not tell us why Company A has a higher rate of return. Further analysis is needed to determine the cause (perhaps higher product prices or better cost control).

Company size sometimes gives economies of scale, so the absolute amounts of net income and revenue are useful in financial analysis. However, metrics reduce the impact of enterprise size, which allows companies to be compared with each other, as well as to compare company performance compared to the same metric in the past.

The second important aspect of performance analysis is that differences in accounting policies(company-wide and over time) can distort the ratios, so sometimes when comparing, additional adjustments to financial data may be necessary. Thirdly, not all indicators must be applied to a specific analysis. The ability to select the appropriate ratio or ratios to answer a research question is an important analytical skill. Finally, as in the case of financial analysis in general, the analysis of indicators does not turn into a simple calculation; interpretation of the results is important. In practice, the difference in performance over time and between companies may be subtle, so the interpretation of the performance should be appropriate to the specific situation.

Financial indicators, as a rule, are expressed in percentages, times, days, rubles or without a unit of measurement. The following indicators are the financial indicators of the enterprise:

1. Liquidity ratios(short-term solvency), which measure the ability of a firm to meet its current obligations (within one current year). They may include ratios that measure the effectiveness of the use of current assets and current liabilities.

2. Ability scores answer for debts(financial stability and long-term solvency) - ratios that measure the degree of protection of suppliers of long-term financial resources (that is, long-term creditors of the enterprise).

3. Profitability ratios measure a firm's ability to earn.

4. Business Activity Indicators talk about how efficiently assets are being used.

5. Cash flow ratios may indicate liquidity, creditworthiness, or profitability.

6. Indicators of property status measure the condition of assets, their structure and mobility.

The index can be calculated from any pair of numbers. Given the large number of variables in financial statements, a very long list of significant ratios can be drawn up. There is no standard list of coefficients or a standard way to calculate them. Each author and source on financial analysis uses a different list and often there is a different way to calculate the same proportion. This site presents the ability to calculate the indicators that are used most frequently. When analyzing ratios, an analyst sometimes encounters negative earnings numbers. Analysis of coefficients that have negative numerators or denominators is meaningless, and the negative sign of the coefficient should simply be noted in the output.

Indicators are interpreted in comparison with the indicator for the previous year, coefficients of competitors, coefficients of the field of activity and specified standards (normative values). The analysis of the company's financial statements is more significant if the results are compared with industry averages and with the results of competitors. The use of several methods of financial analysis allows you to form a comprehensive opinion about the financial condition of the enterprise and various industries.

The analyst is faced with a problem when it is not clear which industry the company belongs to due to its diversified activities. Because many companies do not fit into just one industry, it is often necessary to use data from the industry that best fits the firm for comparison. In the process of financial analysis, it is important to remember that accounting methods in enterprises of the same industry may differ. Therefore, it is important to read the notes to the financial statements or an accounting policy order or other document that reflects this aspect. Ideally, all types of comparison should be used in the process of financial analysis. Analysis of trends, industry averages, and comparison with a major competitor support conclusions and provide a solid basis for analysis.

Comparison of firms various sizes can be more difficult than comparing firms of the same size. For example, large firms often have access to wider and more complex capital markets, can buy raw materials in large quantities, and serve wider markets. Ratios, vertical and horizontal analysis will help eliminate some of the problems associated with the use of absolute numbers. Be careful when analyzing firms of different sizes. Differences between companies can be seen by looking at the relative size of sales, assets, or earnings.

The use of percentages is generally preferred over the use of absolute numbers. Let's take an example. If company A earns 10,000 rubles and company B earns 1,000 thousand rubles, which of them works more efficiently? Firm A is probably your answer? However, the total value of the owners' capital invested in company A is 1 billion rubles, and in company B it is 10,000 thousand rubles. Therefore, firm B is much more efficient. As a result, the analysis of relative indicators allows comparing firms of different sizes much more qualitatively and balanced.

indicator trend and its volatility are also important aspects to consider in financial analysis.

Comparing the income statement and the balance sheet, in the form of financial figures, can create difficulties due to the timing of financial reporting. In particular, the income statement covers the entire financial period; while in the balance sheet the numbers refer to one point in time, namely the end of the period. Ideally To compare profits and losses to numbers in the balance sheet, for example, to receivables, we need to know the average receivables for the entire year (that is, in each individual month). However, this data is not available to an external analyst. In most cases, the analyst uses the average, taking into account the value at the beginning and end of the year. This approach smooths out changes from start to finish, but it does not eliminate the issue of seasonal and cyclical changes. It also does not reflect changes that occur unevenly throughout the year. In general, the average ratio based on the value at the beginning and end of the year will usually be a fairly accurate value.

Characteristics of indicators

Formulas and even coefficient names are often differ depending on the analyst or database. The number of different coefficients that can be created is almost limitless. There are, however, widely accepted ratios that have been found to be useful. However, the analyst should keep in mind that some industries have developed unique metrics tailored to the specifics of that industry. When confronted with an unfamiliar metric, the analyst can examine the formula behind that metric to get an idea of what the ratio measures. For example, consider the following formula:

Operating Profit / Average Annual Asset Value

Having never seen this ratio before, an analyst might ask if a result of 12 percent is better than 8 percent. The answer can be found in the ratio itself. The numerator is operating profit and the denominator is average total assets, so the ratio can be interpreted as the sum of operating profit per unit of assets. If a company generates 12 rubles of operating profit for every 100 rubles of assets, then this is better than the creation of 8 rubles of operating profit. In addition, it is obvious that this indicator is an indicator of profitability (and, to a lesser extent, the efficiency of using assets in generating profits). When confronted with the indicator for the first time, the analyst must evaluate the numerator and denominator, which will allow you to evaluate the company itself.

The ratio of operating income to average assets during the year shown above is one of many options for the return on asset ratio (ROA). It should be noted that there are other ways to display this formula, for example, depending on how the assets are defined. Some practitioners suggest calculating ROA using the ending value of assets (the value of assets at the end of the year), rather than using the average value of assets.

In some cases, you can also see the value of assets at the beginning of the year in the denominator. Which of them is right? It depends on what you are trying to measure and what the company's main trends are. If the company has a stable level of assets, then the answer will not differ much for the three measures of assets (at the beginning, on average, at the end of the study period). If, however, assets rise or fall, the results will differ. When assets grow, operating income divided by assets will not make sense because some of the income would have been generated prior to the acquisition of new assets. This would lead to an underestimation of the company's performance indicators.

Similarly, if seed assets are used, then a portion of the operating income will be generated later in the year with newly acquired assets. Thus, the indicator will overestimate the efficiency of the company. Since operating income is generated over the entire period, it usually makes sense to use some average measure of assets.

General rule is that if the numerator uses data from the income statement or cash flow statement, and the denominator - from the balance sheet, then it is desirable to use the average annual balance sheet indicators. There is no need to do this if both numbers in the calculation of the ratio are taken from the company's balance sheet, since both are determined as of the same date.

If an average is used, then one must also decide what type of average to use. For simplicity, most practitioners use a simple average, taking into account the value at the beginning and end of the operating year. If the company's business is seasonal, which causes asset levels to vary depending on the time period (half a year or quarterly), then it is worth taking the average of all interim periods, if any (if the analyst works in the company and has access to monthly data, you should use them).

To summarize, in general, the process of calculating financial ratios depends on the goals that the analyst faces.

Significance, goals and limitations of the indicator method

The value of performance analysis is that it allows the credit or stock analyst to evaluate the past performance of the enterprise, to consider the current financial position of the company, and also to get an idea of useful for forecasting future results. As noted above, the indicator itself is not an answer, but is an indicator of some aspect of the company's performance. Financial indicators provide an understanding of such aspects:

- microeconomic relationships within the company, which helps analysts project profits and free cash flow.

- the company's financial flexibility, or the ability to obtain the cash needed to grow and meet its obligations, even if unexpected circumstances arise.

- managerial ability of the leadership.

There are also restrictions indicator method:

- homogeneity of the company's operations. Companies may have divisions operating in various sectors of the economy. This can make it difficult to compare company ratios with market averages. In this case, it is worth considering the performance of individual business units.

- the need to determine whether the results of the indicator analysis are consistent. One set of coefficients may indicate a problem, while another set of coefficients may indicate that the potential problem is only of a short-term nature.

- the need to use judgements. The key question is whether the company's performance is within reasonable limits. While financial ratios are used to help assess a company's growth potential and risks, they cannot be used in isolation to directly evaluate a company, its securities, or its creditworthiness. It is necessary to study all the activities of the enterprise, as well as the external economic and industry conditions in which it operates. This will allow you to correctly interpret the values of financial ratios.

- use of alternative accounting methods. Companies often have some wiggle room when choosing certain accounting methods. Ratios taken from the financial statements and to which different accounting options have been applied cannot be comparable without additional adjustments. Several important aspects of accounting include the following:

Inventory accounting method, such as FIFO;

Cost or equity methods for non-consolidated subsidiaries of the company;

Depreciation calculation method;

Evaluation of fixed assets when they are purchased or leased.

With this in mind, it can be argued that there are a number of accounting decisions that an analyst should consider.

Coefficient Sources

The coefficients can be calculated using the data directly from financial statements companies or from a database. These databases are popular because they provide easy access to a lot of historical data so you can see trends over time. For example, some financial indicators can be calculated according to the materials of the Federal State Statistics Service.

Analysts should be aware that the underlying formulas may differ when third-party data is used. The formula to be used must be obtained before starting the analysis and the analyst must determine if any adjustments are needed. In addition, database vendors often apply judgment when classifying items.

For example, operating income may not appear directly in a company's financial statements, and the database provider may use judgment to classify the determination of the figures as "operating" or "non-core" income. Differences in such judgments may affect any calculation involving operating income. Therefore, it is considered good practice to use the same data sources when comparing different companies or when evaluating the historical record of one company. Analysts should check the consistency of formulas and classification data.

Main groups of financial ratios

Due to the large number of coefficients, it is useful to think about indicators in terms of which group they belong to.

The use of various groups of indicators allows you to form an opinion about the general financial condition of the company at the current moment, and also coefficient analysis can become the basis for predicting the future financial position of the enterprise.

These categories are not mutually exclusive; some ratios can be used to measure different aspects of a business. For example, accounts receivable turnover, which belongs to a group of business indicators, measures how quickly a company collects receivables, but is also useful in assessing a company's liquidity, as revenue collection increases cash.

Some profitability ratios also reflect the operating efficiency of the business. Thus, analysts appropriately use certain ratios to evaluate various aspects of a business. They should also be aware of changes in industry practice in calculating financial ratios.

2. Industry regulations(analysis by industry). A company can be compared to others in its industry by relating its financial performance to industry norms or to a subgroup of companies in the industry. When industry standards are used to make judgments, care must be taken because:

- Many indicators are industry-specific and not all indicators are important for all industries.

- Companies can have several different lines of business. This will lead to the fact that the total financial indicators will be distorted. It is better to study the indicators in the context of types of business.

- There may be differences in the accounting methods used by companies, which can distort financial performance.

- There may be differences in corporate strategies that may affect certain financial ratios.

3. Economic conditions. For cyclical companies, financial performance tends to improve when the economy is strong, but they can weaken during an economic downturn. Thus, financial performance should be considered in light of the current phase of the business cycle.

List of sources used

Thomas R. Robinson, International financial statement analysis / Wiley, 2008, 188 pp.

Kogdenko VG, Economic analysis / Textbook. - 2nd ed., revised. and additional - M.: Unity-Dana, 2011. - 399 p.

Buzyrev V.V., Nuzhina I.P. Analysis and diagnostics of financial and economic activities of a construction company / Textbook. - M.: KnoRus, 2016. - 332 p.

Analysis of financial ratios

Analysis of financial ratios is an integral part financial analysis, which is an extensive area of research, including the following main areas: analysis of financial statements (including ratio analysis), commercial calculations (financial mathematics), forecasting reporting, assessment of the investment attractiveness of a company using a comparative approach based on financial indicators [ Teplova and Grigorieva, 2006].

First of all, it is about analysis of financial statements, which allows you to evaluate:

- o financial structure (property status) of the enterprise;

- o capital adequacy for current activities and long-term investments;

- o capital structure and the ability to repay long-term liabilities to third parties;

- o trends and comparative effectiveness of the company's development directions;

- o liquidity of the company;

- o the threat of bankruptcy;

- o business activity of the company and other important aspects characterizing its condition.

The analysis of financial statements is very important for financial management, because "it is impossible to manage what cannot be measured."

At the same time, the analysis of financial statements must be considered in the context of the goals that the researcher sets for himself. In this regard, there are six basic motives for conducting a regular review of financial statements:

- 1) investing in company shares;

- 2) provision or extension of a loan;

- 3) assessment of the financial stability of the supplier or buyer;

- 4) assessment of the possibility of obtaining a monopoly profit by the company (which provokes antitrust sanctions from the state);

- 5) predicting the probability of bankruptcy of the company;

- 6) internal analysis of the effectiveness of the company's activities in order to optimize decisions to increase the financial result and strengthen its financial condition.

As a result of the regular conduct of such an analysis, it is possible to obtain a system of basic, most informative parameters that give an objective picture of the financial condition of the organization, characterizing the effectiveness of its functioning as an independent economic entity (Fig. 2.4).

In the process of analysis, the analysis of three types of activity of the enterprise - the main (operational), financial and investment - should be linked.

Rice. 2.4.

Ratio analysis is one of the most popular methods for analyzing financial statements. Financial ratios - these are the ratios of data from different reporting forms of the enterprise. The coefficient system must meet certain requirements:

- o each coefficient must make economic sense;

- o coefficients are considered only in dynamics (otherwise they are difficult to analyze);

- o At the end of the analysis, a clear interpretation of the calculated coefficients is required. Interpreting coefficients means giving correct answers to the following questions for each coefficient:

- How is it calculated and in what units is it measured?

- - what is it intended to measure, and why is it interesting for analysis?

- - what do high or low odds indicate, how misleading can they be? How can this indicator be improved?

In order to correctly analyze the state of a particular enterprise, it is necessary to have a certain standard. For this, normative and industry average indicators are used, i.e. the basis for comparison of the obtained calculations of indicators is selected.

It should be remembered that the ratio analysis should be systematic. "We need to think of ratios as clues in a detective novel. One or even several ratios may not say anything or be misleading, but with the right combination, combined with knowledge about the company's management and the economic situation, in where it is located, the analysis of the coefficients will allow us to see the correct picture.

Financial ratios are traditionally grouped into the following categories (Figure 2.5):

- o short-term solvency (liquidity);

- o long-term solvency (financial stability);

- o asset management (turnover indicators);

- o profitability (profitability);

- o market value.

The liquidity and financial stability ratios together characterize solvency companies. Turnover and profitability ratios indicate the level business activity enterprises. Finally, market value ratios can characterize investment attractiveness companies.

Rice. 2.5.

Liquidity ratios characterize the company's ability to pay for its short-term obligations. Current liquidity ratio (current ratio) is defined as the ratio of current assets to short-term liabilities:

where OA - current assets of the enterprise on a certain date; but - its short term liabilities.

For creditors enterprises, especially short-term (suppliers), the growth of the current liquidity ratio means an increase in confidence in the solvency of the enterprise. Therefore, the higher the value of the current ratio, the better. For managers enterprises too high value of the current liquidity ratio may indicate inefficient use of cash and other short-term assets. However, the value of the current liquidity ratio less than one indicates an unfavorable situation: the net working capital of such an enterprise is negative.

Like other indicators, the current liquidity ratio is subject to the influence of various types of transactions.

Example 2.3

Suppose a business has to pay the bills of its suppliers. At the same time, the value of its current assets is 4 million rubles, the total value of short-term liabilities is 2 million rubles, and the amount of invoices presented for payment reaches 1 million rubles. Then the current liquidity ratio will change as follows.

As is obvious from the table, the value of the current liquidity ratio has increased, i.e. the company's liquidity position has improved. However, if the situation before the operation was the opposite (current assets amounted to 2 million rubles, and short-term liabilities - 4 million rubles), it is easy to see that the operation with the payment of suppliers' invoices would worsen the position of the enterprise even more.

This simple reasoning should be kept in mind by business managers: reducing the short-term funding base in a situation where liquidity is unsatisfactory seems like a natural step, but in fact leads to an even worse situation.

![]()

Quick (urgent) liquidity ratio (quick ratio) is also called the "litmus paper test" (acid test). Its calculation allows "highlighting" the situation with the structure of current assets. The quick liquidity ratio is calculated as follows:

OA-Inv

"" "CL"

where inv (inventories) - the amount of stocks (industrial, stocks of finished products and goods for resale) in the balance sheet of the enterprise on a certain date.

The logic for calculating such a ratio is that reserves, although they belong to the category of current assets, often cannot be sold quickly if necessary without a significant loss in value, and therefore, they are a rather low-liquid asset. The use of cash to purchase inventory does not change the current ratio, but reduces the quick ratio.